If you have an entrepreneurial mindset but do not want to go through the hurdles of starting a business from scratch, there are alternatives for you. One of them is buying an LLC.

A limited liability company is a separate entity that protects the personal assets of business owners from debt and other liabilities and offers pass-through taxation.

Buying an LLC is especially advantageous because it is flexible and easy to set up and maintain. With this, you will be able to receive immediate returns and grow your business operations faster.

There are alternatives when you have an entrepreneurial mindset and you do not want to go through the hurdles of starting a business from scratch.

In this article, we will show you the steps on how to buy an LLC and the best process to follow so you can have a seamless business acquisition at the minimum risk.

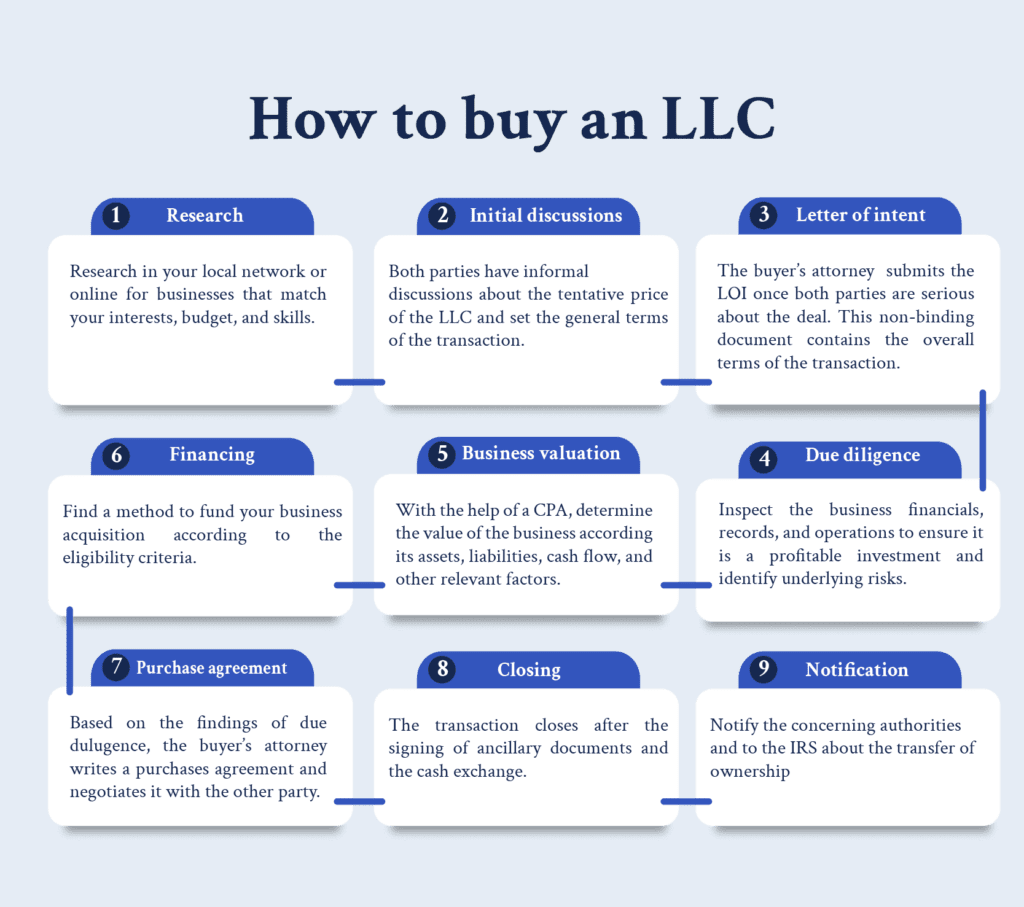

1. Research businesses on sale

There are plenty of sources from where you can purchase an LLC. Either online or in your network, you can find multiple choices and what each offers. The following are some of the places you can find LLCs for sale:

- Local search: You can start by looking in your local newspaper or asking other business owners who are part of your network. It is also a good idea to go to your local chamber of commerce in search of potential sellers.

- Online: Multiple websites offer business listings from a variety of prices and industries. An example is bizbuysell.com, where you can find thousands of businesses for sale and filter them according to industry, location, price range, and more.

- M&A professionals: Professionals who are involved in the world of Mergers and Acquisitions are a reliable source of information when it comes to business opportunities. You can ask either a lawyer, a business broker, or an accountant about any offered businesses that match your interests and needs.

- Tradeshows: Regularly, there are conferences or tradeshows where you can see businesses for sale.

When looking for LLCs to buy, ensure the target business suits your needs in terms of:

- Interests: Ensure you are passionate about the business you plan to buy. Ask yourself whether you picture yourself enjoying being the business owner and if you are committed to making it grow.

- Experience: Preferably, look for a business whose services or products you are familiar with and match your skills. You are more likely to succeed if you already know the intricacies of the industry you want to work in.

- Budget: Besides analyzing the cost of the business, assess whether you can afford additional costs related to the business acquisition, such as professional fees, hiring new staff, and buying new equipment, among others.

2. Start initial discussions

Once you have found the ideal LLC, it’s time to contact the business seller and discuss the general terms of the transaction. Ensure to negotiate with someone who has full permission to act on behalf of the target company.

The objective of the initial negotiations is not to set the final terms of the deal, but to talk about the viability of the transaction, gauge the interest of the parties, and gather as much information as possible from the target business.

This starts by asking a fundamental question: Why is the business on sale? After asking essential business purchase questions, the buyer can analyze whether to move forward with the negotiation.

Since the business seller may also share financial information about the LLC, the buyer may be required to sign a non-disclosure agreement (NDA), or a confidentiality agreement that prohibits the people involved in the transaction from sharing any sensitive information. Additionally, the seller may want to look at the buyer’s financial statements to verify the buyer is serious about the LLC purchase and can afford the business.

Valuation of the business also often happens during this stage. The seller will provide its EBITDA and the buyer will take this information to her accountant to see if the financial calculation adds up. Based on the numbers, the buyer, and seller will agree on a tentative purchase price.

3. Sign the letter of intent (LOI)

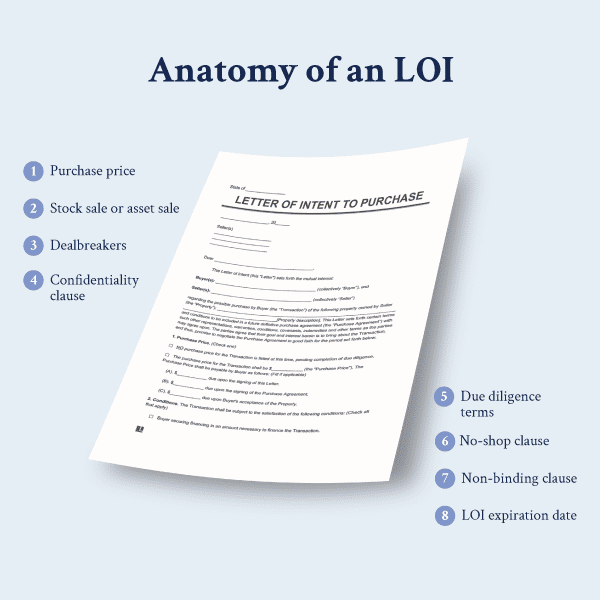

In the context of M&A, the letter of intent is a document that demonstrates the intention of both parties to move forward with the purchase of a business. Also called term sheets, LOIs are meant to be non-binding and outline the basic and preliminary terms of the deal.

The submission of the letter of intent is the ideal moment for a business acquisition attorney to intervene. The buying party’s lawyer will ensure the document is not enforceable, and that it contains clauses that protect the buyer, such as no-shop provisions, which prevent the seller from getting outside offers.

The letter of intent is the backbone of the deal, as it contains the basic agreed-upon terms that eventually make their way into the contract. The signing of the LOI will also create mutual trust between the parties and allow the LLC seller to share detailed information and documents about the target business.

Some of the common terms you will find in an LOI are the following:

- Tentative purchase price

- The structure of the deal, which specifies whether it will be a stock or asset sale and which items will be included in the LLC purchase

- Non-shop clause

- Dealbreakers, or conditions the buyer insists on to move the deal forward

- Length and extent of due diligence

- Buyer’s right to access seller’s documents and financials

- Confidentiality clause

- Non-binding clause, to ensure the document is not legally enforceable

- Timeline or expiration date for the LOI

4. Conduct due diligence

You do not want to buy a business and realize later on that it was a bad investment. Before buying an existing LLC, it is key to be certain of the condition of the business, the risks it entails, and its profitability. This is why you conduct due diligence.

Due diligence is the process of making an in-depth investigation of the target business’s key elements, such as its structure, financials, operations, and contracts before entering a binding purchase agreement.

This process starts with the buy side sending to the seller a due diligence checklist, or a list of requested documents and information. The business attorney and buyer’s team will analyze this data in search of inconsistencies with the previously provided information, helping the buyer make an informed decision and mitigate risks.

The following are some of the areas of interest before buying an LLC:

- Financial due diligence: It is essential to analyze the financial health of the LLC. With the help of an M&A accountant, you will verify the accuracy of its financial statements, projections, and tax returns. The books and records of the business will also help you identify underlying risks, such as pending debts, and the sustainability of the LLC. Financial due diligence will help you support the results of the business valuation.

- Legal due diligence: Comprises the legal aspects of the LLC, including the organization, contracts, and litigation issues. An attorney will verify the Articles of Organization, whether the company has the required permits and licenses, review any existing contracts, or any past or pending lawsuits.

- Operational due diligence: This type of due diligence will evaluate the efficiency of the business operations in terms of processes, systems, supply chains, inventory, and equipment.

- Commercial due diligence: The potential of the business is measured in terms of its competitive advantage in the market, for it inspects the trends in the industry, positioning, and growth opportunities.

Some of the documents you want to review before an LLC purchase include:

- Articles of organization

- Operating Agreement

- 3 years of financial statements: Cash flow projections. balance sheets, and income statements

- Lease agreements

- Business licenses and permits

- Employment agreements

- 3 years of tax records

- Intellectual property rights (Patents, trademarks, and copyrights)

- Current, past, and potential lawsuits and disputes

- Debts and loan agreements

- Business processes and workflows

- Inventory

- Technology infrastructure and systems

- Safety, health and environmental compliance

The due diligence process may take up to 2-6 months, depending on the complexity of the transaction and the commitment of both parties. It’s important to note that the required documents will vary according to the type of the target business.

5. Business valuation

Based on the previous due diligence, a CPA will make a business valuation on the limited liability company and set a fair purchase price. When valuing a business, an appraiser will take into account

The accountant can take different appraisal methods depending on the transaction, such as the ones below:

- Discounted cash flow analysis: Also called income approach valuation, this method involves evaluating the value of a company based on its projected cash flow according to the inflation adjustments. This method is typically used when the company has stable financials and does not expect many fluctuations.

- Capitalization of Earnings: This formula calculates the business’s value based on its cash flow, annual return on investment, projected profits, and value. This method is also used for financially stable companies.

- EBITDA: Calculated on the earnings before taking into account interest, taxes, depreciation, and amortization expenses of the business. It is estimated by adding back interest, taxes, depreciation, and amortization to the net income and applying a multiple that is based on industry standards.

- Multiples of earnings: The worth of the company is based on the business’s potential to generate revenue, according to the company’s projected profits, industry situations, and other factors.

- Market multiple method: The company’s value is based on how much similar businesses have sold for.

- Book value: Also called liquidation value, is defined by the balance sheet, which reports the business equity by subtracting the liabilities value from the total assets of the business.

6. Fund Your Acquisition

Buying an LLC will require significant financial resources, for you may not have the required amount on your account. However, there are several alternatives to fund your business acquisition:

- Term loans: Bank loans usually come with reasonable interest rates and structured repayment terms, but you will likely need to have a strong credit score and prove the profitability of the LLC you want to buy.

- Online loans: If you do not have an acceptable credit score, you can look into online loans, which have high approval rates and fast processing times. However, take into account that these loans usually have high interest rates.

- Seller financing: In some business acquisitions, the seller may be willing to act as a lender and finance a portion of the sale. In this arrangement, the buyer makes payments directly to the seller over an agreed-upon period.

- SBA loans: These loans typically require a lower down payment and offer longer repayment terms at competitive interest rates. However, the eligibility requirements are strict, they have a lengthy approval process, and may require collateral.

7. Write the purchase agreement

At the tail end of due diligence, the buyer’s attorney writes up the purchase agreement. Based on the findings when conducting due diligence, the attorney will draft a contract that protects the buyer and mitigates the identified risks.

The purchase agreement will outline the terms of the transaction in more detail and clarify all the representations, warranties, and contingencies. Here, both the buyer’s and the seller’s lawyer will go back and forth and further negotiate the deal, and there may be multiple rounds of the purchase agreement.

Some of the key elements a purchase agreement includes are:

- Purchase price

- The scope of the purchase

- Closing date

- Terms of payment

- Terms after the transaction closes

8. Closing

Similar to real estate closings, the buyer and seller set a date for when money and deliverables are exchanged.

When buying an LLC, there is a considerable amount of paperwork that has to be signed, and additional contracts that will take into place. Some of the ancillary documents that may be included in the transaction are the following:

- Bill of sale: Serves as evidence of transfer of ownership of tangible assets, such as equipment, inventory, and other physical property.

- Transitional agreement: This document outlines the terms and conditions for the transitional period following the completion of the acquisition.

- Assignment and assumption agreement: Proves the ownership transfer of the assets, such as patents, trademarks, or copyrights.

- Non-compete agreement: Restricts the former owner from competing with the business being sold for a specific time and geographical area.

- Lease agreement: Ensure the real estate or equipment you will acquire is being transferred with the consent of the landlord or person providing the lease.

- Franchisor consent: If the LLC that is being acquired is part of a franchise agreement, the buyer will need the franchisor’s consent to be the new owner.

- Escrow agreement: If applicable, the parties must sign an escrow agreement when a third party holds funds on behalf of the buyer until the terms of the transaction are met.

- Bulk sales notice: Used to notify creditors of the impending sale and to allow them to make claims against the seller before the sale is completed.

9. Notification of Ownership Transfer

After purchasing the LLC, you may need to notify the Secretary of State, the IRS, and local authorities about the transition. This includes filing an amendment of the LLC’s articles of organization to inform about the new ownership structure. Also, be sure to update your Beneficial Ownership Information Report (BOIR) to ensure you comply with the Corporate Transparency Act.

With an experienced transactional lawyer by your side, you will not have to worry about all the required documentation and complex procedures. A skilled attorney will enable a seamless and smooth transaction while you focus on running your new business.

Pros and Cons of Buying an Existing LLC

Are you thinking of buying an existing limited liability company? Consider some of the advantages and disadvantages of this business opportunity:

Advantages

- Established customer base: Buying a business with good performance can imply benefiting from a loyal customer base and good reputation. Your business can be already positioned in the market.

- Easier financing: Funding institutions are more willing to support you when you want to fund a profitable existing business rather than a startup.

- Established operations: You will benefit from a well-established supply chain and existing contracts with vendors. You can also have access to trained staff and proven business models.

Disadvantages

- Covered risks: A business may conceal liabilities, such as debts, lawsuits, internal disputes, and other risks.

- High investment: Buying an LLC may require a hefty investment, in addition to the professional fees that need to be covered. With a startup, you can pay for the assets as you acquire them, while a business purchase may not offer this flexibility.

- Transfer of ownership: LLCs may have specific procedures for the transfer of ownership, as established on their operating agreement, for they may present more difficulties to acquire than a corporation in this matter.

Hire a lawyer to have a successful LLC acquisition

The process of buying an LLC is complex and requires careful legal navigation. From due diligence and negotiations to drafting agreements and closing the deal, every step demands precision. That’s why having an M&A attorney by your side is crucial.

Our M&A attorneys at Motiva Business Law have the expertise to guide you through the intricate legal aspects of the transaction, ensuring that your interests are protected and that the process is conducted smoothly and effectively.

Our services for business buyers and sellers include:

- Guidance throughout the transaction

- Writing and review of Letter of Intent

- Due diligence

- Writing, review, and negotiation of purchase agreement

- Regulatory compliance

Schedule a consultation at (630) 517-5529.