What is due diligence in M&A?

In Mergers and Acquisitions, due diligence is the process of doing in-depth research on the target business to verify the veracity of the provided information and the potential profitability of the business acquisition.

The purpose of due diligence in M&A is to have all the relevant information about the business to make an informed decision and ensure you are going to make a good investment.

Why is due diligence important in a business acquisition?

It’s paramount that a buyer has a complete perspective of the business that he is about to purchase, and knows whether it is safe to proceed with the transaction or not.

Conducting due diligence can help a buyer:

- Gain knowledge of the business’s operations: By conducting due diligence, a buyer will gain insight into how the business operates and identify the areas that need further research.

- Assess risks and opportunities: In M&A, making a proper investigation is going to disclose the red flags of a business purchase. The buyer will be able to have a better understanding of the risks and weaknesses of the prospect, but also its strengths and opportunities for growth. By conducting due diligence, a buyer will have a more accurate expectation of the business and be protected from risky investments.

- Determine the business’s true value: This process allows the buyer to make a valuation of the business’s assets and liabilities and determine an accurate purchase price.

On the sell side of M&A, due diligence allows a seller to have a clear idea of the purchase price of the business.

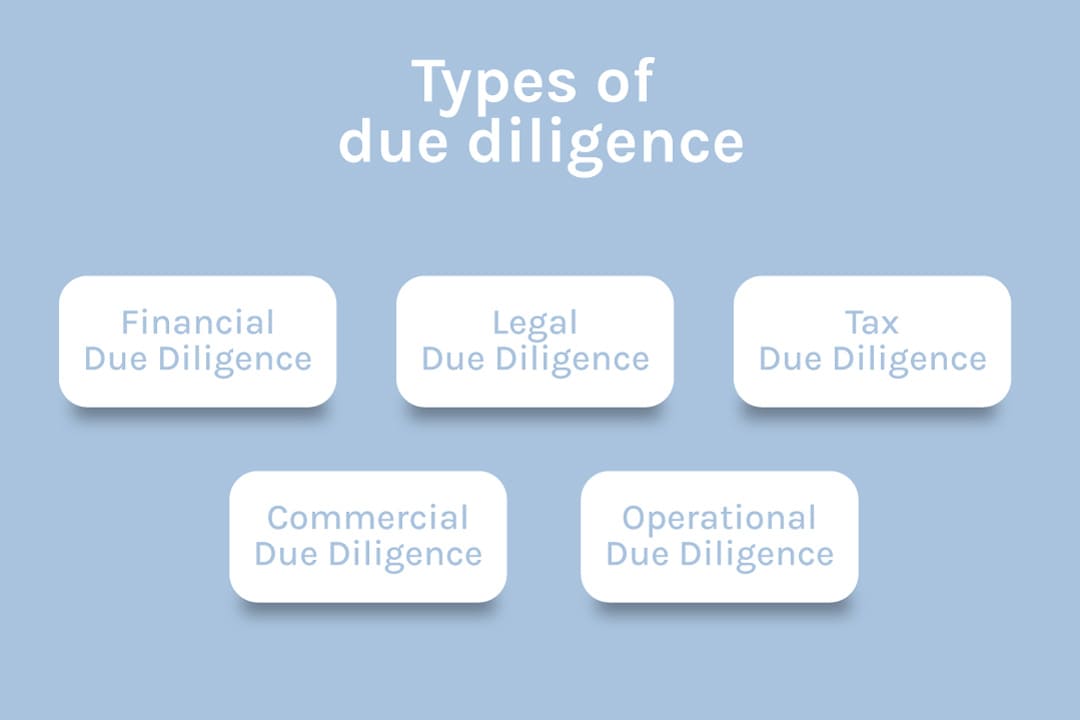

Types of due diligence

In Mergers and Acquisitions, due diligence can be classified into different categories:

Financial due diligence

It involves one of the key factors to consider when buying a business. Financial due diligence provides detailed information of the financial statements and projections of the company. Through financial due diligence, a buyer can analyze the profit margins of the company, its fixed and variable costs, and statutory accounts.

It also allows the buyer to be aware of any outstanding debts that may suppose a risk after the acquisition.

Legal due diligence

Legal due diligence focuses on verifying if the business meets its legal requirements or has underlying issues that need to be addressed. A business acquisition lawyer will review all the documents and agreements that compromise the company, such as employment contracts, leases, or licenses. Also, an attorney will look for any past or pending lawsuits against the business.

Depending on the industry, a business will have to comply with environmental and safety standards, whose inspection will also be included.

Tax due diligence

Includes assessing the tax compliance of the company, including all tax returns, information regarding any past tax audits, and other documents that expose the tax status of the business. An M&A accountant will ensure all the tax liabilities have been addressed and forecast how they will be affected after the business transaction.

Commercial due diligence

A buyer needs to be aware of the potential for growth and the business’s performance projections in the market. Commercial due diligence provides insights into the feasibility of a company and analyzes its position against competitors, the reputation of the business, and the market conditions.

Operational due diligence

Focuses on the daily operations and management of a company. It may include the inspection of matters related to human resources, SOPs, the performance of the management team, policies, assets, facilities, software, and others.

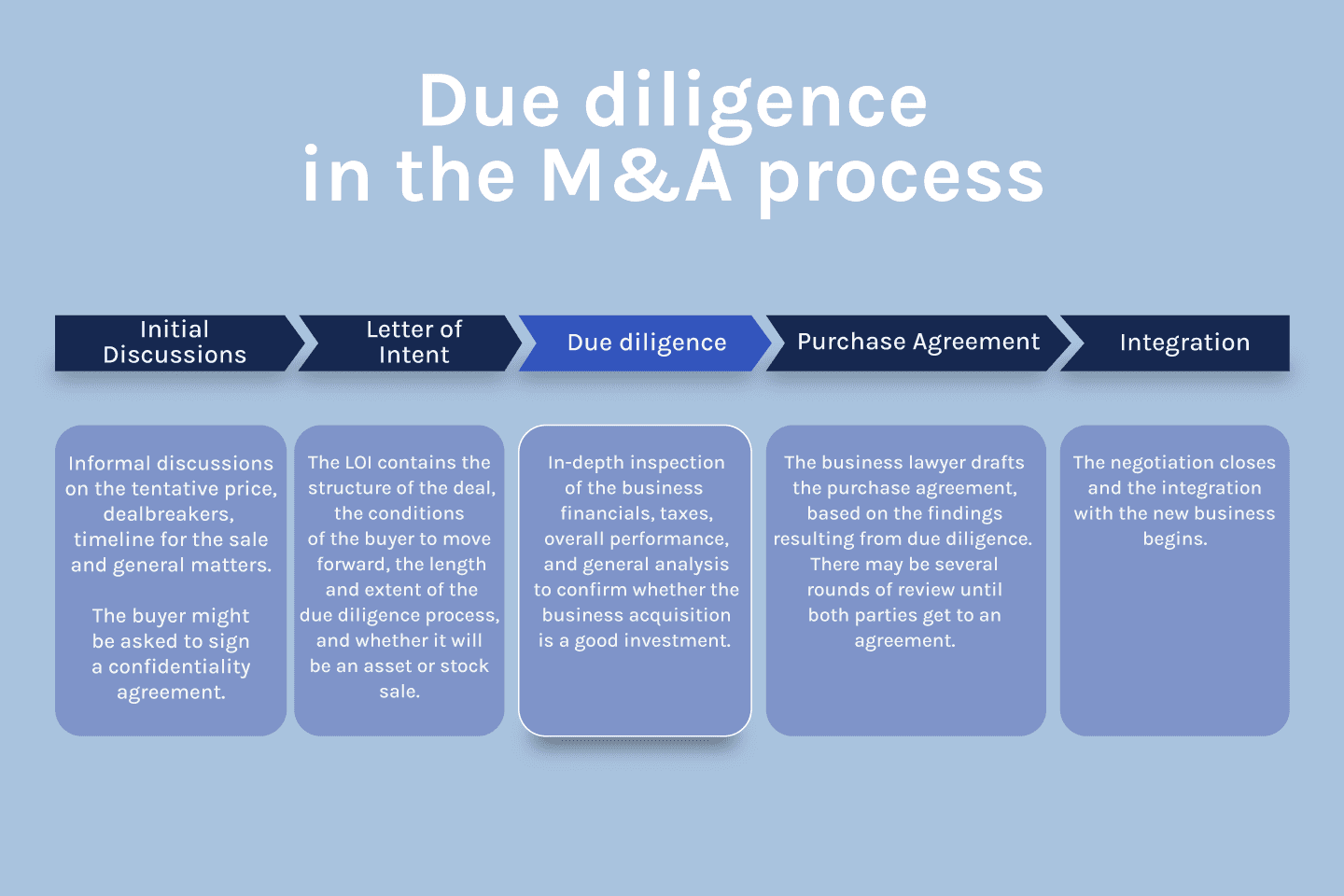

M&A Due Diligence Process

How to conduct due diligence depends on different aspects of the transaction, such as the following:

- Industry of the business

- The type of business

- Size of the transaction

- Whether it is an asset sale or stock sale

Generally speaking, the larger the transaction, it requires a deeper and more rigorous due diligence process. This process can last from several weeks to several months.

To ensure proper conduction of due diligence, the buyer needs a team of advisors with experience in M&A transactions. Essentially, this team must be confirmed by an accountant and a business lawyer, but it can also include other experts, such as a business evaluator and a business consultant.

The following is the standard procedure for conducting due diligence:

1) Establish due diligence goals

The first step is to determine what kind of intel you want to gain from this inspection. A buyer needs to have a clear purpose for doing due diligence.

Some of the most common objectives are:

- Make an informed decision about the investment

- Identify the strengths, weaknesses, opportunities, and threats of the target business.

- Having an accurate valuation of the business

- Identify areas where representations and warranties will be a useful resource to mitigate risk

- Have clear expectations of the company

2) Gather documents

The buy-side team will request the seller a detailed checklist of documents to be examined. For this process involves sharing sensitive information, it is natural that the seller will ask the buyer to sign a confidentiality agreement.

The optimal way of reviewing due diligence documents is to have access to them through a data room. A data room is usually a computer file where the target company uploads its due diligence documents for the buyer to review.

The data room has to be easy to navigate and accessible, but mostly, it has to be completely secure, for the

People can use a Google Drive file, or other specific M&A software with a higher level of security to upload their financial, legal, or administrative documents.

The most common data room paid platforms are:

- DealRoom

- FirmRoom

- Intralinks

- Merrill

- SecureDocs

3) Inspection of the financials and documents

The inspection of the financials of the business is going to take the most part of the due diligence process.

For the high relevance of this information, it is key to leave this step in the hands of an accountant, who will make a thorough analysis of the overall financial performance of the business.

The CPA will evaluate the business’s financial health and any potential risks by analyzing some of the following documents or information:

- Annual reports

- Balance sheets

- Tax filings,

- Profit and loss statements

- Accounts payable

- Future performance projections

- Outstanding debts

This part of the process also involves the revision of the legal, administrative, and operational documents, and other files that are relevant for the inspection.

The buyer will have access to the business plan and be able to check its viability and concordance with his objectives.

Also, the state of the intangible and physical assets of the companies is carefully examined. An inspection will help determine the authentic ownership of the property and its economic value.

The team performs an assessment of the inventory and the physical assets, which may include real state properties, equipment, facilities, supplies, and raw materials.

This is also a good time to conduct interviews with employees, customers, and other key agents that may give an unbiased insight into the target business.

4) Evaluation of findings

In this step, the team’s due diligence will review all the information provided and share outstanding risks that were encountered in the different areas of focus. An expert will determine which is the real value of the business and the appropriate purchase price.

5) Risk allocation procedures

Now that the buyer and the team have all the pertinent information to make a decision, they will help the buyer determine whether it is a good idea to continue with the merger or acquisition. The buyer can decide to abandon the whole deal or opt for modifying specific aspects of the transaction.

If the buyer decides to continue, based on the findings resulting from the due diligence, the lawyer will create a business purchase agreement.

The M&A attorney will mitigate the exposure of the business owner by tailoring a contract that limits the liabilities that will be inherited after the business purchase.

The lawyer will add representations and warranties that will protect the buyer in case the seller is not completely transparent about the business sale and what it entails.

How long does the due diligence process take?

In M&A, the process of due diligence occurs after both parties agree to move forward in the negotiation after signing the LOI, and it can take from 30 to 60 days.

The due diligence period can be affected by some factors such as the following:

Availability of information: If the seller uploads the required documentation to the data room, or provides the information promptly, the due diligence time will be reduced.

Inspection of documents: The time the buyer takes to analyze the provided documents, which may also depend on the seller’s capacity of organizing the files.

Responsiveness: The extent to which the buyer is willing to answer the buyer’s questions and attend his inquiries.

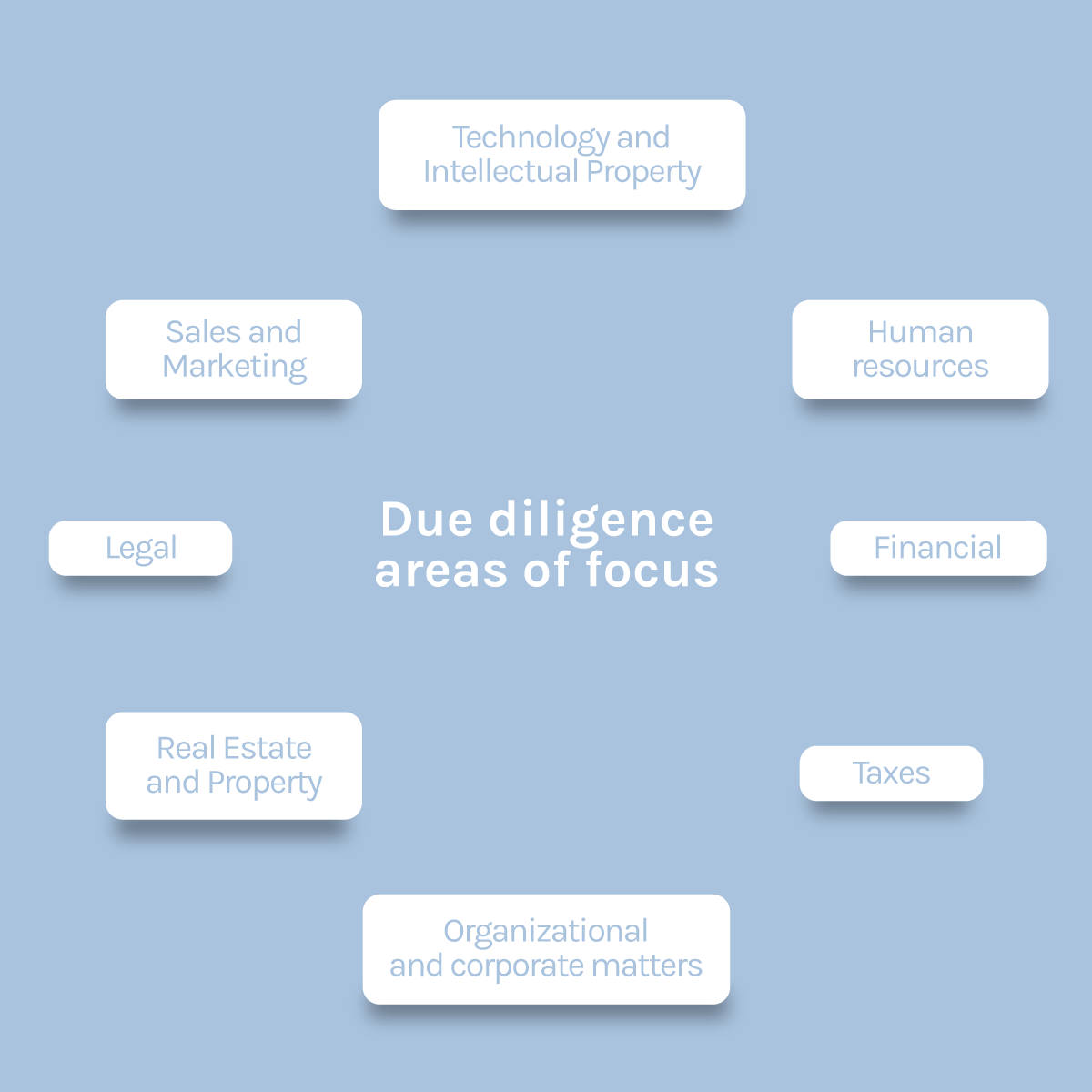

M&A Due diligence checklist

The following is a summary of the essential activities that must be performed in the different areas that concern a Mergers and Acquisitions transaction.

Organizational and Corporate Matters

Firstly, the future business owner needs to understand the structure and functioning of the business. The hierarchy and functions of the members or shareholders, as well as the areas where the business operates. The buyer must have a clear idea of the company’s:

- Articles of Incorporation or corporate documents filed with the Secretary of the State

- Bylaws or operating documents

- Business Entity

- Key stakeholders

- The organizational chart and management structure

Financial

The buyer will inspect the overall’s financial health of a business and gauge the projections of its future performance. The following are some areas of interest:

The past performance and financial projections of the business, based on annual, quarterly, and monthly financial statements for at least three past years.

- Audited financial statements

- Schedule of accounts receivable and accounts payable

- Debt financing documents

- Budgets and operating plans

Transition strategy

It’s key that the buyer understands the process of transition and if the seller and key employees will be involved after the business acquisition.

- Will the seller provide products, services, or technology the buyer doesn’t have?

- Handover period

- The permanence of the seller during the transition

Technology and Intellectual Property

Offers the opportunity to be aware of the IP the purchase is going to include, such as trademarks, copyrights, patents and trade secrets, and the software or technology the business requires to operate.

- Patents

- Intellectual property protection procedures

- Trademarks

- Technology and software licenses

Taxes

An overview of the historical tax records of the business is key to be aware of any underlying liability. The investigation of this subject should focus on the business’s tax information for the last three years, including federal, state, local, and foreign income sales.

- Government audits

- Reporting forms to the IRS for the last three years

- List of any tax liens

- Federal, state, and local tax returns for the last three years

- IRS Form 5500 for 401(k) plans

- Withholding tax compliance

Legal

Involves exploring any litigation concerns, contractual obligations, and regulatory compliance of the business. The objective of legal due diligence is to ensure all the documentation, policies, and permits are in place.

- Filed or pending lawsuits

- Violations of the government laws

- Permits and licenses

- Internal and external contracts

- Antitrust and regulatory matters

Sales and Marketing

Helps to have a better vision of the business’s customers and sales approach. The investigation should revolve around customer retention and satisfaction, sales policies, production procedures, marketing plans and strategies.

- List of products and services offered

- Policies related to sales, pricing, warranties

- Top customers for the past three years

- Marketing plans and strategies

- Standard Operating Procedures (SOPs)

- Distribution channels and description

- Strategic relationships and partnerships

Human resources

The objective of this inquiry is to understand the value employees provide to the company, their relationship with the company, and their compensation.

- Management organization chart

- Workers\’ compensation, insurance, incentives

- Employment manuals and policies

- Employee retention

- Labor law compliance

- Any labor disputes

Real Estate and Property

The buyer inquires about the physical assets of the business, such as leased properties, machinery, inventory, and other properties.

- List of properties and applicable details (rent amount, location, dates, etc.)

- Real property title documents

- Lease agreements for equipment

- Material machinery and equipment and corresponding depreciation

- Inventory listing

- Deeds of trusts and mortgages

Environmental, Health, and Safety

Buyers should ask for environmental and safety reports that are pertinent to the industry of the business.

- Environmental audits

- EPA notices

- Environmental permits and licenses

- Permits and records relating to safety and health issues

- Accidents within the last 5 years

Due Diligence Documents

The required list of documents for due diligence also varies depending on the size of the business and the mentioned factors.

These are some documents that you should request from the seller in a merger or acquisition:

Organizational

- Articles of Organization/ Articles of Incorporation

- Operating Agreement or Shareholders Agreement

- Stock certificates

- Bylaws

- Board of Directors\’ meeting minutes

Financial Documents

- Balance sheets

- Bank statements of all business bank accounts

- Loan or financing agreements

- Lines of credit to which the company is a party

Technology and Intellectual Property

- List of websites, patents, trademark registrations, and copyrights.

- Agreements that dictate the use and distribution of the company’s IP

- Description of data privacy policies and procedures

- List of IT systems, data-processing systems, and software programs.

Taxes Reports

- Local, state, and federal income tax returns for the last three years

- Tax liens

- IRS Form 5500 for 401(k) plans

- Government audits

- Tax sharing and transfer pricing agreements

Legal

- Active litigation, arbitration, administrative or other proceedings involving the company

- Permits and licenses

- Internal contracts

- External contracts

- Sales and Marketing

- Business and marketing plan

- List of key customers

- List of suppliers

Human Resources

- Management organization

- List of employees and their positions, current salaries, internal files, years of service, and total compensation over the past three years.

- Employee handbook

- Sexual harassment or discrimination policies

- Schedule of compensation paid to officers, directors, and key employees

- Employment agreements

- Copies of all stock option and stock purchase benefits for employees

Real Estate and Property

- Lease agreements

- Equipment leases

- Equipment inspection reports

- Copy of inventory listing including item description, units, and cost

Environmental health and safety

- Permits and records relating to environmental matters

- Copies of notices and fillings with the Environmental Protection Agency (EPA)

- OSHA Compliance reports

Most Common Mistakes when doing Due Diligence

Not verifying information: The objective of the due diligence process is to ensure that what you buy is exactly what you were expecting. It is not enough to ask questions to the vendor but to analyze the veracity of the provided documents and use your own resources to confirm this information.

Not using due diligence as a basis for the purchase agreement: It is common for people to use purchase agreements that are too “boilerplate”, and do not contemplate the specific needs of the business acquisition.

Due diligence serves as an opportunity to protect yourself against the potential risks you found in the process. A business acquisition lawyer will add specific provisions to the purchase agreement that will counter these hazards.

Not having the right team of M&A advisors: It’s paramount that you count on experts that will help you make an informed decision and choose if you want to continue with the acquisition.

Taking the inappropriate amount of time: Take the precise amount of time to analyze the profitability of the business. If the seller pressures you to make a decision, that may be a red flag. On the contrary, if you take too long, the seller may lose interest in the sale.

How our M&A due diligence services can help you?

Our business acquisition lawyer will conduct due diligence to ensure your business transaction is made in your best interest.

With our legal help, you will be able to:

- Minimize the risk of buying a company with poor efficiency and liabilities.

- Save time and resources. We help you have a smooth and seamless business purchase.

- Stay protected after the business acquisition. We ensure your purchase agreement contains the provisions that will reduce any negative impact.

- We ensure you comply with the law and that everything is in place after your business acquisition.