What is M&A financial due diligence?

Financial due diligence refers to the process of inspecting a target business’s financial performance to verify its value and profitability.

By conducting financial due diligence, both the buying and selling parties of a business acquisition can make an in-depth analysis of the numbers of the company and assess any financial risks involved in the transaction. Financials are a key aspect of the due diligence process, during which the buyer will also inspect the legal, operational, and commercial position of the target business.

Buy-side financial due diligence

Typically, financial due diligence is associated with the buying party of M&A. By evaluating the financial state of the target business, the buyer will conclude if the company has a solid foundation that will allow the business to be profitable after the transition. After conducting financial due diligence the buyer can decide whether to continue with the deal or withdraw from it before entering into a binding agreement.

Sell-side financial due diligence

Sellers can also inspect the financial state of their business to ensure it is attractive to buyers and have a clearer idea of the purchase price they can sell it for.

The M&A sell-side can uncover any irregularities or underlying issues that need attention before the sale and ease the transaction process for both parties.

Importance of financial due diligence

To gauge the convenience of the investment during a business purchase, the buying party must evaluate multiple dimensions of the target company. Conducting due diligence also includes observing the commercial, legal, and operational aspects of the business.

However, although the research of other areas is essential, financial due diligence is the key factor that will reflect the performance of the surrounding areas and the company’s potential for growth.

Conducting financial due diligence helps both parties study:

![]() The profitability of a company: Reveals whether the company is generating an acceptable revenue, helps determine its true value, and if the acquisition is viable.

The profitability of a company: Reveals whether the company is generating an acceptable revenue, helps determine its true value, and if the acquisition is viable.

![]() Projections: Explains the strategies that were devised to expand the company’s operations in the short and long term.

Projections: Explains the strategies that were devised to expand the company’s operations in the short and long term.

![]() Financial health: Gives a better understanding of the overall performance of the business, underlying debts, revenue and expenses, and the profit it produces at a specific period.

Financial health: Gives a better understanding of the overall performance of the business, underlying debts, revenue and expenses, and the profit it produces at a specific period.

![]() Revenue generation: Buyers can understand whether the financial management of the company is sustainable

Revenue generation: Buyers can understand whether the financial management of the company is sustainable

![]() Associated risks: Identify potential liabilities that could impact the profitability of the business and mitigate risks before signing the purchase agreement.

Associated risks: Identify potential liabilities that could impact the profitability of the business and mitigate risks before signing the purchase agreement.

How long does the financial due diligence process take?

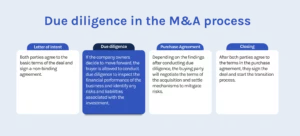

The process of due diligence starts after the offer is accepted by both parties and the Letter of Intent has been signed. Although the time varies according to the complexity of the deal and the responsiveness of both parties, financial due diligence for small to mid-sized businesses typically takes from 30 to 60 days to be completed.

Financial due diligence process

As a business buyer, there are three main steps to take when conducting due diligence

Preparation

Formulate clear goals to guide the due diligence process. Assemble a team of qualified experts, such as M&A lawyers and business acquisition accountants, who will help you gather and analyze the provided information.

Set a realistic timeline for due diligence that is broad enough to allow you to review the business records, but not too extensive, for it could cool down the negotiation. Set the expectations with the vendor and communicate how you will assign different tasks at specific periods and what data you will require.

Prepare the list of documents you will need to scrutinize and set up a virtual data room, which is an online platform where the business owner will upload the required files.

Research

Talk to the company’s decision-makers and ask pertinent questions that will help you have a general idea of the business’s finances. Review concerning financial documents and reports. Although financial due diligence is the primary focus, always support your research with commercial, legal, operational, and concerning due diligence.

Compare public documents and the information you gathered against the data you obtained by reviewing the company’s financial data.

Analysis

Understand the company’s financial performance by analyzing its revenues and expenses, cash flows and working capital, balance sheets, and all the concerning financial statements. Assess what are the risks involved in the business acquisition and how to mitigate them, and examine the performance of the business, and its potential for profitability.

How to conduct financial due diligence

To conduct financial due diligence, the interested team audits from 3 to 5 years of financial statements and asks pertinent questions to evaluate the company’s financial condition and its ability to continue subsisting.

The best practice is to have an M&A accountant carefully review the financial statements and determine the risks and opportunities associated with the target business.

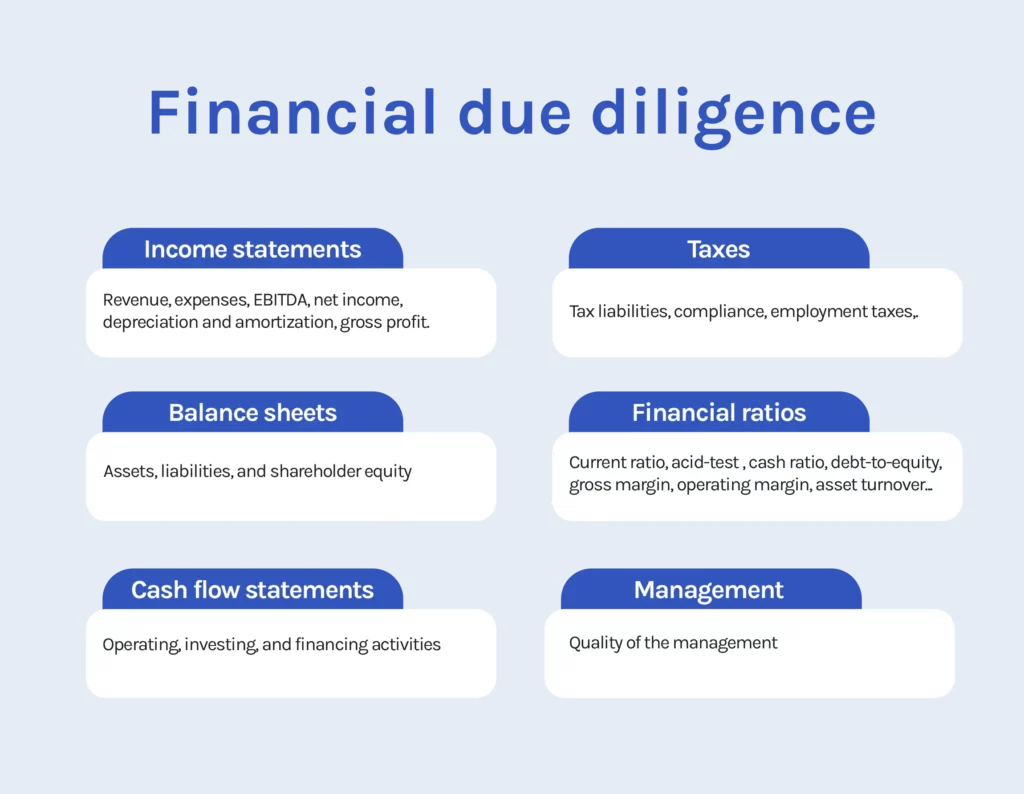

Income statements

Also known as the profit and loss (P&L) statement, the income statement will expose the revenue, costs, gross profit, and losses that the company reports at the stated period. Make sure to review the income statement of the past five years to define whether the company has been managed efficiently, what areas are performing poorly, and its profitability compared to other businesses in the industry.

Starting with the income statement is mostly recommended, as it requires the least information from the remaining two financial statements.

The areas of focus of an income statement are the following:

![]() Revenue and sales: Reports what the company gains from its sales. It includes the generated operating and non-operating revenue.

Revenue and sales: Reports what the company gains from its sales. It includes the generated operating and non-operating revenue.

![]() Cost of goods sold (COGS): The total cost of sales or services that are provided to generate revenue.

Cost of goods sold (COGS): The total cost of sales or services that are provided to generate revenue.

![]() Gross profit: Refers to the net sales minus the total cost of goods sold.

Gross profit: Refers to the net sales minus the total cost of goods sold.

![]() Expenses: All the costs the company has to pay to continue generating revenue, such as wages, supplier payments, and equipment depreciation.

Expenses: All the costs the company has to pay to continue generating revenue, such as wages, supplier payments, and equipment depreciation.

![]() Marketing and advertising expenses: The costs required to promote the business

Marketing and advertising expenses: The costs required to promote the business

![]() General and administrative expenses: Include indirect costs associated with running the business.

General and administrative expenses: Include indirect costs associated with running the business.

![]() Depreciation and amortization expenses: Calculates the value of business assets over time.

Depreciation and amortization expenses: Calculates the value of business assets over time.

![]() EBITDA: Stands for Earnings before Interest, Tax, Depreciation, and Amortization, and helps you determine the company’s ability to generate cash flow.

EBITDA: Stands for Earnings before Interest, Tax, Depreciation, and Amortization, and helps you determine the company’s ability to generate cash flow.

![]() Net income: The earnings that a company keeps after deducting all costs of operation.

Net income: The earnings that a company keeps after deducting all costs of operation.

These financial documents are indicators of the management strategy and creditworthiness of the company. An income statement will help you decide whether you’ll be able to generate profit by increasing revenues or decreasing costs, and if the company can repay its current obligation.

Balance sheets

This financial statement reports the company’s assets, liabilities, and shareholder equity for the last five years.

Analyzing the balance sheet is key before buying a business because investors get a sense of what the company owns and owes at that moment.

During M&A, business buyers can scrutinize the specifics of a company’s finances such as:

![]() Assets: Refers to what the business owns, including cash, marketable securities, accounts receivable, inventory, prepaid expenses, fixed assets (properties), and intangible assets (intellectual property).

Assets: Refers to what the business owns, including cash, marketable securities, accounts receivable, inventory, prepaid expenses, fixed assets (properties), and intangible assets (intellectual property).

![]() Liabilities: What the business owes, including long-term debts, tax payable, interest payable, wages, dividends payable, and accounts payable.

Liabilities: What the business owes, including long-term debts, tax payable, interest payable, wages, dividends payable, and accounts payable.

![]() Shareholder equity: Representing the net value of the company, it includes common stock and retained earnings of the company.

Shareholder equity: Representing the net value of the company, it includes common stock and retained earnings of the company.

Understanding a balance sheet will help you measure key financial ratios, such as the debt-to-equity ratio, the debt-to-asset ratio, and the current ratio at the stated period. This will help buyers know the worth of the business, track their investments, and set expectations of what they will receive in the future.

Cash flow statements

Being one of the three fundamental financial reports of a company, a cash flow statement details how cash entered and left a business during the specified period.

When inspecting the cash flow statement, you will be aware of the company’s capacity to generate cash from its operating and investing activities and pay its debt obligations.

The cash flow statement will point to the cash flow associated with different activities:

![]() Operating activities: Calculates the cash derived from the business activities or the selling of products and services.

Operating activities: Calculates the cash derived from the business activities or the selling of products and services.

![]() Investing activities: Includes cash flows related to the buying and selling of long-term assets like property and equipment.

Investing activities: Includes cash flows related to the buying and selling of long-term assets like property and equipment.

![]() Financing activities: Involves the cash obtained from investors and loans, such as dividends, payments for stock, and repayment of debts.

Financing activities: Involves the cash obtained from investors and loans, such as dividends, payments for stock, and repayment of debts.

It is essential to evaluate the cash flow statement before a business acquisition, for it will provide a holistic picture of the different payments made by the company that cannot be spotted in a profit and loss report such as loans. Additionally, a cash flow statement will make it easier to interpret the working capital of a business, which are the funds that are currently available to the business.

This statement will help buyers determine if the company will continue to be solvent and its ability to increase cash inflow.

Taxes

Taxes are one of the most disregarded elements in Mergers and Acquisitions and one of the heftiest liabilities that must be considered since they are transferred in the transaction.

Investors need to determine their responsibilities and liabilities by identifying the tax structure of the business, reviewing the company’s historical tax compliance, and assessing any tax-related risks involved.

When purchasing a business, tax due diligence covers payments associated with income, payroll employment, and property.

Whenever you are going through the mentioned financial statements, be careful whenever you identify one of the following red flags in the business acquisition:

Tax liabilities

![]() Financial inconsistencies

Financial inconsistencies

![]() Poor product margins

Poor product margins

![]() Declining sales figures

Declining sales figures

![]() High volatility in stock price

High volatility in stock price

![]() Increasing debt-to-equity ratio

Increasing debt-to-equity ratio

![]() Unsteady cash flows

Unsteady cash flows

![]() Poor credit scores and outstanding debts

Poor credit scores and outstanding debts

![]() Deficient growth potential

Deficient growth potential

![]() Rising accounts receivable or inventory in relation to sales

Rising accounts receivable or inventory in relation to sales

![]() Higher liabilities than assets

Higher liabilities than assets

![]() Decreasing gross profit margin

Decreasing gross profit margin

Financial due diligence checklist

The following is a list of the documents and financial specifics you want to examine when conducting due diligence before buying a business. Remember that it is highly recommended to study the financial statements and documents of the last 3-5 years.

![]() Audited financial statements for the last three to five years, including income statements, balance sheets, and cash flow statements.

Audited financial statements for the last three to five years, including income statements, balance sheets, and cash flow statements.

![]() List of assets and liabilities, valuation and analysis of their condition

List of assets and liabilities, valuation and analysis of their condition

![]() Analysis of fixed, variable, and non-operational expenses

Analysis of fixed, variable, and non-operational expenses

![]() Analysis of gross margins

Analysis of gross margins

![]() Analysis of working capital

Analysis of working capital

![]() EBITDA calculations

EBITDA calculations

![]() Bank statements

Bank statements

![]() Financial budgets and projections

Financial budgets and projections

![]() Capital structure

Capital structure

![]() Accounts receivable schedules

Accounts receivable schedules

![]() Accounts payable schedules

Accounts payable schedules

![]() List of outstanding debt and copies of debt financing documents

List of outstanding debt and copies of debt financing documents

![]() Schedule of inventory

Schedule of inventory

![]() Tax returns filed for the last five years (federal, state, local, property, and foreign)

Tax returns filed for the last five years (federal, state, local, property, and foreign)

![]() List of any tax liens

List of any tax liens

![]() IRS Form 5500 for 401k plans

IRS Form 5500 for 401k plans

![]() Employment tax filings for the past five years

Employment tax filings for the past five years

Financial due diligence questions

Get a better sense of the target company by gathering the following financial information. Complement your research with other questions to ask before a merger or acquisition.

- Why are you selling the business?

Although it is not directly a financial question, asking the business owner this information will give you confidence in moving forward or withdrawing from the transaction.

- What is the asking price? What method did you use to set the asking price?

Before moving forward, ensure the asking price is reasonable and that the business has been objectively appraised by a third party. Use this time to ask the seller whether the price is negotiable.

- Are there any other investors or owners?

Make sure you have the approval of all the decision-makers involved

- What is the business annual gross revenue?

Understand how much is generated from regular business operations and the amount that comes from non-operating income.

- How much profit does the business make a year?

Calculate not only how much the business is generating, but whether there are quality earnings from it

- What level of working capital will you need?

Understand the amount of money the company requires to cover its day-to-day operations to analyze whether it is a feasible investment.

- Are there any outstanding debts?

See if there are any loans or liabilities that need attention.

- What are the assets included in the sale?

Ask for a list of all the properties that belong to the company and that are included in the M&A and examine their condition and value.

- Is the business tax-compliant?

Ensure the target company will not transfer unnecessary tax liabilities

- What are the projections for next year?

Analyze if the buyer is certain of the growth opportunities and has realistic estimations about the business’s future performance.