What is a Letter of Intent?

An LOI is a document that establishes an agreement between two parties that are negotiating a business transaction, such as a business acquisition, merger, or joint venture. In M&A, the letter of intent is a formal, non-binding offer to buy a business from a seller.

The first step of buying a business is the buyer signing a Letter of Intent or “LOI” which shows the seller that the buyer is serious. Even though LOIs are mostly not binding, they are still important to the business purchase because they include the essential terms of the deal, and they show a serious commitment toward the business transaction from both parties.

Purpose of an LOI

Letters of intent serve the purpose of describing the basic conditions of a purchase agreement regarding prices, conditions, the subjects of the transaction, and the timeline. This is the reason LOIs are the backbone of any business acquisition.

Letters of intent have the function of

- Establishing the key terms of a transaction

- Settling a formal adherence to a deal

- Protecting the participants of the business transaction

Other applications of an LOI

Letters of intent are mainly used in Mergers and Acquisitions (M&A) to establish the basis of a formal business negotiation. However, LOIs can have other applications, such as:

Real Estate: LOIs are used to show an authentic interest in buying a residential property.

Scholarship acceptance: Another use of letters of intent is sending them to institutions that have provided support for students. With an LOI, the new member of the organization can express their appreciation for the opportunity.

Admissions application: Whether it’s a new job or a graduate school, you can send an LOI to show your interest in being a member of the company or institution.

How to write a Letter of Intent for M&A

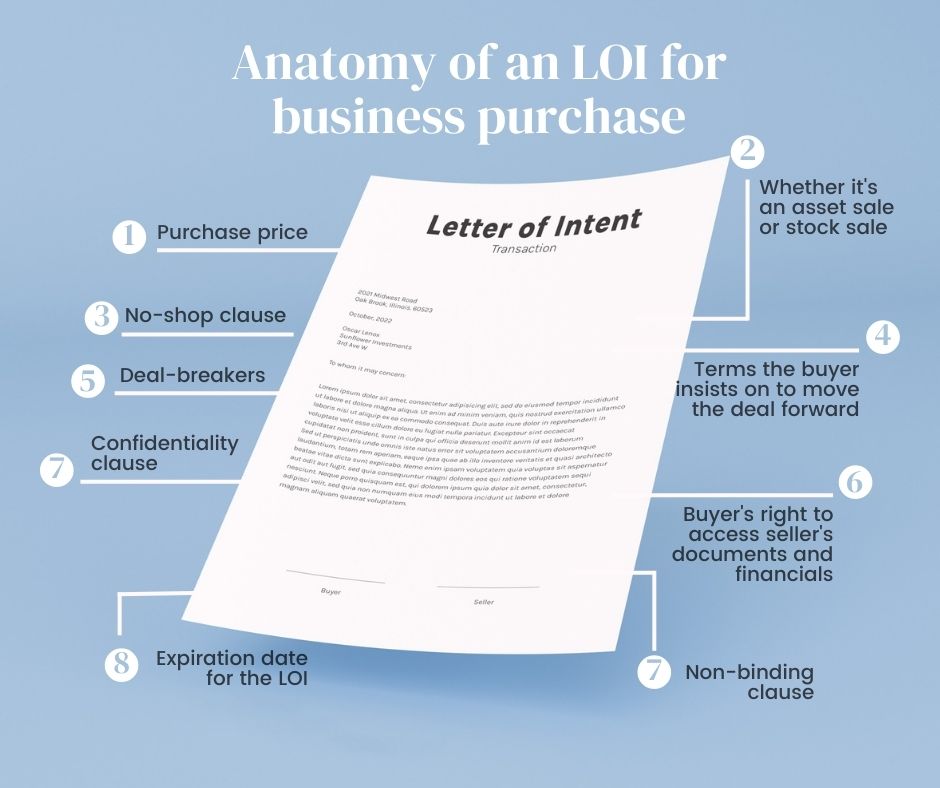

You should include the following in your LOI:

-

Purchase price

A tentative cost of the transaction. Although it may change depending on the ulterior events, it sets a basis for the business acquisition.

-

Asset sale or stock sale

This section determines whether the sale will be an asset sale, which involves the individual assets and liabilities, or a stock sale, where the buyer acquires the shares of a corporation.

-

No-shop clause

This clause is of utter importance because it prohibits the seller from accepting offers from other buyers during the whole negotiation.

-

Terms

These are the conditions the buyer insists on in order to move the deal forward. A common example is a buyer often requires the seller’s key people to remain in the company to help the transition.

-

Deal-breakers

The issues that, if not resolved, could lead to the termination of the agreement and the business relationships.

-

Buyer’s right to access seller’s documents and financials

In this section, the seller concedes permission to the buyer to analyze documents and financials that will help him determine whether to proceed with the business acquisition.

-

Confidentiality clause

In order to protect the target company and its intellectual property, a confidentiality clause must be included in the letter of intent.

-

Non-binding clause

Adding the wrong information to the letter of intent can make it legally binding. To remove any doubt, you must add a non-binding clause.

-

Timeline or expiration date for the LOI

It details the period of validity of the letter of intent, or the conditions for its termination.

Is an LOI legally binding?

If the parties treat the LOI like a contract (which does happen), then the court may consider it a binding contract. Likewise, if the Letter of Intent has too many key terms, it may start looking like a purchase agreement. The court considers the following factors to determine if it is binding or not:

- Whether the agreement will be put in writing

- The level of detail contained in the letter of intent

- Whether a formal writing is required to fully express the applicable covenants

- Whether the negotiations indicate that a written draft is contemplated at the conclusion of the negotiations. Courts also consider whether the LOI has clauses such as warranty, liquidated or other damages, taxes, and notice provisions. In other words, if your LOI starts to quack like a contract and walk like a contract, the court may consider it a contract. See also See QUAKE CONSTRUCTION v. American Airlines, 181 Ill. App.3d 908 (1st Dist. 1989).

For this reason, it’s better to receive counseling from an M&A lawyer from the start of the negotiations. The attorney will write the Letter of Intent in the buyer’s best interest and also ensure the LOI both parties are signing is not enforceable.

Need help with your Letter of Intent? Give us a call to (630) 517-5529 today to receive personal attention from an M&A advisor.