In the context of a business acquisition, a letter of intent (LOI) is a document that defines the preliminary terms of the transaction and formalizes the intention of two parties to engage in it.

Typically, the letter is created by the purchasing party, who proposes a price and outlines the structure of the negotiation. Although the terms of the letter of intent are not definitive, they will establish the basis of the final business purchase agreement.

Is an LOI legally binding?

Essentially, a letter of intent itself is not legally binding since it cannot require the parties to move forward in the transaction. However, it contains enforceable clauses concerning confidentiality and exclusivity.

Some of the binding provisions in a letter of intent include:

- No shop provisions: Restrict the seller from soliciting or discussing other offers from potential buyers for a specified period.

- Confidentiality: Restricts both parties from disclosing sensitive information that is to be shared during the transaction

- Non-solicitation: Prevents one party from seeking out the other party’s employees.

Although a letter of intent is not a contract, an incorrect draft or use of it can have legal consequences. If a letter of intent contains the elements of a contract, the Court can regard it as such and proceed legally.

When does the letter of intent come into play?

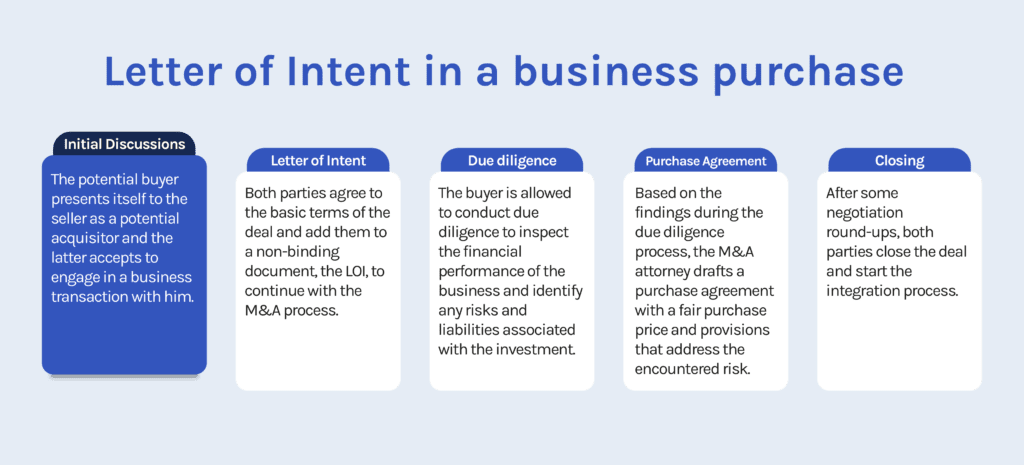

The LOI enters the M&A process after the initial discussions between both parties have occurred. This means that once the buyer has found the business they want to purchase and has an idea of its price, they will provide the letter of intent to negotiate it with the seller. After both have signed it, the buyer will proceed to conduct due diligence.

With the help of their M&A attorney, the buyer will present the letter of intent and negotiate the terms with the seller before both sign it.

Importance of LOIs when buying a business

An LOI facilitates a business transaction because it will express the commitment of both parties toward the deal and prepare them for the negotiation.

The following are some of the reasons to use an LOI during M&A:

Serve as a record for the deal

Signing a letter is a way of documenting the parties’ willingness to move forward in the acquisition process. If you are looking for business financing alternatives, you may be required a copy of the LOI to confirm there is an existing M&A offer.

Set the expectations of the transaction

The key to speeding up a business purchase is minimizing misunderstandings and ensuring both parties have the same objectives. An LOI will work as a roadmap that outlines elements associated with costs, the included assets, the timeline, and restrictions.

Express good faith

Another purpose of the LOI is to make the transaction transparent and to clarify the intention to remain exclusive and discrete to the deal.

Protecting both parties

Buying a business requires a hefty investment in terms of time, money, and resources. With a letter of intent, not only both parties will avoid disputes, but each party will protect its interests. A buyer will confidently spend on conducting due diligence and additional services knowing they are the sole potential buyers. On the other side, a seller’s confidential information will be safe.

How To write a letter of intent for M&A?

The terms and clauses included in a letter of intent will vary according to the nature of the transaction. A typical format will be structured in the following way:

- Identification of the parties: Specifies the buyer’s and the seller’s name and contact information

- Introduction: States the objective of the document and describes the roles of both parties in the transaction.

- Assets: Determines the items to be transferred and the ones the seller wants to retain

- Sale structure: Specifies whether the business sale will consist of a stock sale, asset sale, or if it’s a merger.

- Tentative price: Proposes an approximate price or price range and payment terms, including the deposit, down payment, and loan type.

- Contingencies: These clauses express conditions to be met before the closing. They can be related to obtaining financing, and finding the performance of the business satisfying, among others.

- Due diligence: Describes the documents the buyer will require to conduct due diligence and an expected timeline.

- Non-shop clause: Restricts the buyer from negotiating with other potential buyers

- Confidentiality: Prohibits the parties from disclosing sensitive information

- Non-binding clause: Clarifies the letter of intent is not enforceable, and neither party is bound to conclude the transaction.

- Dealbreakers: Defines what issues could lead to the termination of the agreement

- Governing law: Identifies the state laws that rule the legal document

- Expiration date: Sets out a time limit for the due diligence and negotiation process

Should I hire a lawyer to write an LOI?

Although hiring an attorney is not legally required, it is highly advisable to get the assistance of a business acquisition lawyer, for they will help you:

Set Clear Expectations

The LOI works as a template for the final purchase agreement. Even when the terms in the letter of intent can be modified, it’s key that both parties have an accurate idea of the cost of the transaction, what it involves, its conditions, and restrictions.

Do you know how long will due diligence take? What about the documents you will require? Is it better to opt for a stock sale or an asset sale? All these questions will be addressed by the attorney and added to the LOI.

Once you have proceeded with the acquisition, it’s difficult to negotiate terms that were initially agreed to, so they should be precise from the beginning.

Identify Key Considerations

Every business acquisition has different nuances that vary according to the size of the deal, the industry, and the parties’ objectives. It is most likely that using a template will not cover your particular needs. An attorney will help you address every issue and potential risk.

Avoid litigation and protect your interest

By writing a letter of intent yourself, you risk accidentally entering a binding agreement, or contract. A lawyer will ensure you are not bound to the transaction and will add the necessary clauses to protect your investment.

Bringing your attorney into the deal will help you avoid unnecessary expenses and structure the deal in the most convenient way for you.

A business acquisition formally starts with a letter of intent. Being the backbone of the negotiation, you want to ensure you structure it properly and that it addresses any liabilities and opportunities from the beginning.

Motiva Business Law’s Mergers and Acquisitions attorneys will help you structure your deal in the most favorable way for you, conduct due diligence, negotiate the best terms, and help you have a smooth and seamless business transaction.

Frequently Asked Questions

Are letters of intent legally binding?

Letters of Intent are not meant to create a contractual relationship with the counterparty and if properly written, they should not be enforceable.

However, some of its provisions regarding confidentiality and exclusivity are binding.

If the letter of intent contains the elements of a contract, the court could regard it as such.

Can I modify the terms of the letter of intent?

Yes, the terms of an LOI can be adapted according to the needs of the buyer and the seller, and negotiated in the final purchase agreement.

What’s the difference between a Letter of Intent and a Memorandum of Understanding?

Both are essentially non-binding documents used to create an informal business relationship. However, while LOIs are used in the context of mergers and acquisitions to propose the basic terms of a business purchase, an MoU is used to describe the contribution of each party to a common project, such as a joint venture or a partnership.