Mergers and Acquisitions (M&A) is the process by which companies transfer their ownership or consolidate with other business organizations with a strategic purpose. Put simply, M&A refers to the activities concerning the sale and purchase of businesses.

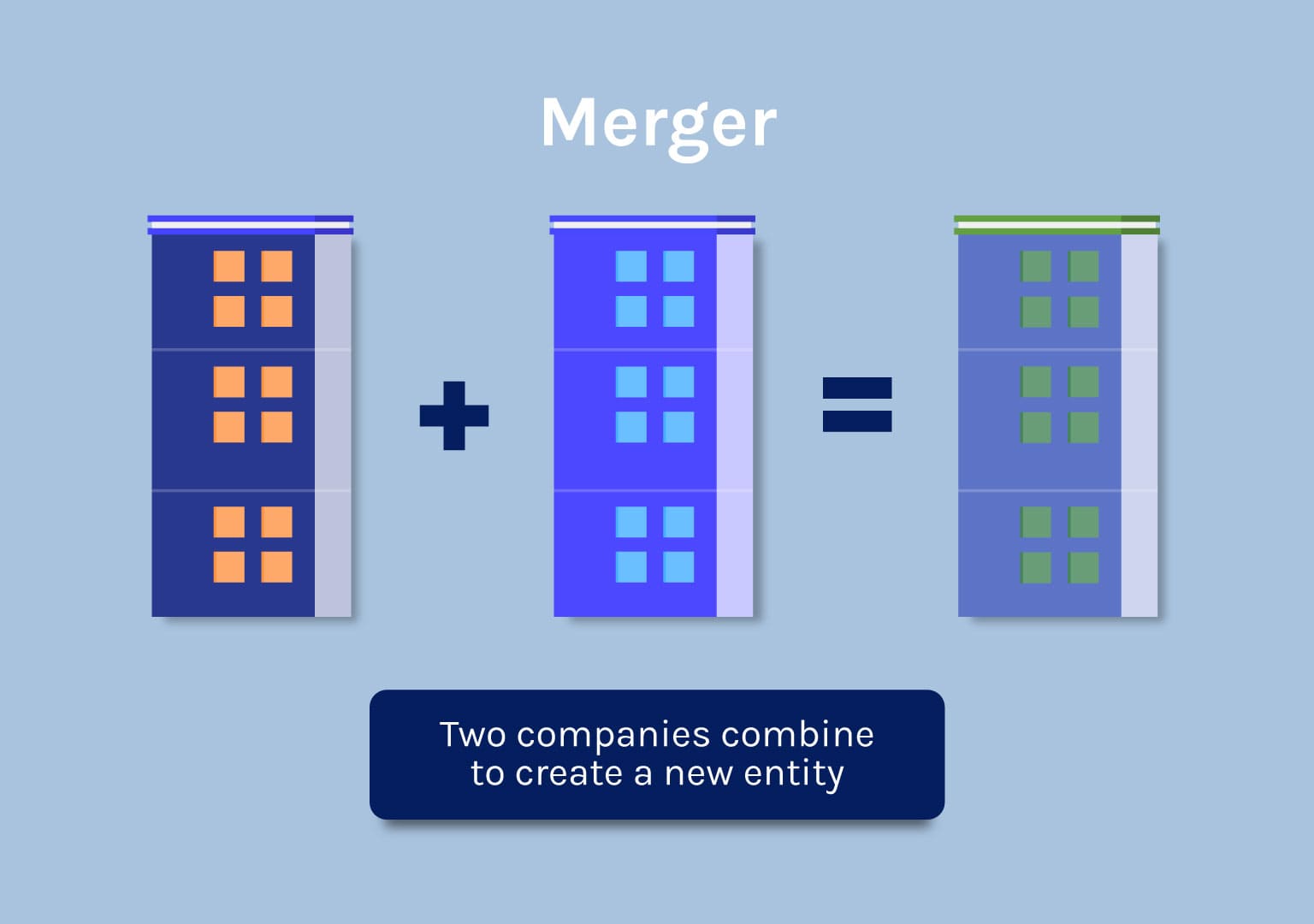

What is a merger?

In a merger, two or more companies combine to create a new corporate entity, which usually is assigned a new name. The firms are typically the same size, and they merge strategically to gain leverage from this integration. With a merger, both companies can benefit by saving on production costs, entering new markets, and potentializing their strengths.

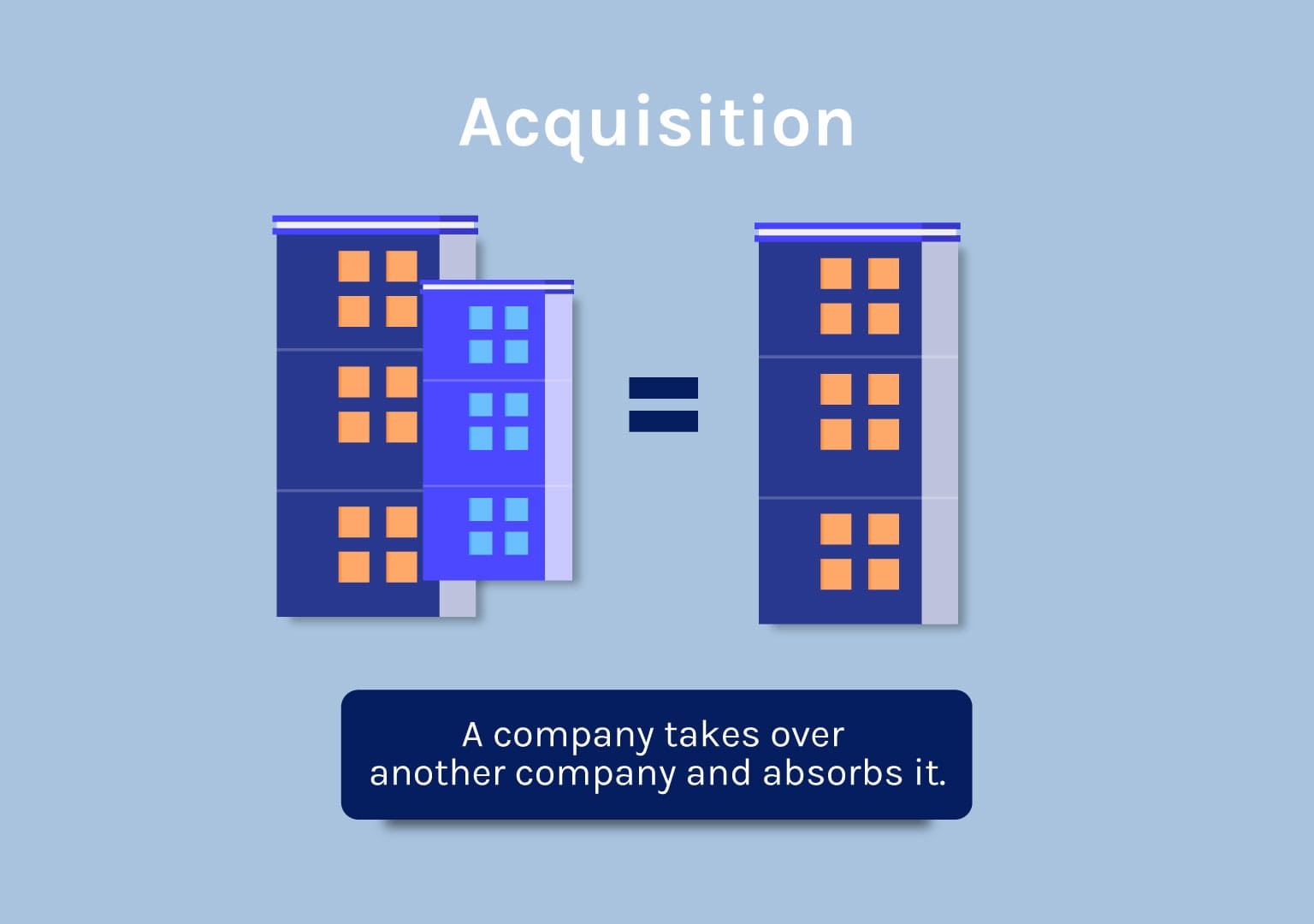

What is an acquisition?

On the other hand, in an acquisition, a company takes over another company and establishes itself as the new owner. Through a business purchase, companies may be able to achieve significant growth, by increasing their market share and being able to access new technologies, assets, operating procedures, and distribution channels.

Difference between mergers and acquisitions

In a merger, two or more companies join together to create a new business entity; while in an acquisition, a business absorbs another company.

Choosing whether to merge with a company or acquire it is more of a matter of strategy rather than a legal matter. In other words, a business owner may want to acquire another business, but legal technicalities make a merger more appropriate. In the end, your legal and financial advisors will give you the best guidance on choosing.

Benefits of mergers and acquisitions

- Growth

The main reason why companies go through an M&A process is to significantly increase their revenues at a faster rate. Buying a company or integrating with one has a direct impact on performance efficiency that could have not been achieved so easily organically.

- Competition and market share

When two competing companies merge, they will gain leverage and a larger market share. Similarly, with a business acquisition, the buyer immediately absorbs the competition and gains more relevance in the market.

- Synergy

Mergers follow the adage, “One plus one equals three”, which means that two companies can provide even higher value together by joining forces, knowledge, and resources.

- Economies of scale

By combining, companies are able to buy resources in greater quantities at a lower cost and improve profit margins.

- Diversification

Mergers and acquisitions can help companies expand their geographic scope, as well as the variety of products and services it provides.

Types of M&A

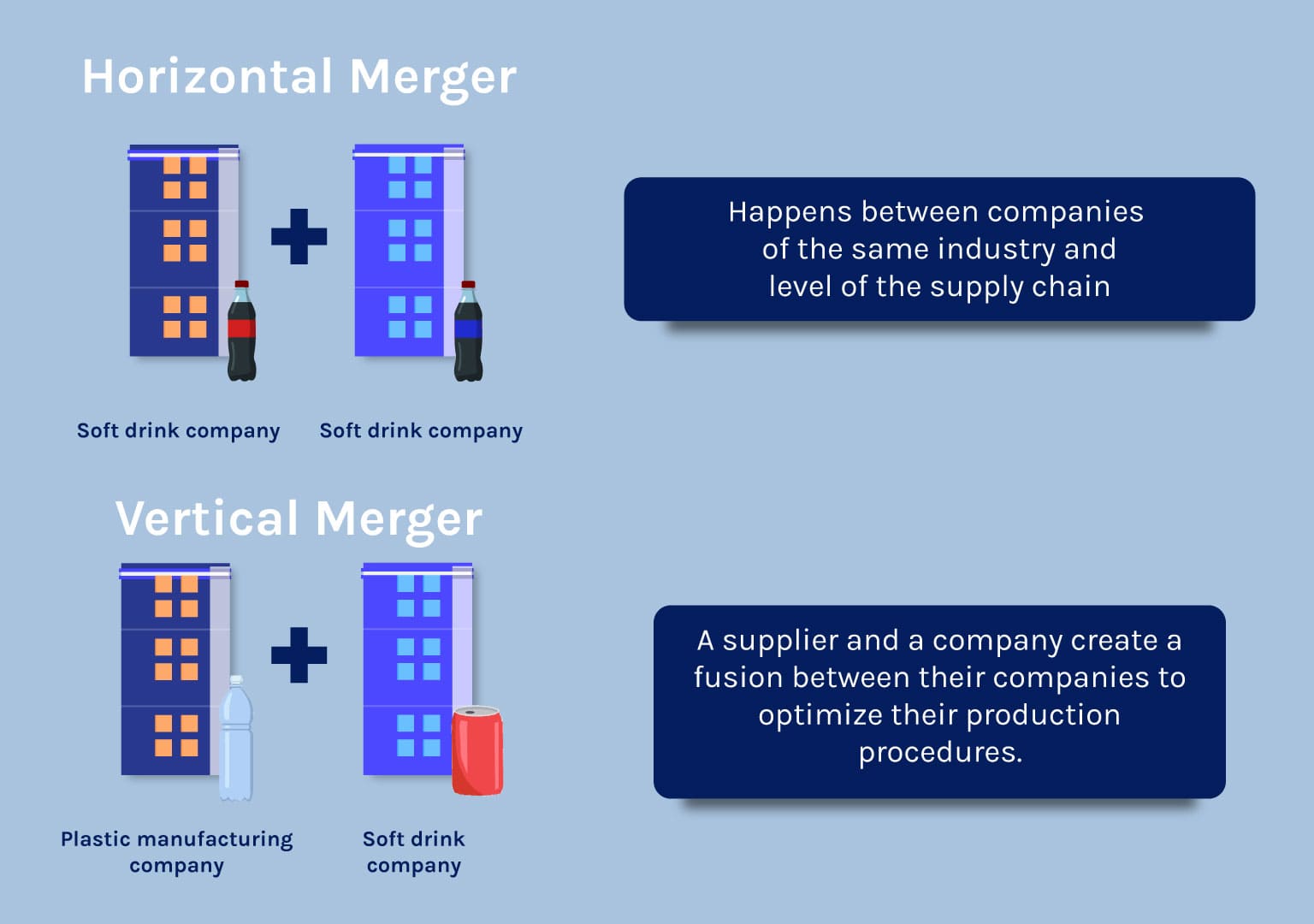

By functional roles in the marketing

- Horizontal acquisitions:

Horizontal mergers occur when two competitors in the same industry and level of the supply chain consolidate. One example would be Disney and Marvel. They are both entertainment producers that merged to create higher-quality products.

- Vertical acquisitions

A supplier and a company create a fusion between their companies to optimize their production procedures. An example would be Netflix, which benefits from the licenses of studios to provide a broader range of content.

- Conglomerate

This kind of merger occurs with companies that offer different products and services or industries and is usually done for diversification purposes. A clear example would be P&G, which is formed by several companies.

Types of M&A by business outcome

- Statutory merger

In a statutory merger, one of the companies that are part of the transaction continues to exist as a legal entity.

- Subsidiary merger

In this business combination, the acquired company becomes a subsidiary of the purchaser but continues to operate.

- Consolidation

When the companies join together, they dissolve to create an entirely new legal company. The purpose of this merger is to form a new legal entity using the capital and assets of both the acquiring entity and the entity.

M&As by Acquired goods

- Asset Sale

The buyer acquires individual assets of the target company, such as equipment, licenses, intellectual property, inventory, fixtures, and other assets. This kind of acquisition helps the buyer avoid assuming some of the target’s liabilities and be able to claim more tax write-offers. In this kind of transaction, buyers are able to choose which assets they want to purchase and turn down the assets and liabilities that are not very favorable for their deal.

- Stock Sale

In a stock sale, the buyer buys the shares of the selling business, which makes the latter the owner of the seller’s legal entity. With this kind of purchase, the buyer acquires more liability, such as legal issues, employment matters, environmental concerns, and others.

Although the transfer of liabilities and the tax concerns are the most determining factors when it comes to deciding whether to opt for an asset or stock sale, there are other considerations that should be taken into account.

One of them is that if the target company has business contracts or relationships that are key to the performance of the business, then they should go for a stock sale. This kind of acquisition will include this useful information.

M&A Financing

There are several ways in which a company raises money to fund mergers and acquisitions. The main forms of M&A financing are debt (loans) and equity (investor capital).

The objective of financing, besides funding an acquisition, is to manage the capital in a way that corresponds to the operating cash flow performance of the company.

These are some ways to finance M&A, and can even be combined for the benefit of the transaction.

- Equity financing

Companies can simply pay the transaction with cash, or opt for a stock exchange. The latter is one of the most used alternatives for financing. In this situation, the acquiring company exchanges its shares for the shares of the target company.

- Debt Financing

The parties involved in the transaction agree for the buyer to take charge of the debt the seller owes as a way of payment. Since it is very common that the reason behind a sale is debt, this is a great alternative that benefits both the buyer and the seller.

Business Valuation in M&A

Business valuation refers to the process in which the worth of a company is established depending on determining factors. The way a business’s worth is settled varies from industry, but the range of value will mostly depend on the earnings of the company. However, appraisers also take into account other factors such as the differentiating traits of the business, the stage of the company’s lifecycle, and its positioning in the market.

There are several methods of business valuation in Mergers and Acquisitions:

- Discounted cash flow (DCF) method

This approach takes into consideration the future projections of the cash flow and compares it with its current cash flow perspective.

- Cost approach

This method estimates how much would it cost to create a replica of the business from the ground. This approach works best with businesses that have physical locations or serve tangible goods.

- Market approach

This valuation approach takes into consideration the price for which similar businesses have been sold recently and uses it as a basis for determining the selling cost.

The M&A process

There are five main steps for mergers and acquisitions. The specific actions may slightly differ depending on whether you are on the selling side or buying side of the transaction, but essentially, the M&A process involves the following 5 steps:

- Initial discussions

This phase is where informal discussions between the seller and buyer begin. It is in the best interest of the seller to make the buyer sign a Non-disclosure Agreement (NDA) to protect the sensitive information he is about to handle. Both parts of the deal establish general terms of the transaction.

- Letter of Intent

Once the terms of the negotiation have been set, we can assume both parties are serious about the merger or acquisition, so they can move forward to signing the letter of intent (LOI).

An LOI is a non-binding document that includes the key points of the negotiation. Although it is not enforceable, it is important for an M&A lawyer to draft it, because it will be the foundation for the transaction. Also, LOIs can be binding when adding the wrong information, so it is better for a legal expert to take care of it.

Letters of intent include essential terms of the transaction, in which can be included:

- Purchase price

- Whether the sale will be an asset sale or a stock sale

- Buyer’s right to access seller’s documents and financials

- Confidentiality clause

- Timeline for the LOI

- Due Diligence

Due diligence is the process of inspecting the target business to ensure it is a good investment. In Mergers and Acquisitions, the buyer needs to go through the key aspects of the business to be protected after the purchase. Some considerations the purchaser needs to look after are:

- Management structure

- Federal, state, and local tax returns for the last three years

- Profit and loss statements

- Business, sales, and marketing plans and strategies, with any printed materials and SOPs

- Business licenses

- Lease/real estate agreements

- Environmental compliance

- List of all active or threatened litigation, arbitration, administrative or other proceedings involving the company, any subsidiary or any officer or director (including parties, remedies sought, and nature of legal action).

- List of products and services offered or planned to be offered, and their respective descriptions. prices, and SKUs

- Permits and records relating to safety and health issues

- Business valuation

Although a tentative price has already been set, the previous due diligence will help determine the final purchase price. Depending on whether the buyer found problems with the state of the business, the price can be decreased.

Also, the valuation methods described above are used to calculate the business’s worth.

- Purchase agreement and closing

This is when a mergers and acquisition lawyer, typically the buyer’s, draws up the purchase agreement. The attorney will assess the information collected from the due diligence and write the contract based on the liabilities that were encountered and add clauses that will prevent the specific potential risks.

Lastly, the parties will choose a closing date and exchange necessary documents and money in order to close the transaction.

Basic M&A concepts

- Target: The business being bought

- Due diligence: The legal, business, and financial research a buyer conducts on the target business to make sure the deal is a good one

- Data room: This is usually a computer file where the target company uploads its due diligence documents for the buyer to review

- Letter of Intent: This is the (mostly) non-binding formal offer from a buyer to buy the target business.

- Purchase Agreement: This is the binding contract that spells out all the terms of the purchase. It is important that the purchase price and associated warranties, covenants, and liabilities are negotiated.

- Term sheet: In larger deals, the parties may draft a “term sheet” that has the essential terms of the purchase agreement as the parties negotiate the details of the deal.

- Main street acquisitions: This refers to businesses business generating less than $5 million in revenue. These acquisitions tend to be asset sales versus stock sales.

- Middle Market acquisitions: This refers to businesses business generating $5 million-$1 billion in revenue. This category is further divided into lower, middle market, and upper middle market.

- Closing: This is the final transaction where the purchase agreement is executed, and the money and assets are exchanged between the parties. Only about 15% of business acquisitions actually close.

Need help buying or selling a business? An M&A Lawyer will give you personalized attention at (630) 517-5529.