A joint venture is an agreement in which two parties combine resources or expertise for a certain project or objective.

In a partnership, two or more individuals agree to continuously conduct a business together and share its ownership.

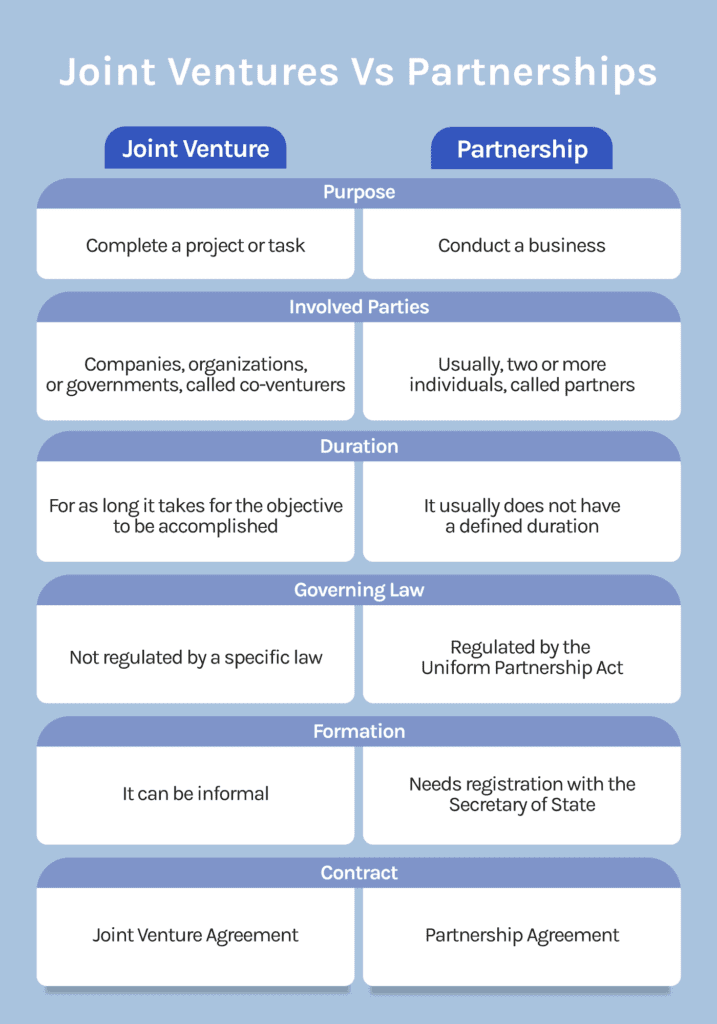

The key difference between them is that, while in a partnership there is an ongoing business relationship, in a joint venture this relationship is temporary since it ends once the objective is accomplished.

Key differences

Purpose

The objective of a partnership is for two or more people to operate a business they have invested in and share its profits.

The purpose of a joint venture may not be directly related to profit. The objectives can also involve business expansion, the development of a product, or the entrance to foreign markets.

Duration

Partnerships are meant to last for the life of the business. On the other hand, a joint venture is conceived for a short term and lasts for as long as it takes to attain the specific project.

Members

Partnerships are business organizations formed by two or more individuals. The members of a partnership are called partners.

A joint venture usually comprises two or more parties which can be individuals, companies, or even governments. The parties that are involved in a joint venture are called co-venturers.

Formation

While a formal partnership is a legal entity, a joint venture is not a defined legal term. JVs are formed through agreements and are not expressly regulated, while partnerships need to be registered in the state in which they do business and abide by specific laws.

For this reason, partnerships need to have an identifiable name, while joint ventures don\’t require this.

To form a partnership, the individuals should count on a partnership agreement that will define the terms of the business relationship, including profit and loss share, the percentage of control, and the rights and responsibilities of the members.

Although joint ventures can solely rely on an oral agreement, it’s of the utmost importance for the parties to abide by a joint venture agreement. This contract will outline the contribution of the parties, daily operations, and distribution of profit and losses, which will help avoid misunderstanding, and therefore, disputes.

Contribution

Partners contribute capital to the business. In contrast, the parties of a joint venture can also provide assets, skills, labor, and other resources for the accomplishment of the task.

Profit and loss share

In a joint venture, profits and losses are typically shared equally. For partnerships, the distribution of loss and profits is stated in the partnership agreement, as defined by the partners.

What is a Joint Venture?

A joint venture involves the cooperation of two or more parties in the pursuit of a project.

The parties may contribute to this endeavor with:

- Capital

- Labor

- Expertise

- Equipment

- Assets

A JV is typically formed for production purposes, but there can be other reasons behind this alliance, such as:

Research and development

Just like Alphabet Inc. and a British Pharmaceutical company called GlaxoSmithKline, companies can unite their efforts to develop products or services.

Through a joint venture, these two corporations used their knowledge and technology to create implants for the treatment of health conditions like asthma and diabetes.

Expansion

Another good reason to form a joint venture is to facilitate the entrance to foreign markets. Using the example of Kellogg’s and Wilmar, these two companies are associated so that Kellogg’s could introduce its product into the Chinese market with the help of Wilmar’s extensive distribution capacity. In return, Wilmar was able to increase its profit, too.

Cost reduction

By sharing the costs it implies carrying out a certain project, a joint venture is an effective strategy to reduce costs. Altogether, companies can benefit from economies of scale by getting a lower per-unit cost and increasing their levels of production.

Daimler Truck, TRATON Group, and Volvo are proof of this. These companies agreed to invest €500 million to install and operate a charging infrastructure for their heavy-duty trucks so they can boost the value of their supply chain.

Combine expertise

Joint ventures are a great way of complementing the skills and experience of different organizations to create innovative products. Two or more entities can benefit from each other’s talent, just like Google and NASA did.

Thanks to this joint venture, Google Mars appeared. With NASA’s astronomic knowledge, and Google’s technology, these companies made possible an interactive mapping of the surface of Mars and the creation of quantum processors.

Joint venture agreement

The success of a joint venture relies heavily on a solid agreement that addresses the needs of each party and prevents future conflicts.

These are the essential elements a joint venture agreement must contain:

- Purpose

The agreement must specify the objective parties pursue and the duration of the business relationship.

- Roles and responsibilities

Parties must be clear about how each will contribute to the completion of the task. As mentioned before, they can cooperate financially, in the form of assets, with their experience, or through other contributions.

- Cost and profit share

Not all joint ventures have an equal distribution of effort and compensation. According to the role each party will play in the project, the contract must outline a fair reward for each party’s intervention.

- Risk allocation

Just as parties will obtain benefits from the transaction, they are also responsible for negative outcomes. In this section, the contract will specify how liability and risk are shared between the parties.

- Dispute resolution

The contract must specify what procedures to follow in the event of conflict between the companies, in order to prevent costly disputes.

- Dissolution terms

Specifies under what circumstances the business relationship is over.

- Confidentiality

Businesses must be committed to not disclosing sensitive information

Advantages of a joint venture

Engaging in a joint venture can facilitate the profitability of a company in several ways. These are some of the advantages of entering a joint venture:

![]() Increase capacity: Together, two or more entities can leverage their strengths and increase their opportunities for success.

Increase capacity: Together, two or more entities can leverage their strengths and increase their opportunities for success.

![]() Independency: Although in a joint venture both entities work together, they are still independent companies and do not exclusively rely on the other’s actions.

Independency: Although in a joint venture both entities work together, they are still independent companies and do not exclusively rely on the other’s actions.

![]() Expansion: Through mutual collaboration, a business is capable of entering new markets that would be out of reach on its own.

Expansion: Through mutual collaboration, a business is capable of entering new markets that would be out of reach on its own.

![]() Divided risks: Co-jointers can benefit from a reduced liability by dividing the costs in the event of failure of the project.

Divided risks: Co-jointers can benefit from a reduced liability by dividing the costs in the event of failure of the project.

![]() Access to knowledge and expertise: Joint ventures allow companies to mutually nurture their skills and expand their areas of expertise.

Access to knowledge and expertise: Joint ventures allow companies to mutually nurture their skills and expand their areas of expertise.

![]() Access to resources: By working hand in hand with another business, a company can have access to equipment or technology without the need of purchasing it.

Access to resources: By working hand in hand with another business, a company can have access to equipment or technology without the need of purchasing it.

![]() Flexibility: One of the best joint venture advantages is that it is temporary, for its duration is only subject to the achievement of the objective.

Flexibility: One of the best joint venture advantages is that it is temporary, for its duration is only subject to the achievement of the objective.

Disadvantages of a joint venture

![]() Unequal efforts: One of the major concerns with joint ventures is that the distribution of workload or contribution is frequently uneven. Companies can work in a hostile environment when there is a generalized idea of an unfair assignation of roles

Unequal efforts: One of the major concerns with joint ventures is that the distribution of workload or contribution is frequently uneven. Companies can work in a hostile environment when there is a generalized idea of an unfair assignation of roles

![]() Cultural differences: One of the most common objectives of joint ventures is to expand a market to other countries with the help of native companies. However, co-jointers may have misunderstandings and incompatible points of view due to the diversity of backgrounds.

Cultural differences: One of the most common objectives of joint ventures is to expand a market to other countries with the help of native companies. However, co-jointers may have misunderstandings and incompatible points of view due to the diversity of backgrounds.

![]() Lack of clarity: Deficient communication can cause parties to have different expectations toward the objectives of the joint venture. Similarly, misunderstandings may embroil the making of decisions or the assignment of roles.

Lack of clarity: Deficient communication can cause parties to have different expectations toward the objectives of the joint venture. Similarly, misunderstandings may embroil the making of decisions or the assignment of roles.

![]() Deficient co-jointers: One risk of joint ventures is engaging with organizations that show a lack of commitment or do not have the expected knowledge or resources, which may lead to disputes or financial losses.

Deficient co-jointers: One risk of joint ventures is engaging with organizations that show a lack of commitment or do not have the expected knowledge or resources, which may lead to disputes or financial losses.

![]() Lengthy decision-making: When collaborating with each other, companies may find it difficult to agree on their operational activities. A difference in points of view can delay the accomplishment of tasks and cause financial losses.

Lengthy decision-making: When collaborating with each other, companies may find it difficult to agree on their operational activities. A difference in points of view can delay the accomplishment of tasks and cause financial losses.

![]() Confidentiality breaches: When two companies work close to each other, they inevitably expose sensitive information and risk their data to unwanted disclosure.

Confidentiality breaches: When two companies work close to each other, they inevitably expose sensitive information and risk their data to unwanted disclosure.

Although there are disadvantages associated with engaging in a joint venture, companies can mitigate their risks through a well-written joint venture agreement. A business contract attorney will ensure each risk is properly addressed and put safeguards to reduce liability.

Examples of Joint Ventures

1. Sony and Ericsson

This famous collaboration occurred in 2001 when the Japanese electronic company, Sony, and the Swedish telecommunications enterprise, Ericsson, associated.

The objective of this cooperation was to distribute mobile phones globally. With Sony’s consumer electronics expertise and Ericsson’s knowledge of mobile telephony, the expansion was successful. Sony Ericsson became one of the largest mobile phone manufacturers in the world and produced innovative devices, such as the Walkman.

2. Walmart and Eko

The American retail corporation, Walmart, and Eko, a developer of interactive video content, signed in 2018 a joint venture in which they invested $250 million.

The venture, called W*E Interactive Ventures, had the purpose to develop interactive and personalized content that would allow Walmart to connect with clients in a more meaningful and memorable way.

3. HULU

Although it is now owned by Disney, Hulu was originally a streaming service founded in 2007, created from a joint venture between News Corporation and NBC Universal. Eventually, Providence Equity Partners and The Walt Disney Company joined this alliance.

The objective of these companies\’ cooperation was to create a video streaming website to display high-quality on-demand entertainment.

In 2019, The Walt Disney Company assumed full operational control of Hulu. This platform now has more than 48.2 million subscribers in the U.S.

What is a partnership?

A partnership is a relationship between two or more people that manage and operate a business. Each person brings in their own resources, such as capital, assets, labor, or skill, and shares in the profits and losses of the business.

In a broad sense, a partnership refers to any endeavor undertaken jointly by multiple parties.

A partnership, as an entity, exists in three categories: General partnership, limited partnership, and limited liability partnership.

- General partnership

In a general partnership, partners share the company’s profits, losses, and assets equally.

This structure is the most common partnership type, for it is the default for multi-owner businesses.

Similarly, partners will share the company’s profits, losses, and assets equally by default, unless their partnership agreement outlines a different arrangement.

With this type of business entity, partners are personally liable for debts or legal action. Since they are pass-through entities, owners are only taxed one time, at the personal level.

- Limited Partnerships

A limited partnership includes at least one general partner with unlimited personal liability and silent partners, which don\’t run the business directly, but contribute financially and have limited liabilities according to the amount they invested in the business.

While the general partners contribute with their management skills, limited partners cooperate financially to the business.

This is also a pass-through entity, for individual partners only file their personal taxes.

- Limited Liability Partnership (LLP)

In contrast with the previous structures, an LLP offers partners some legal protection from other partners\’ negligence.

This business structure is common in professional businesses like law and accounting firms, architects and medical practices.

The regulations of LLPs vary by state in terms of liability, and not every state allows the formation of an LLP.

Pros of a partnership

![]() Costs: A partnership has inexpensive start-up costs and is easy to set up.

Costs: A partnership has inexpensive start-up costs and is easy to set up.

![]() Flexibility: The structure can be adapted later on.

Flexibility: The structure can be adapted later on.

![]() Combined efforts: Provides an opportunity to gain knowledge and resources

Combined efforts: Provides an opportunity to gain knowledge and resources

Cons of partnerships

![]() Liability: Partners are personally responsible for debts and legal issues.

Liability: Partners are personally responsible for debts and legal issues.

![]() Risk of Disputes: The distribution of profits is a typical cause of conflict between the partners.

Risk of Disputes: The distribution of profits is a typical cause of conflict between the partners.

![]() Complex Duties: Difficult financial duties and responsibilities

Complex Duties: Difficult financial duties and responsibilities

How to create a partnership

1. Choose partners and their roles: Decide who your partners will be, their contribution to the company, and the percentage of profits each partner will receive.

2. Select a partnership structure: With the help of a startup attorney, Choose between general partnership, limited partnership, and LLPs according to your needs and business objectives.

3. Choose a name for your partnership: Choose a unique name that reflects the purpose of your business.

4. Register your business: File your registration with the secretary of state where your business will be located

5. Create a partnership agreement: A contract attorney will help you clearly define the rights and obligations of the partners, the profit distribution, and address provisions that will help you prevent future disputes.

6. Apply for EIN and tax ID number: Apply for these identification numbers so you are able to pay taxes accordingly and comply with your obligations a a business owner

7. Obtain licenses and permits: Depending on state and local requirements and the industry of your business, you may need a sales tax permit, DBA license, business license, and other documents.

8. Open a business bank account: To improve the management of your finances, you want to keep your partnership’s funds in a separate bank account.

Partnership Agreement

To increase the possibilities of success for your partnership, it’s crucial to count on a binding contract that will define all the terms of your business relationship.

Some of the essential terms your partnership should include are the following:

a) Purpose of the business

Include what is the objective of the business

b) Contributions

The investments of the parties or their contribution to the partnership.

c) Ownership

Typically the contribution to the company is proportionate to the percentage of ownership. But this may not always be the case. Regardless of the situation, the partnership agreement should determine the rights of possession of the parties.

d) Profit and loss distribution

Similarly, the division of profit or loss is usually related to the partners\’ ownership stake, but partners can decide a different allocation of gains and losses.

e) Length of the Partnership

Although most of partnerships are designed to last for an unspecified amount of time, some decide to dissolve at a certain number of years.

f) Roles and duties

The contract should address who is going to be responsible for making decisions and the way partners are going to manage the company

g) Dispute resolution

A partnership agreement must contain instructions on how to resolve differences between partners. This provision is meant to solve conflicts without resorting to litigation.

Expanding your business through a partnership or a business venture is a decision that will have a significant impact on your business. Always count on the help of a business contract lawyer that will ensure you are entering into a profitable deal that will boost your potential and keep you protected.