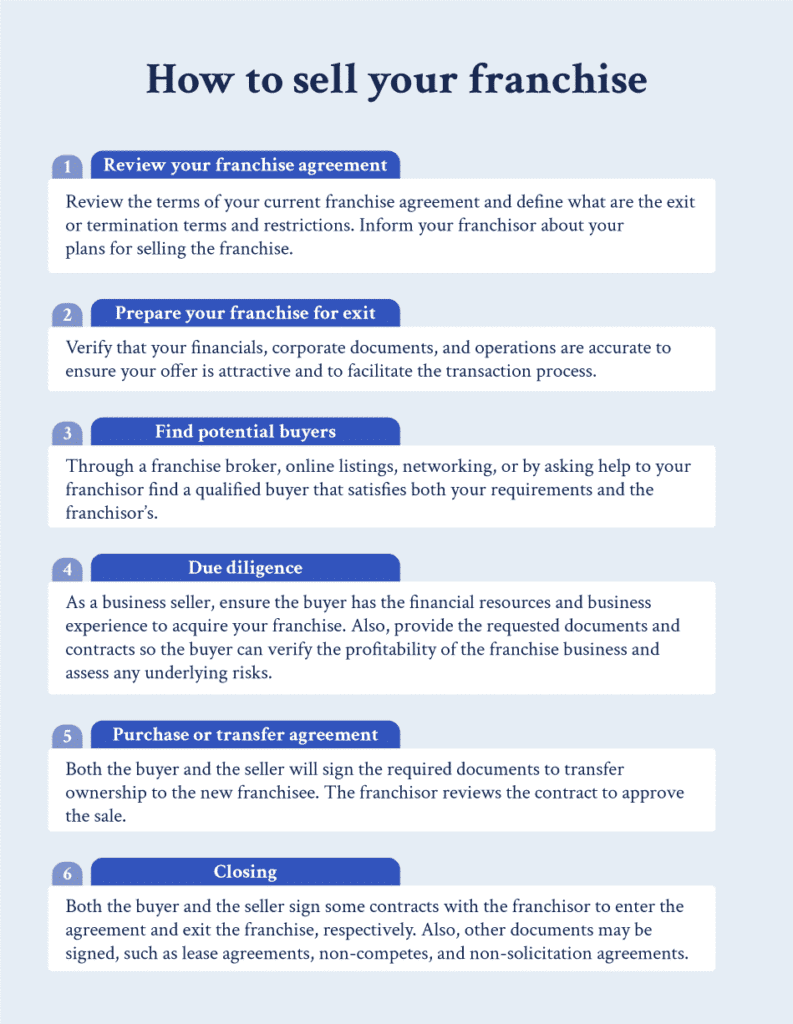

As a franchisee, you may want to sell your franchise for a variety of reasons. Retirement, the franchise not being what you expected, or chasing other business opportunities may be some of them. Regardless of the reason for the transfer, you want to ensure that when you sell your franchise you have a seamless and safe transition so you are free of liabilities. Below, we explain the process for reselling your franchised business:

Review the terms of the franchise agreement

First and foremost, you need to be aware of your transfer rights as a franchisee and the terms under which you can sell your franchise. It is of the utmost importance to consult a franchise attorney to help you review the franchise agreement so you can understand the restrictions of the resale.

The following are some of the considerations a lawyer will help you analyze in the contract:

Franchisor approval

Some agreements may require you to consult with the franchisor before you approach prospective buyers. Even if the contract does not require it, you should send a written notice of your intentions to sell to maintain a good relationship with the franchisor, who may also have a decisive role later on in the transaction.

Transfer fees and payments

The franchisor will typically set a charge for exiting the franchise business, also called an assignment fee. Also, you may need to take care of payment defaults to remedy any of the contract violations and amounts that are owed to the franchisor or suppliers.

Franchisor’s right of first refusal

It is common for franchise agreements to include a ROFR clause, which is a provision that determines that if the franchisee finds a buyer, the franchisor has the right to buy the franchise at the same price and terms offered to the buyer.

Restrictions on who you can sell to

The franchisor may impose certain qualifications, background, or other criteria that prospective buyers need to meet. Depending on the terms of the franchise agreement, the franchisor may have the right to refuse or approve the transaction and can evaluate the suitability of the candidate according to their financial stability, experience, and adherence to the franchisor’s brand standards of potential buyers.

Post-termination obligations

The franchisor may impose certain qualifications, background, or other criteria that prospective buyers need to meet. Depending on the terms of the franchise agreement, the franchisor may have the right to refuse or approve the transaction and can evaluate the suitability of the candidate according to their financial stability, experience, and adherence to the franchisor’s brand standards of potential buyers.

Prepare your franchise for exit

Once you are aware of your contractual obligations and you have the franchisor’s approval, you need to ensure your business is in optimal condition to be an attractive offer for buyers. It is key that the term of the franchise agreement is not close to being finalized, because that affects the value of your franchise. Some of the other elements you need to assess are the following:

FINANCIALS

Ensure your franchise business is profitable and that you have the elements to prove its financial performance. With the help of an accountant, gather evidence of the stability of your business by getting your financial documents in order, such as audited income statements, balance sheets, cash flow statements, and tax returns.

OPERATIONS

Ensure you have defined operational procedures and a solid business plan. Things such as having well-defined roles among your employees, key suppliers, or an established customer base add value to your franchise business.

CONTRACTS AND LEGAL DOCUMENTS

Your franchise attorney will help you review any lease agreements, employee contracts, permits, licenses, and other contractual obligations that must be regarded. Also, ensure you comply with the industry’s regulations and verify your insurance coverage and the correct use of intellectual property.

BUSINESS VALUATION

With the help of a CPA specialized in business valuations, use the most adequate method to set a purchase price, according to your profits, expenses, and franchise’s net worth. Some of the most common methods include Adjusted EBITDA or discounted cash flow analysis. The value of your franchise will vary depending on a variety of factors, including:

- Financial performance

- Location

- The terms of the franchise agreement

- Operational efficiency

- The condition of its equipment or other assets.

- Customer base

- Scalability and growth potential

FIND A POTENTIAL BUYER

After the appraisal of your franchise business, it’s time to find a prospective buyer who can meet your qualifications and the franchisor’s, if applicable. Remember to protect your data and to only disclose sensitive information to qualified buyers who are serious about the negotiation. The following are some of the places you can start with:

Franchisor

Your first resource is the franchisor, as they will be likely interested in purchasing your location. Even if they are not, they may be aware of previous franchisee inquiries in the geographical area or be a great source for connecting with other interested prospects.

online

A simple yet effective method to find interested franchisees is posting your business on franchise listing sites, where you can optionally add details about the offer, such as purchase price, business industry, cash flow, years in operation, and more. Business listing websites will typically charge a fee that is around $50-60 USD. The most popular include:

Other Franchisees

Reach out to other franchisees in your franchise system and discuss whether they would be interested in buying your franchise as a way to expand their operations or change their location. It is a better idea to have an in-person communication so you can convey the benefits and attractiveness of your proposal.

employees

Although it may not seem like it, your employees may be great potential buyers and have both the capacity to purchase and operate your business. Remember that many employees dream of owning a business, and since they already know how to run yours or at least the basic operational aspects, they can be an ideal prospect.

franchise broker

A franchise broker can help you find ideal opportunities according to your requirements and also help give you basic guidance during the negotiation process. Brokers will usually charge a fee that is about 10% of the final sale price. Ensure to engage a business broker with experience in franchise resales so they can help you screen the ideal candidates and help you avoid common pitfalls in the transaction.

NETWORKING

You can also get valuable information from professionals in the M&A industry, such as transactional lawyers or CPAs, or simply asking around. Another way is attending trade shows, industry events, or conferences where you can market your franchise and know candidates face-to-face.

When vetting potential franchisees, some of the aspects you want to evaluate are the candidates’s interest, business experience, and financial background.

DUE DILIGENCE

When buying any type of business, both parties of the deal go through a process called due diligence, which is the phase in which occurs an in-depth examination of the business’s records and operations to gauge the profitability of the business purchase.

While franchise buyers will conduct due diligence to assess the company’s financial health and identify any hidden liabilities, franchise sellers will investigate the potential candidate to verify whether they have the expertise and financial resources to afford not only the purchase but the franchise’s operational costs.

However, business buyers take a major role during due diligence to determine an accurate valuation of the target franchise. For this reason, franchisees will have to provide a list of requested documents, which may include financial statements, contracts, permits, and tax returns for the prospective buyer to verify the condition of the franchise before entering the agreement.

The following are some of the aspects and documents the acquiring party will analyze before deciding to enter the franchise and that you need to be prepared for:

Franchise Agreement

The buyer will likely want to read the terms of the franchise agreement, including the fee and royalties payment structure, their rights and responsibilities as new owners of the franchise, territorial restrictions, the termination and renewal clauses, and more.

Franchise Disclosure Document

Just as you were given when you were a potential franchisee, you need to provide the FDD to the potential investor to ensure they are aware not only of the implications of buying your franchised business but entering the entire system. The FDD will contain relevant information about the franchise history, performance, current franchisees, rights and responsibilities, and restrictions. Buyers will need to sign a confidentiality agreement to ensure this sensitive information stays undisclosed.

Operations

The way a franchised business handles its day-to-day activities reflects its efficiency, productivity, cost control, and customer satisfaction. A potential customer will examine operational matters such as workflows, inventory management, scalability and growth, employee retention, and sustainability.

Lease Agreements

The potential buyer will want to be informed on any equipment commercial leases and how they will be handled during the transaction. The buyer will review whether these contracts can be transferred and what are their terms.

List of Assets

The buyer will carefully inspect the tangible and intangible items that will be part of the transaction to verify their condition including inventory, technology systems, equipment, furniture, intellectual property, customer base, and other assets.

Employees

For their major role in the company’s operations, the possible buyer will verify who are the key employees of the franchise and what are each’s roles and obligations, as well as the existing employment contracts.

Some questions that the potential buyer may ask include the following:

- What is the reason behind the sale?

- How involved are you in managing the business?

- What do you think of the training offered by the franchisor?

- What is the competition like?

- Can you share your business plan?

- Does the business have a customer base?

- What is your relationship with the franchisor?

- What is the competitive landscape?

- Are you willing to help during the transition?

Sign franchise purchase agreement

FRANCHISE AGREEMENT

Once the buyer has conducted due diligence and wants to continue with the franchise acquisition, the seller will have to provide a new franchise agreement that defines the terms of the franchise sale, including information regarding royalty payments, the assets included in the sale, any financing terms, and related information. There are specific clauses from the original franchise agreement that will need to be included.

FRANCHISOR’S CONSENT

After the franchise agreement is signed, you likely will need the franchisor’s approval to ensure they also agree with the terms of the agreement and the qualities of the buyer.

CLOSING

For a seamless franchise transfer or sale, your attorney will ensure that all the required legal documents are properly executed and that your duties as a former franchisee are satisfied. For example, have the landlord’s consent, if required, to transfer the lease agreement. Also, pay the assignment fee or any debts that you owe to the franchisor. Other post-termination obligations may include returning the operations manual, providing training support to the new franchisee, and signing a non-compete agreement, which won’t allow you to start a business in a similar field for a specific time once you sell your franchise.

Both you, as a buyer, and the seller will have to sign documents with the franchisor. While you do it to terminate the business relationship, the new franchisee will do it to enter the agreement.

To ensure a clean transaction, an attorney will also help you stay compliant by notifying regulatory authorities about the franchise sale and keeping you informed on any tax implications.

Smoothly sell your franchised business

Selling your franchise is a process that requires careful attention to detail since the risks you face are not only related to entering an unprofitable deal but also contract breaches and disputes with your former franchisor.

Motiva Business Law’s franchise attorneys will guide your franchise resale to ensure you are making informed decisions from the beginning. Our attorneys will review your franchise agreement to help you understand the procedure for a safe franchise exit. We will also structure your sale most conveniently and help negotiate the most profitable terms for the transaction.

By ensuring regulatory compliance and that all the pre and post-transaction legal requirements are met, you will have a seamless franchise transfer, avoiding disputes and minimizing legal risks.