Business law can be puzzling to many new business owners. Put simply, the definition of business law is “The combination of statutes and court rulings that govern everything that concerns business operations”.

Also known as commercial law or corporate law, this area of law addresses a wide variety of legal issues regarding business formation, contracts, mergers and acquisitions, franchising, intellectual property, and employment law, among others.

Commercial law includes two aspects:

- The administration and regulation of partnership, agency, bankruptcy, and laws for commercial entities

- The legislation of business contracts.

Over time, laws have changed and have to adjust to the progress of technology, industry regulations, and the ever-evolving demands of society.

Business law and its importance

Business law plays an important role in regulating entrepreneurial activities while making sure the business owner and their clients are both protected. Commercial law governs how corporations are managed by the state, the contracts between business owners and investors, and the contracts that govern business relationships.

Here is why corporate law is key in commercial transactions.

Regulatory compliance: It’s crucial to meet all the legal requirements and abide by the laws of the government, which may vary depending on the industry and state a company operates in. A business lawyer will ensure the shareholders understand their rights and obligations as business owners, and that all the documents, licenses, and demands are in compliance with the regulations. Also, along with an accountant, a corporate attorney will help business owners to address tax concerns.

Avoid litigation: The purpose of business law is to identify potential legal issues and take the necessary actions to prevent them. Corporate attorneys create guidelines that companies must follow in order to avoid disputes, and the actions they must take in case issues arise to facilitate a solution. With the right contracts and abiding by government regulations, businesses are able to continue their commercial activities without exposing themselves to liability.

Safeguard the rights of the parties: With enforceable contracts, a qualified commercial attorney will secure the rights of the shareholders and reduce the liability of each.

Functions of business law in Commerce

Business lawyers help with addressing corporate legal matters and issues. Commercial attorneys can assist businesses in

- Avoiding consumer violations

- Limiting liability

- Organizing their firms

- Avoiding antitrust violations

- Putting in place solid contracts and business procedures to reduce the chance of lawsuits

Here are the specific aspects of a business where lawyers can come in and provide legal assistance.

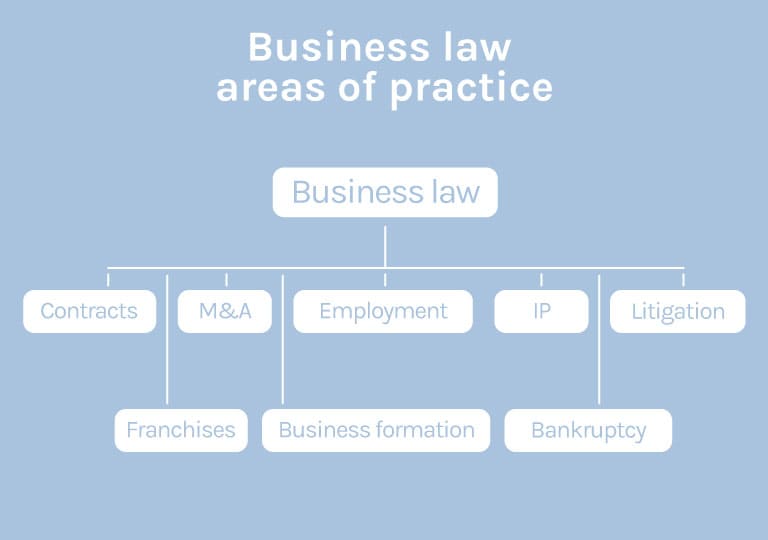

Types of business law

Formation law

Business law is involved since the formation of a business. This is where formation law comes in. Formation law dictates the laws and procedures a business must comply with to be constituted and incorporated as a formal business.

Part of this process is filing the required documentation and choosing a business entity. A business entity is the manner in which a business is structured, and it determines the taxation, liability, and federal and state guidelines a business will assume.

Corporate lawyers can help owners set up their businesses and opt for an entity that protects their liability and brings the best tax-saving benefits according to their business goals.

Regarding startups and business formation, business law governs matters involved with:

- Choosing the correct business structure

- Filling out the paperwork to legally constitute a business

- Licensing

- Regulatory compliance

Industry Regulations

Many industries have their own set of rules that apply to businesses operating within their sphere. Regulations ensure that your business follows the standard for a particular sector.

Industry regulations include rules for forming a company, managing personnel, privacy laws, trademarks, and consumer protection. All businesses are affected by these general industry regulations.

Business lawyers help with compliance with industry-specific regulations. Unfortunately, many business owners are far from being well-versed in compliance, so they would need legal counsel to ensure their operations or products do not violate any of these rules. Your business attorney can provide the most appropriate legal advice.

Contract Law

Once the owners selected the business entity that best fits their interests and professional goals, a corporate lawyer creates the contracts that determine the roles and duties of the members of the business.

The name of these contracts varies according to the business structure they are prepared for. A partnership, or LLP, will need a partnership agreement, an LLC will require an operating agreement, while a corporation will have a shareholder’s agreement as its governing document.

Contract law will play an important role in a business, for it will propitiate healthy business relationships between owners, clients, and other groups.

A business will get involved in commercial transactions with its clients, suppliers, or other businesses. For this reason, it is key that a contract attorney ensures that all parties are aware of their rights and obligations and provides risk allocation mechanisms to protect the business.

Commercial lawyers create contracts with the objective of preventing lawsuits against the company and disputes among the owners. An experienced contract lawyer will create binding legal documents that comply with federal and state laws, and review and negotiate existing contracts to ensure they’re structured in the best interest of the business.

In case of lawsuits concerning business structure or roles, or disputes within the company, business lawyers can assist the owner in taking the next right step.

To minimize risks, successful corporations often have a business lawyer “in-house”, which is an attorney or group of them that handles the legal matters of the business. Companies can also hire lawyers “on retainer”, or from outside firms, to ensure the protection of assets and intellectual property as the company continues to expand.

Contract law is involved in:

- Business-to-business contracts

- Business-to-clients contracts

- Internal agreements

- Privacy policies, terms of service

- Alliances or business ventures

- Employment contracts

- Lease agreements

Employment law

To ensure a fair treatment and a safe environment for employees, labor law dictates the rights and obligations of both workers and employers. This includes the procedures that need to be followed regarding the hiring, termination, and management of employees.

Business owners need to clearly understand the payment and benefits they must provide, and all the factors that influence a worker’s performance, such as workplace conduct, anti-discrimination and harassment policies, and safety.

Employment law varies according to the industry, for it’s key to count on an expert who is aware of the required workplace conditions and safety standards.

Tax law

As mentioned earlier, the business entity will determine the way in which a business and its owners pay taxes. Taxation issues need to be addressed by a professional, for they are the most common pitfalls of businesses and their correct filing involves different factors.

A business lawyer can guide business owners on which are their tax obligations.

Businesses should take care of various types of taxes:

- Sales Tax: The amount that must be paid for sales tax varies from state to state, for this expense will depend on the location of the business.

- Employment and payroll taxes: Payroll taxes are added to the wages of employees to finance social security and medicare.

- Income tax: This kind of tax is based on the profit the business received the previous year.

- Property tax: These taxes are applied in concordance to the property a business owns and are influenced by the type of building, the property value, and other factors.

Intellectual property law

One of the most important assets of a business is its intellectual property, for it encompasses all the elements that differentiate it from other companies. Intellectual property refers to any invention that can exclusively be used and distributed by an entity.

A business must protect its IP from theft or misappropriation, for the guidance of a business lawyer is key in this matter.

IP can include products, designs, names, recipes, jingles, and other creations.

There are several areas of intellectual property:

- Copyright: Protects the rights of creators in their works in fine arts, publishing, entertainment and software.

- Trademarks: Refers to words, designs, phrases, or imagery that identifies a particular brand or product. These can be slogans, logos, or brands and business names. The first person to use a trademark in commerce or register it is who acquires the rights to use it.

- Patents: Refers to products, processes, or designs. The owner is protected from other people distributing, producing or using the patent in any form. The patent can be licensed, sold, mortgaged or assigned.

- Trade secrets: Involves recipes, formulas, or practices used in a business that provide a competitive advantage. Trade secrets are protected without need of registration, but a business owner must take specific actions to maintain confidentiality.

Transactional Law

This type of business law dictates commercial transactions and is inherently related to the laws of contract. It involves agreements between owners or entities such as the purchase and sale of businesses, alliances, or business ventures.

Mergers and Acquisitions

Business law is also an essential element in M&A, which stands for “Mergers and Acquisitions”.

Mergers: A merger is a process where two companies integrate to form a single new entity. Also known as consolidation, a merger occurs when two firms unite to produce a new company in which none of the previous companies stays independent.

Companies merge to be able to gain more resources and expand their operations as a result of the merger. A company may merge to benefit its shareholders. Following the merger, stockholders of the original businesses receive shares in the new firm.

Corporations may agree to merge to enter new markets or diversify their product and service offerings, resulting in increased profitability.

For example, a corporation with considerable taxable income may try to merge with a company with a significant tax loss to reduce its tax liability. A merger of companies will minimize rivalry between them, lowering the cost of advertisements. Furthermore, the price reduction will benefit customers and, as a result, sales will improve.

Mergers may result in better financial resource management and allocation.

Acquisitions: They are transactions in which one corporation buys the property of another. An acquisition, sometimes known as a takeover, is the ownership of one firm or enterprise by another.

Acquisitions are usually classified into two categories: “private” and “public.” The difference is drawn depending on whether the target company’s shares are publicly traded or not. In addition, acquisitions can be classified as friendly or hostile, based on how the business organization sees the acquirer.

An acquisition may occur for several reasons. For example, they may be looking for cost savings, diversification, higher market share, improved efficiency, or new specialized offers. Other motives for acquisitions include international market entry, expansion strategy, and the addition of new technologies.

Both mergers and acquisitions involve complex legal paperwork. It’s key to have a solid background in business law to ensure that all the state regulations concerning the merger or acquisition will be followed. It also prevents disputes in the future and keeps the business owners protected in case issues arise between the parties involved.

In a business acquisition, commercial law dictates the procedures for transition in the ownership of the business, contracts, intellectual property, employment, structure, and other aspects of the purchase.

A business acquisition attorney will ensure the transaction occurs in the best interest of the client, spotting red flags or liabilities that may be inherited through due diligence and ensuring the M&A process is smooth.

Franchise Law

Franchising is a way of expanding the reach and profit of a business. A person who buys a franchise, called franchisee, will have access to the business plan, trade secrets, and intellectual property of an established business and make use of them.

In exchange, the franchisor, or the person who owns the original business, will receive a fee and royalties.

Franchise law varies depending on the state, and both parties of this business venture must be aware of their duties and obligations as specified in the franchise agreement.

A franchise lawyer can assist the franchisor to set up the required documentation to start the franchising process and ensure the business is compliant with the franchise law. On the other hand, the franchise attorney can help the franchisee by reviewing the agreements and ensuring it is a fair deal.

Antitrust law

In order to preserve a fair and healthy competitive environment, businesses and buyers must comply with antitrust laws. These laws were created with the objective of balancing the power of companies and ensuring there is no abusive dominance from a group.

Some prohibitions of antitrust laws include:

Market allocation: This forbidden practice occurs when two businesses agree to divide markets or customers amongst themselves, causing the reduction of the competition.

Price fixing: A violation occurs when it is the business and not the market’s demand who sets the price of a product or service.

Litigation

Business law also includes addressing lawsuits or disputes. A lawsuit can involve a dispute between a business and a client, the business owners, a business and its suppliers, and other parties.

Lawsuits can be handled outside of court when the parties reach an agreement. Otherwise, the court will need to take the final decision.

While a litigation business lawyer will focus on solving the problems that have already arisen, a commercial attorney will focus on putting safeguards in place to prevent them.

Bankruptcy

A business needs to file for bankruptcy when it is unable to repay outstanding debts or obligations. By conducting this process, the debtor’s assets are evaluated and may be used to repay a portion of the debt.

Filing for bankruptcy is a complicated process that must follow determined steps according to the situation of the business. A bankruptcy lawyer will explain the situation to the business owner and provide guidance on which is the best option.

Also, the business attorney will ensure the bankruptcy process is carried out correctly and complies with the requirements.

The importance of having a business lawyer for your company

Financial management, performance monitoring, raising competencies, attracting new workers, customer service, reputation management, regulation, corporate expansion, and compliance to industry-specific rules are all potential business concerns.

Business law requires a vast understanding of policies, laws, and special guidelines that vary widely by state, which is why having a business lawyer is extremely necessary for your business. An attorney will look out for the best interests of your company and safeguard it against the numerous problems and difficulties that may arise during your operations.

With a knowledgeable commercial lawyer on your side, you may be better prepared to resolve the issues that could impair your ability to run your company successfully. Your attorney could even help you develop a successful formula to get you to achieve your business goals.

Common legal mistakes

When companies do not have the proper legal guidance, they fall into two common mistakes. One of them is not having the proper business agreements between business owners. When conflicts arise, the business owners end up in a lawsuit costing tens, if not hundreds, thousands of dollars. In addition, the business itself is often forced to dissolve not only because of the high legal bills, but because the business owners failed to agree on certain fundamentals of the business.

Another costly mistake is not having the proper business-to-business (B2B) contracts. The problem is the same as above— the businesses will end up in a dispute, and not before long, are suing and incurring legal bills and having their business operations compromised.

Having the proper business documents and contracts is absolutely worth the up-front investment and consideration. Otherwise, you risk losing your reputation, business, and a ton of money.

For the reasons explained above, a considerable understanding of business law is necessary for the well-being of your company and your business relationships.

With the counsel of a business lawyer, you can confidently involve in business transactions and expand your operations, knowing that you are not prone to lawsuits or conflicts.