Buying and Selling Businesses

Our business law attorneys help our clients buy and sell their businesses. Offices in Illinois and Florida.

These business law blog posts focus on topics related to mergers and acquisitions (buying and selling businesses). We help clients with their letters of intent, purchase agreements, due diligence, and closing.

We take a practical approach to business growth and strategy with our clients’ goals and needs in mind.

Serving in Illinois: Oak Brook, Burr Ridge, Naperville, Hinsdale, Lombard, Addison, Downers Grove, Oak Park, Darien, Chicago, Lisle, Westmont, Willowbrook, Clarendon Hills, and the Chicagoland Area.

Serving in Florida: Tampa, South Tampa, New Tampa, Wesley Chapel, Odessa, Lutz, and the general Tampa area.

Buying a restaurant comes with several advantages. By purchasing an existing food business you will have access to its equipment, existing brand recognition, and built-in customer base, which may translate into an immediate profit. However, purchasing a restaurant also comes with risks that may be imperceptible at first sight. Follow our guide to buy a […]

How to buy a restaurant Read More »

What is commercial due diligence? Commercial due diligence is the process of inspecting the business you are buying. It’s similar to buying a house —you do an inspection before purchasing the house. The objective of due diligence is to have a full understanding of the target company’s liabilities and strengths, in order to be aware

What is Commercial Due Diligence? Read More »

Congratulations, you signed a letter of intent (LOI) to buy a business, but now you don’t know what to do next. Or maybe you’re about to sign an LOI, but want to go with eyes wide open and know the next steps. So what are the steps of the M&A process? The process of buying

The M&A Process Read More »

An M&A lawyer is in charge of setting all the pieces of the merger or acquisition together. She in the middle of the conversation between both parties and their respective advisors. The M&A attorney is the one leading the transaction, as she is the point of contact that reunites the rest of the deal team

What do M&A Lawyers do? Read More »

Why is it important not to skip due diligence I get a lot of clients who have problems after they bought a business. Unfortunately, many of the problems were avoidable, but the biggest mistake we have seen by buyers — particularly when the buyer bought the business without an attorney — is skipping the due

Why due diligence is important in an M&A transaction? Read More »

What is a Letter of Intent? An LOI is a document that establishes an agreement between two parties that are negotiating a business transaction, such as a business acquisition, merger, or joint venture. In M&A, the letter of intent is a formal, non-binding offer to buy a business from a seller. The first step of

LOI: Meaning of a Letter of Intent in M&A Read More »

What is Due Diligence? Due diligence is the process of examining the business details and data when buying a business. It’s similar to inspecting a home before closing on the house. A buyer will want to check, to name a few things, the financial health of the company, the quality of the standard operating procedures,

Why is Due Diligence Important When Buying a Business? Read More »

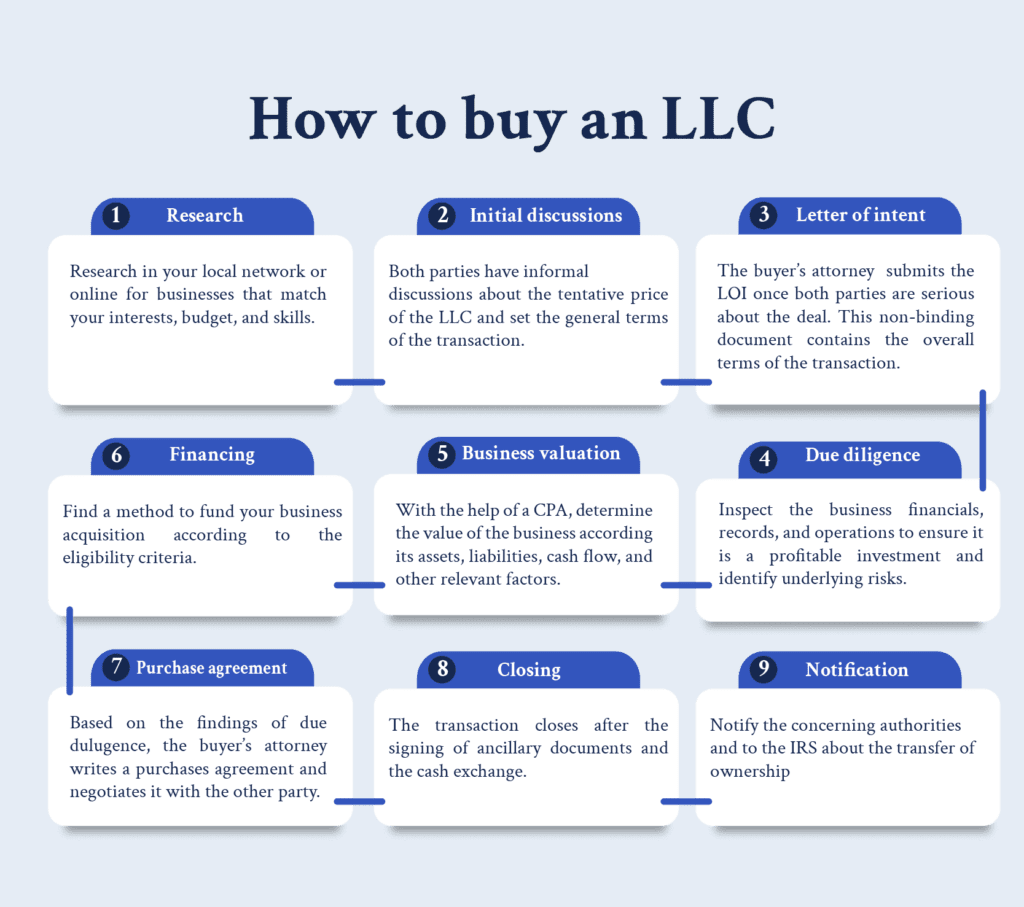

If you have an entrepreneurial mindset but do not want to go through the hurdles of starting a business from scratch, there are alternatives for you. One of them is buying an LLC. A limited liability company is a separate entity that protects the personal assets of business owners from debt and other liabilities and

How to Buy an LLC? Read More »

What is an LOI? We get a lot of people and business owners coming to our office asking if they should sign a “letter of intent”. Many people and business owners mistakenly think they can sign the letter of intent (LOI) without any risk. Because LOIs are meant to be not binding, it is easy

Letters of Intent (LOI) Are Not Binding, BUT… Read More »

Many business professionals dream of owning a business, but they may not want to start from scratch. While entrepreneurialism is a common way to own a business, it can also be daunting and risky. Building a business from the ground up involves much more than just coming up with a product or service. A business

What Are the 3 Stages of Purchasing a Business in Illinois? Read More »