A professional limited liability company, or PLLC, is a kind of business structure that offers personal asset protection to a group of licensed professionals whose business provides the same type of services.

PLLCs are formed specifically for services that require professional licensures, such as lawyers, dentists, accountants, and chiropractors. Not all states allow this variation of LLCs.

With this kind of business entity, professional service providers can have protection against taxes, debts, and judgments against the company they own.

Difference between a PLLC and an LLC

LLCs

A limited liability company (LLC) is a state-registered entity, separate from its owners. The owners of an LLC, called members, cannot be held personally responsible for the debts and obligations of the company. This means that if someone sues an LLC, the personal assets of the business owners are not used to satisfy a judgment, nor their personal finances will be affected in the event of debt.

PLLCs are variants of LLCs. Both business structures function in the same manner, including taxation and ownership concerns. One difference is that while an LLC allows anyone to be a member, a PLLC can only be formed by certain categories of licensed professionals.

PLLCs

Both business entities protect the personal assets of business owners against debts and lawsuits. However, the key difference between an LLC and a PLLC concerns malpractice.

Under an LLC, all owners of a business are held liable if even one member gets sued for malpractice. In a PLLC, the owners of the business are not held responsible for malpractice committed by their business partners. Only the practitioner is personally responsible for the alleged professional negligence or malpractice.

Although a PLLC generally protects you from your employees\’ actions, if you act in a supervisory role, you may be liable for the actions of the employees whom you supervise. For this reason, even when you are a member of a PLLC, it is highly recommended to carry your own malpractice insurance in the event that you must defend malpractice claims.

How a PLLC works

With a PLLC, members have access to the management flexibility, tax benefits, and liability protection an LLC offers. However, a PLLC can only be formed by a group of professionals who have proof of licensure on specific services and comply with certain regulations depending on the state of registration.

Types of businesses that can start a Professional LLC

The professions that can opt for an LLC vary depending on state regulations. Commonly, the following can form a PLLC.

- Attorneys

- Engineers

- Social workers

- Chiropractors

- Accountants

- Architects

- Dentists

- Pharmacists

- Veterinarians

- Physicians

- Real estate agents

- Therapists

Apt businesses for PLLC in Illinois

Illinois statutes determine the PPLC members must be licensed by the Department of Financial and Professional Regulation, Division of Professional Regulation, to provide those services.

If the PLLC provides any of the following professional services, all members and managers must be licensed for the same profession, including the practice of:

- Dentistry

- Medicine

- Social work

- Clinical professional counseling or professional counseling

- Veterinary

- Clinical psychology

- Marriage and family therapy

- Sex Offender Evaluation and Treatment

Note that certain professions in Illinois, like healthcare practitioners, are required to have PLLCs and cannot use LLCs registration. Similarly, lawyers cannot form a PLLC.

PLLC Ownership

PLLCs can only be owned by licensed professionals that provide the same type of services, or, depending on the state of registration, a specific percentage of ownership must consist of individuals licensed in that profession. In most states, retired members who were once licensed can also be part of the ownership.

In some states, unlicensed individuals can be transferred ownership for a period of two years, usually in the case of a member’s death. This allows for the sale or transfer of the ownership stake to a person who is licensed while the estate is being settled.

Combining services

Many states prohibit owners of a PLLC to provide more than one type of service under the same business, only for a few exceptions. These special cases regularly apply to the medical field, such as the example of a physician’s having a pharmacy under the same PLLC. To find out what services you can combine, you can verify your state’s PLLC statutes.

Taxation

PLLCs offer the same tax flexibility as LLCs. Professional Limited Liability companies can opt to be taxed as a disregarded entity (sole proprietorship) or an S corporation.

A PLLC with two or more members will be considered by the IRS as a partnership by default and be taxed as such. Any profits from the business will pass through to the individual members, who report them as personal income on an individual tax return. The PLLC, however, will be subject to employment taxes.

You can also elect your PLLC to be treated as an S corporation. S Corp tax treatment is also on a pass-through basis. Earnings for individual members are reported as wages or dividends, based on the type of work and percentage of ownership, and are taxed as personal income.

Another option is C corporation status, in which the PLLC will retain earnings as a corporation, but will not distribute them to members for personal taxation. Members are taxed on what they receive as corporate employees or the dividends they get as shareholders.

You will need to make this election, or else the IRS will do it on your behalf.

Liability and malpractice

With a PLLC, the professional service providers that own the business will have the same level of protection against debts and lawsuits as with an LLC. But what makes PLLCs a more favorable option for professional service providers is that in case of malpractice, the partners of the company are not liable for the alleged harm committed by a specific member. Only the professional receiving the accusation will face the consequences personally.

Pros and cons of a PLLC

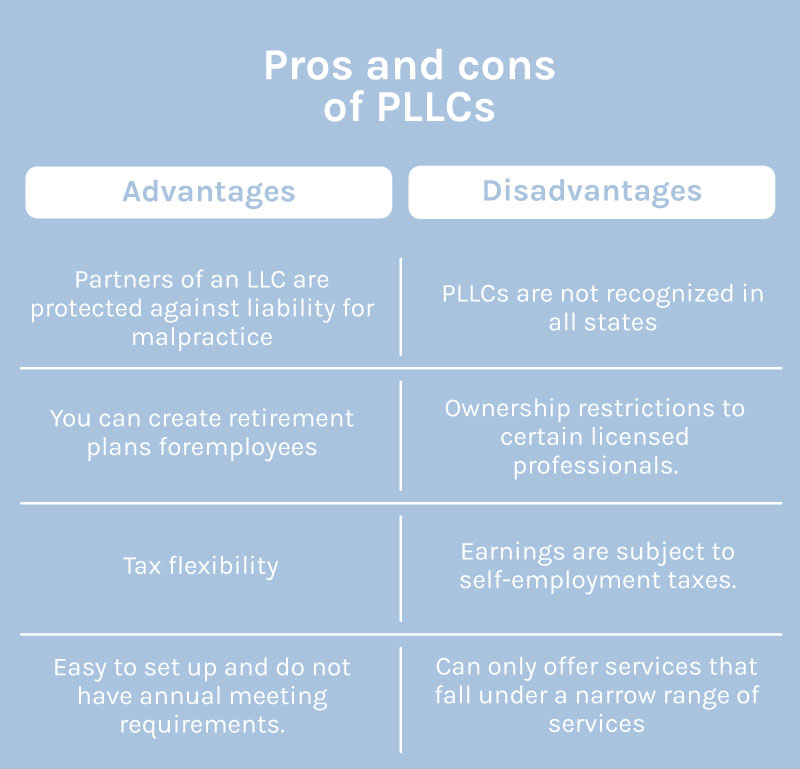

Advantages

- The business owners of a PLLC are protected against liabilities caused by the accusations of malpractice against a business partner.

- The members of a PLLC are not liable for business debts and lawsuits.

- A PLLC can elect for pass-through taxation status, which means the owners will report profits and losses on their individual tax returns

- You can create retirement plans for employees with higher contribution limits than are available to sole proprietorships or partnerships

- PLLCs are easy to set up, inexpensive, and subject to a few corporate requirements, such as annual meetings and reporting.

- They exist in perpetuity, which means they continue to be a valid legal entity in the event a partner dies or exits the business.

Disadvantages

- PLLCs are not recognized in all states

- There are several requirements for the owners of a business to elect a PLLC, such as the restriction to certain professions and a determined percentage of licensed professionals that conform to the ownership.

- Your company can only offer services that fall under a narrow range.

- It is less likely that lenders grant loans to PLLCs unless their owners provide personal guarantees

- All PLLC earnings are subject to self-employment taxes.

How to form a PLLC in Illinois

1. Set up the professional licenses

Ensure that all members and managers of your company are licensed for the same profession and that their respective licenses are currently active.

2. File Illinois Articles of Organization

The first step is to fill the Articles of Incorporation, which you can do online or by sending your documents via mail to the following address

Secretary of State

Department of Business Services

Limited Liability Division

501 S. Second St., Rm

For this process, you will have to pay a fee of $150. This step requires the following information:

- Business name

- Information of the organizers, their names, addresses, and signatures.

- The PLLCs principal place of business

- Name and office address of the registered agent

- Name and address of any business managers

- The purpose of the company

- Especial provisions

Note that the name of your company must end with the words Professional Limited Liability Company or the abbreviation PLLC. The registration will be issued in the same name as appears on the Articles of Organization as filed with the Illinois Secretary of State.

For further explanation, read our blog entry where we show you how to file the Illinois Articles of Organization.

3. Complete the Application for PLLC Registration

Illinois is unique in that it requires all PLLCs to not only register with the Secretary of State’s office, but also with the Illinois Department of Financial and Professional Regulation (IDFPR). You must submit your application online through the IDFPR Online Services Portal .

As a professional services provider, registering a PLLC in Illinois can bring several advantages to your business. Before getting started with any process, it is highly recommended that you count on the support of a business formation attorney, who will help you choose the business entity that best fits your business and personal goals.