A close corporation, also known as a closely held corporation, is a type of business entity where the majority of the ownership is held by a small number of shareholders. Typically, these shareholders are family members, friends, or a small group of individuals. This type of corporation is often characterized by a more intimate and closely involved ownership structure.

A corporate formation attorney can help you ensure that choosing a close corporation is the decision that will match your personal and professional goals and navigate the legal requirements for forming and operating your business.

Key elements of a closely-held corporation

In the U.S., over 90% of companies are structured as close corporations. These entities follow specific regulations according to the state they are registered. The following are their common characteristics:

- Few shareholders: Close corporations have a small number of shareholders, limited to no more than 30.

- Family-owned: Typically, small corporations are run by family members,

- Limited number of shares: These companies can only issue a limited number of shares, according to the state they are incorporated in.

- Informal operating structure: These companies are not required to follow a determined structure or system, for they may not have a board of directors or hold annual meetings.

- Shareholders in control: Shareholders handle day-to-day operations, their roles are as business owners and managers.

- Shareholder agreement as governing document: In a close corporation, day-to-day and sale of stock decisions are made according to the procedures established in the shareholders’ agreement.

How do close corporations work?

Ideal for businesses that are run as family ventures, close corporations are created to maintain control of the company and its operations by reducing the number of individuals involved in the decision-making process. Also, shareholders choose this structure to avoid having rigid procedures and benefit from potentially lower taxes.

As private corporations, closely held companies cannot trade their shares in the securities market. This means that when a shareholder decides to sell their shares, one of the other shareholders must purchase them because they cannot sell them publicly.

Close corporations can be registered as a C corp or an S corp if they follow the IRS filing procedures in a timely manner.

Taxation

Closely held corporations can be classified as C corps or S corps. If the closely held corporation elects to be taxed as an S corporation, and it meets the IRS eligibility requirements, it will be taxed as a pass-through entity, which means that the corporation itself does not pay taxes on its income. Instead, the profits and losses of the corporation are passed through to the shareholders, who report them on their tax returns.

On the contrary, if the corporation is classified as a C corp, it will be subject to double taxation, which means the corporation will pay taxes on its profits, and then shareholders pay taxes on any dividends they receive from the corporation.

Always consult an accountant to understand your specific tax obligations and deduction strategies to maximize your profit while staying compliant.

When should I structure my business as a closely held company?

Opting for a closely held corporation may be favorable if you are facing the scenarios mentioned below.

- You want ownership exclusivity: If you prefer to have a small group of owners who have personal relationships, certain moral principles, or shared business interests, a closely held corporation can be a suitable choice. This ownership structure allows for close collaboration and decision-making among a select group of individuals.

- You want greater control and more efficient decision-making: With a smaller number of shareholders, it is often easier to reach a consensus and implement strategic plans without the influence of a large and diverse shareholder base.

- You look for greater privacy and confidentiality: Reduce the possibility of information leaks with the fewer disclosure requirements these entities need.

- You owe a family business: Ensure the ownership and control stay within the family or a specific group of individuals.

Requirements to qualify as a closely held corporation

According to the IRS, a business must meet the following requirements to be regarded as a closely held company:

- More than 50% of its stock is owned by 5 or fewer individuals at any time during the last half of the tax year

- Is not a personal service corporation (a corporation that provides personal services in fields such as health, law, engineering, architecture, accounting, and consulting).

How to set up a closely held corporation in Illinois

Depending on the state your business will be registered in, your close company will need to follow specific structure and operational requirements. Here is how to organize a close corporation in Illinois:

- Choose a name: Select a name for your business and ensure it is not already in use in the state by checking the Illinois Secretary of State database. Note that if the name is available in Illinois, this does not intrinsically mean that it is available under the trademark law.

- File the Articles of Incorporation: Prepare and file the Articles of Incorporation with the Illinois Secretary of State. This form, called a BCA 2.10 (2A) requires the company’s name, registered agent, principal place of business, purpose, number and type of authorized shares, and a statement that the corporation elects to be a close corporation.

- Define shareholders and directors: Determine the individuals who will be shareholders and directors of the corporation. In closely held corporations, these individuals are often the same people.

- Draft the Shareholder Agreement: It’s crucial to draft a shareholder agreement that stipulates how the business will be managed and outlines the rights, responsibilities, and restrictions on the transfer of shares.

- Draft Corporate Bylaws: Bylaws outline the internal rules and procedures for operating the corporation. This includes details on day-to-day operations and procedures related to shareholder meetings, director responsibilities, and decision-making processes.The state of Illinois requires corporations to have record-keeping procedures, annually reporting corporate matters, such as a record of shareholders, amendments, bylaws, and director meetings.

- Obtain Necessary Permits and Licenses: Depending on your industry and location, you may need to obtain specific permits or licenses to operate your business legally.

- Tax Registration: Register for state and federal taxes by obtaining the Employer Identification Number and comply with tax obligations in your jurisdiction.

- Open Bank Accounts: Set up a corporate bank account to handle the company’s financial transactions.

Advantages and Disadvantages of Close Corporations

Advantages

- Limited liability: Just as with any other corporation, a close corporation will protect its shareholders and shield them from the company’s liabilities or debts.

- Less regulations: Closely held companies can disregard some of the requirements to which corporations are subject. Close corporations can choose not to hold periodical meetings, not assign officers or directors for the corporation, or file financial statements.

- Control over the business: Because of its limited number of shareholders, each’s actions have a significant impact on the company. Shareholders can make decisions without consulting with a board of directors and run the company freely.

- Stable share prices: Since shares are not traded on the open market, their prices are more stable.

- Protect intellectual property: Because of the private and closed nature of the corporation, the intellectual property of a closely held corporation is less exposed to being used without authorization.

- Lower costs of operation: Because of its minimal requirements, the owners of a close corporation can save on costs associated with accounting, legal counsel, and administrative fees.

Disadvantages

- Difficulty in selling ownership: One of the most relevant challenges closely held corporations face is the restrictions on stock transfer. The sale or disposition of stock can only follow the procedure established in the corporate bylaws and shareholders can have a right of refusal.

- Fewer opportunities to raise capital: Since their shares cannot be listed on a public exchange and the pool of potential shareholders is limited, closely held corporations reduce their expansion opportunities.

- Taxes: State laws vary regarding the classification of close companies. If contemplated as a C corporation, the owners of the closely held corporation could face double taxation.

Closely held vs publicly held corporation

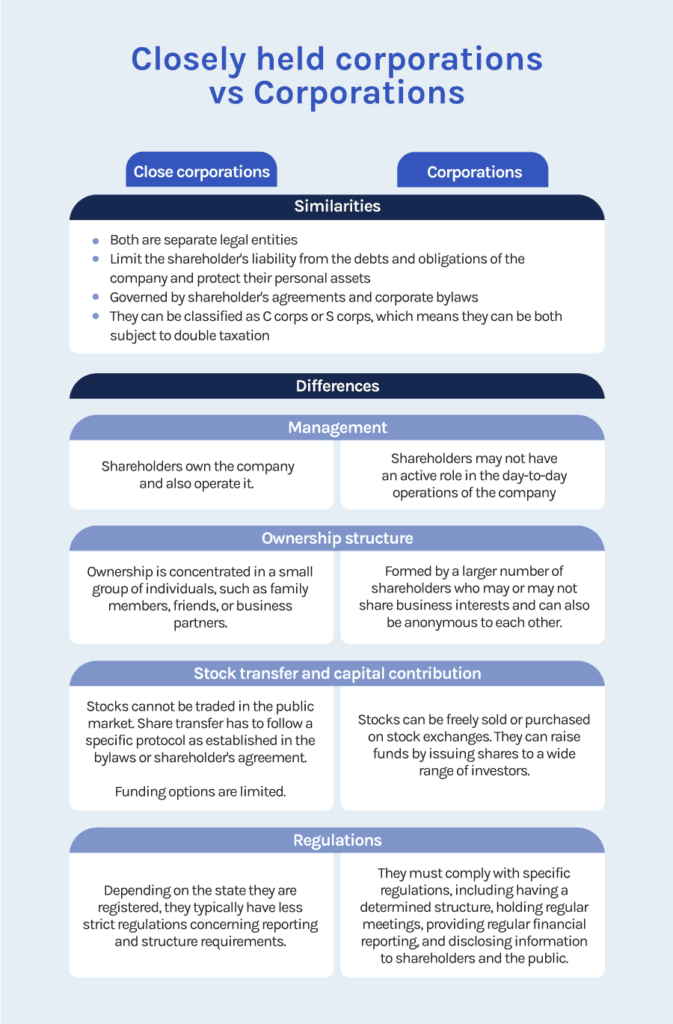

Closely held corporations and regular corporations are both legal entities that are separate from their owners, protect shareholders’ personal assets, have the same governing documents, and are subject to the same tax regulations. However, there are also some differences between the two business entities.

In a closely held corporation, ownership is typically concentrated in small groups of individuals who are relatives or have shared business interests and actively operate the business. On the other hand, a regular corporation has a larger number of shareholders who have limited involvement in the business operations and may not have personal relationships with each other.

Closely held corporations rely on contributions of their shareholders, loans, or other forms of private financing, while publicly held corporations can raise funds by issuing shares to a wide range of investors in public markets. Also, while regular corporations are subject to more stringent requirements regarding financial reporting and corporate governance practices, closed corporations offer more flexibility in the way they are structured.

Examples of closed corporations

Chick fil A

Chick-fil-A is one of the largest and most popular fast-food franchises in the United States. Founded by Truett Cathy in 1946, it is a closely held corporation and remains family-owned to this day. The Cathy family, who serve in all executive positions, have made a deliberate decision to keep the company private and have no plans to take it public. This decision was in line with the late Truett Cathy’s request to his children before his passing.

Chick-fil-A is famous for its chicken sandwiches and is also known for its unique practice of being closed on Sundays. This practice is rooted in the company’s Christian principles, which are aligned with the religious beliefs and preferences of its owners. Additionally, Chick-fil-A’s corporate purpose reflects these principles.

Chick-fil-A operates based on its owners’ religious beliefs and preferences, which has contributed to its popularity and distinctive operating practices.

Are you looking to start your business and you want to decide what business entity is better for you? Our startup attorneys will help you accomplish your personal and professional goals by setting up your business in your best interest. We will help you structure your corporation, write and negotiate your bylaws and shareholder agreement, and minimize the impact of underlying liabilities.

Schedule a consultation at (630) 517-5529.