One of the most resorted strategies to fund a business acquisition is using seller financing. Through this method, buyers and sellers can agree to a purchase price more easily, since this type of financing offers more flexibility and better terms than other M&A funding alternatives.

What is seller financing for business?

Seller financing, or seller note, occurs when an owner serves as a lender and funds a percentage of the purchase price for a business acquisition. The covered portion is eventually paid by the buyer with interest through periodic payments and specific terms, as agreed with the seller.

How does seller financing work in M&A?

With owner financing, the seller of a business directly provides credit to the buyer to cover the purchase price without involving third parties, such as banks or lending institutions.

The business owner can research to verify the creditworthiness of the buyer by inspecting credit scores, and business experience, or asking for financial documentation.

After the business owner approves funding the M&A, a business acquisition lawyer will define the financing terms stated by the seller in the promissory note.

This contract will define the conditions of the financing, such as the amount of the down payment, any required collateral or personal guarantee, applicable interest rates, and the details of the periodic installments to pay the remaining debt.

If the payment is not completed under the established conditions, the buyer forfeits business ownership.

Seller financing requires:

- A business purchase agreement that defines representations and warranties and outlines the general terms of the sale

- A promissory note that legally binds the buyer and defines the lending conditions, such as the amount that will be funded by the seller, the repayment schedule, and the implications of loan defaults.

When should you use seller financing in M&A?

Seller financing makes sense for potential business buyers when they do not have enough cash to fund the acquisition. Additionally, it is a good alternative when both parties of the transaction cannot agree on a purchase price.

On the seller side, showcasing this payment facility on the marketing strategy can also help speed up the business sale, since some buyers are looking only for business offers of this kind and it shows the seller is confident of the success of the business. However, some business sellers prefer to provide this information once they get to meet the buyer prospect.

How to structure a seller financing deal for a business

The way a seller financing is structured depends mostly on the risks the loan involves. Additionally, the terms will revolve around the business’s current profit, the needs of the buyer, and the funds that are necessary to grow the business, among other factors.

Some things to consider when structuring a seller financing are:

- As a seller, always ask for an upfront payment of at least 30%

- Set the interest rate in function of the risk the financing involves. It is fair to charge an interest between 6% and 8%.

- As Morgan & Westfield states, the amount of your loan has to be less than a third of the annual cash flow of the business

To ensure the seller financing has attainable terms and is structured in the best interest of both parties, buyers and sellers should always have the advice of an M&A attorney and be counseled by other transaction professionals.

Typical terms of an M&A seller financing

Seller financing deals involve several terms that must be described in the purchase agreement. See below the significance of each loan condition and how are they regularly handled in M&A transactions.

Seller financing deals involve several terms that must be described in the purchase agreement. See below the significance of each loan condition and how are they regularly handled in M&A transactions.

- Loan amount: The amount the buyer will contribute financially to the acquisition. This depends on the cash flow of the business, for it must cover the amount of the note and the living wage of the buyer. It ranges widely from 30% to 60% of the purchase price.

- Amortization period: The time in which the debt must be paid off. The length is usually established at 5-7 years.

- Down payment: The amount of money or percentage the buyer has to pay upfront. Typically, sellers ask for 50%, but it varies from 30% to 80%.

- Interest rates: Usually ranging from 6% to 8%, the interest rate is the percentage of the loan a buyer will have to pay additionally.

- Repayment schedule: Dictates the amount that must be paid periodically. The payment is usually made in monthly installments, but if the business is seasonal, this may vary.

- Collateral: Additional assets, such as properties, that are used to guarantee repayment.

- Balloon payment: Some loans include a balloon payment, which is an unusually large one-time payment made at the end of a loan term.

The loan agreement should also specify what are the consequences of being late on the payments and adopt measures to resolve any disagreements related to the loan.

You can use this seller financing calculator to budget your business sale more easily.

Pros and cons of seller financing

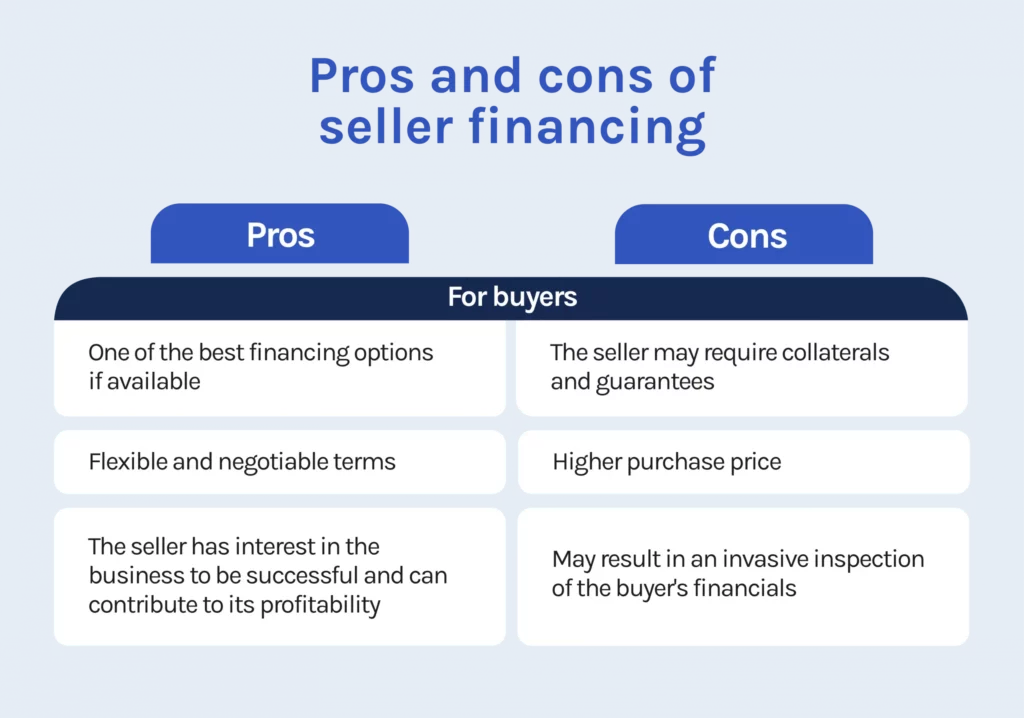

If available, seller financing is an excellent funding alternative for a business acquisition. But it also has some disadvantages that both parties can face. Analyze the pros and cons of seller financing from both the buyer’s and the seller’s perspective.

Advantages for buyers

Additional financing option

For buyers that do not have a favorable credit history and have few possibilities of being qualified for a bank loan, seller financing is a more feasible option.

With seller financing, the lending criteria are not as rigorous and buyers don\’t have to go through such a cumbersome application process.

Flexibility and negotiable terms

This type of loan offers direct contact between the lender and the borrower, which makes space for negotiation and more flexible terms. Sellers are highly motivated to close the deal quickly, and therefore offer lower interest rates and down payments and more favorable terms.

Vested seller interest

For the seller to receive the repayment, the business has to succeed. This is why the seller is interested in ensuring effective performance of the business and is likely to advise the buyer during the term of the loan.

Disadvantages for buyers

Collaterals and guarantees

The seller will likely ask the buyer for a personal guaranty, a security agreement, or any element that protects the business owner at the borrower’s cost.

Due diligence

The seller can conduct strict procedures to ensure the potential buyer qualifies for the financing and is going to manage the business properly. The owner may require a detailed financial statement, credit history, business plan, or even become invasive of the buyer’s financial privacy.

Higher price

Since the seller is mostly in control of the negotiation, the purchase price or interest may be higher. Additionally to this, the loan could require balloon payments at the end of the loan term.

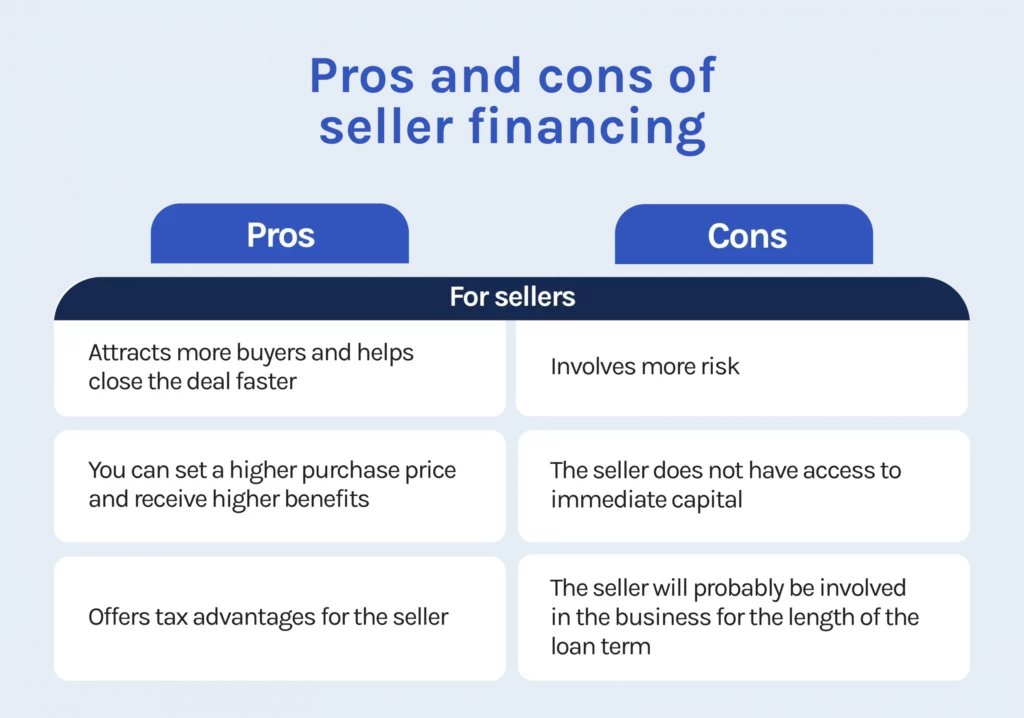

Advantages for sellers

Attract more buyers

Offering a seller note makes the business purchase more attractive to potential buyers. Business owners that promote this funding alternative have higher selling possibilities and can stand out in a highly competitive sector.

Higher selling price

Since buyers are willing to pay a higher purchase price for the convenience and flexibility a seller financing offers, business owners can aspire to raise the value of their business a 15% or more and receive a better profit.

Lower taxes

The tax liability associated with the business sale is reduced. Since sales involving financing are considered installment sales, taxes can be deferred.

Disadvantages for sellers

Risks

If the loan is defaulted, the business will lose value when it is offered again in the market. Not receiving repayment may also arise disputes and hefty financial losses. For this reason, collateral safeguards are highly recommended.

Less immediate capital

By financing a business acquisition, a seller will not be able to receive the integrity of the capital immediately. The seller will have reduced opportunities of reinvesting the money gained from the M&A.

Need to be involved in the business

For many sellers, the reason behind the business sale is having a clean break from the company. With seller financing, the owner can face the need of staying involved in the company.

Things to consider before opting for seller financing

The following is a list of the things buyers and sellers must consider to conclude whether the funding is a good idea:

Buyers

- Do you need the full purchase amount immediately?

- Are you willing to disclose your personal financial information and credit reports, and demonstrate you have a structured business plan?

- Is the profitability of the business enough to pay the note and your living wage?

- Are you comfortable with the owner’s involvement in the business for as long as the loan term?

- Does your credit score and business experience make you a qualified candidate for loans with better terms than the ones the business owner is offering?

- Are you willing to offer any collateral or personal guarantee?

- Can you combine other financing methods?

Sellers

- Are you confident that the potential buyer can repay you?

- Are you aware of the loan terms that are attainable for the buyer and fair for you?

- Do you want to stay involved with your business after the sale?

- If you\’re not so convinced by seller financing, have you tried other price negotiating techniques, such as earnouts?

Alternative funding options for M&A

If seller financing is not your best option, or you want to complement your funding with other alternatives, here are some different kinds of loans that could help you buy a business:

- SBA loan: Another great option when you have exhausted your financing options. The SBA 7(a) loan program has less rigorous qualifying requirements and offers up to $5 million for your M&A.

- Online business loans: Have flexible eligibility requirements but higher interest rates than traditional loans.

- Traditional loans: Banks and credit unions have low-interest rates and favorable terms, but have the most difficult lending criteria

- Private equity: Buyers accept capital contributions from third parties in exchange for ownership of the business