Anyone who is starting a business will need to select a business entity or model with which they will follow. A corporation and limited liability company (LLC) are two different types of business entities that both offer their own benefits. Depending on how you would like ownership, taxation, and management to look for your business, you can select a business entity that reflects these professional goals. You may have an idea of how you want your business to run, but may not be sure which business entity this aligns with. Before deciding upon your business entity, speak with a reputable business attorney for advice on how to proceed with your business.

LLC vs Corporation

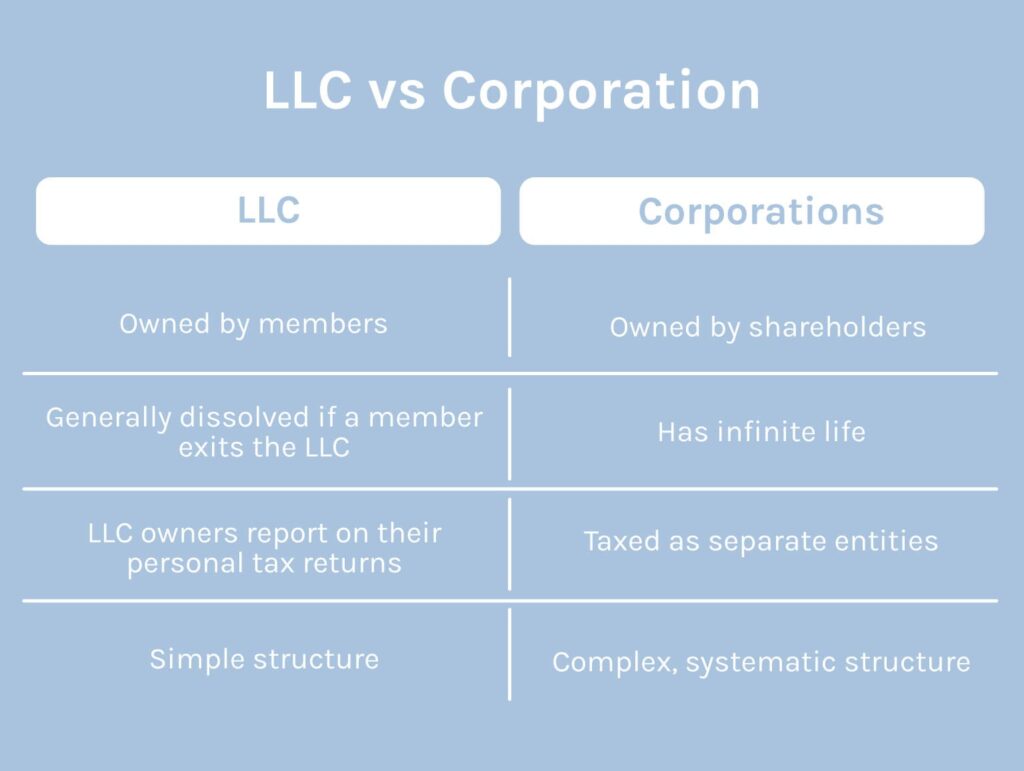

The main difference between LLCs and corporations is that the ownership of a corp belongs to shareholders, whereas LLC owners are called members.

A corporation and a limited liability company (LLC) are different types of business entities that offer their own benefits. Depending on how you would like ownership, taxation, and management to look for your business, you can select a business entity that reflects these professional goals. You may have an idea of how you want your business to run, but may need to figure out which business entity this aligns with. Before deciding upon your business entity, it’s highly advisable to speak with a reputable business attorney to be sure how to proceed with your business.

What is an LLC?

A Limited Liability Company (LLC) is a popular business entity that can be used by either a sole proprietor or a company with two or more owners (partnership). LLCs protect the owners from liability, which means that in case of any type of issue related to debts, bankruptcy, and lawsuits, the members will be shielded and will not face personally the consequences of these outcomes.

It is relatively easy to form an LLC, and they offer the best parts of all corporate forms. Profits and losses are shared in proportion to ownership.

LLCs are also popular because business owners can customize them almost any way they please. Although the default relationship between LLC members is a partnership, a skillfully crated operating agreement (the document that governs the LLC) can create a corporate-like structure of “units” similar to shares in a corporation. Membership units can have different rights and preferred statuses associated with them similar to shares.

Another advantage to an LLC is choosing profit-sharing models. As a default, LLCs are pass-through entities that are not recognized by the IRS. This means that members report their income on their personal income taxes.

However, LLCs can decide to be taxed as a corporation, specifically an S-Corp. This is why business owners don’t actually have to choose between an S-corp and an LLC because the LLC can be both.

Many people incorrectly believe that an S-Corp is a type of corporation. In reality, it is actually just a tax designation can be used by both corporations and LLCs. LLCs typically want an S-corp status if they are single-member LLCs or LLCs with employees. Otherwise, LLC members simply make their income by drawing on the profits of the company.

Although LLCs are very flexible and a great way to organize your business, their flexibility also means they can be complicated to design, especially when multiple members are involved. Having a clear operating agreement is not only important for running a company, but also for keeping harmony between members. Many disputes arise when one member wants to withdraw from the LLC and without a carefully drafted LLC operating agreement, the LLC may be headed toward litigation.

The key is having the right business attorney and accountant to set up the company in the best interest of the owners.

S-Corps

However, there are requirements and considerations for an LLC that wants to elect an S-corp status. An S-corp must:

- Be a domestic corporation

- Have only allowable shareholders

- May be individuals, certain trusts, and estates and

- May not be partnerships, corporations or non-resident alien shareholders

- Have no more than 100 shareholders

- Have only one class of stock

- Not be an ineligible corporation (i.e. certain financial institutions, insurance companies, and domestic international sales corporations).

What is a corporation?

A corporation is a type of business entity in which the company is a separate legal entity from its owners. As mentioned above, the owners of a corporation are called “shareholders”.

Corporations have two primary characteristics:

Limited liability

This attribute keeps the owners of a corporation protected in case legal issues arise. It helps them maintain their personal assets and only puts at risk those that were invested in the company.

Infinite Life

This feature means the inc will remain as long as the shareholders prevail. Although some shareholders may quit or die in the long run, others can buy shares and fill their place, and so the corp continues to exist.

In the United States, companies have two tax options: C-corp and S-corp designation. C-corps are subject to double taxation, whereas s-corps are not. However, s-corps have certain requirements such as all owners having to be individuals, the corporation being owned by less than 100 shareholders, and no shareholder can be a non-resident alien.

Differences between LLC and Corporation

Business ownership

If you are beginning your business with a few investors or partners in mind, you should understand how corporations and LLCs differ in this regard.

As we mentioned, in corporations, one of the main differences between LLCs and Corps resides in the ownership of the business.

In a corporation, ownership is divided by shares of stock purchased by owners, known as “shareholders” whereas LLCs’ owners are called “members.” These shareholders can determine how much ownership they would prefer to have by purchasing additional shares to own a larger percentage of the company or selling their shares if they wish to reduce their ownership amount.

LLCs do not look at ownership through the same financial lenses. LLCs can have as many owners as they want, and their financial contribution does not have to determine their “level” of ownership. Instead, many LLCs will use operating agreements to specify how much ownership each member has—this can be equal ownership between members or varying for each member. If there is no such operating agreement, the LLC operates according to the law.

Although for corporations it is relatively easy to transfer shares, for LLCs, transferring ownership may require the approval of other members, and in some states, it can be dissolved if a member quits, dies, or files for bankruptcy.

Briefly, when it comes to choosing an LLC vs corp, the overall recommendation regarding ownership is that if your business goals involve seeking outside investors or selling company shares, it is best to opt for a corporation. This way, your company will be allowed to share transferability and have infinite life.

Taxes

How the two entities are taxed can be confusing and should be thoroughly discussed with a business attorney; however, there are some general guidelines that new business owners can understand.

Corporations are taxed as separate entities, which can earn their own income. As a result, they are responsible for paying taxes as well, which can lead to “double taxation” where a corporation pays its own taxes and the owners also pay taxes. Fortunately, qualifying corporations can opt for an S-corp status to avoid double taxation.

In contrast, LLCs are pass-through entities since the profits of the business are “passed through” to the individual members who report the income on their personal tax returns. The LLC owners report their earnings and losses on their personal tax returns, rather than their business ones, and any operating costs or losses can be deducted. However, if LLCs want to be taxed as a corporation, the members can also opt for an S-corp tax status. Your business attorney will work closely with your accountant to see which tax status is most suitable for your business.

Management

Another difference between LLC’s and corporations is their management structure. A corporation’s structure is more complicated than that of an LLC. Generally speaking, corporations have a more systematic and rigid operating structure.

Corporations are owned by shareholders, who elect a Board of Directors (BOD), which in turn, appoints the officers. The BOD manages the corporation’s management, and the officers are assigned specific duties and control the corporation’s day-to-day activities. Also, shareholders must meet at least annually and there must be strict control on record keeping.

In contrast, LLCs have a simpler structure where either the owners (“members”) can directly manage the company or simply hire a manager for the daily activities, which allows the business to be driven by all or some of its members. The LLC’s structure should be outlined in its operating agreement to avoid confusion on which members also act as managers, if applicable.

Legal liability

Both corporations and LLCs are entities that protect the liability of their owners. Personal assets, such as vehicles or proprieties of the partners, are not in danger of being taken away in case the business faces debts.

However, the business owners of both corporate structures are still responsible for their personal negligence or any misuse of their faculties as a member of the company.

In order for shareholders to stay protected from legal liability, they need their personal and business finances to be independent of each other.

Owners should also sign documents representing the company, not in their own personal capacity.

The differences between LLC and corporations can have crucial consequences on your business. It is highly advisable to consult an attorney and accountant before taking this decision, for it will impact directly the tax management of your company and the development of its business model.