A startup business plan is a tool for securing funding, guiding your company’s strategy, and ensuring long-term growth. This document acts as a roadmap for your business, outlining everything from market analysis to financial projections, making it essential for attracting investors and stakeholders.

What is a Startup Business Plan?

A startup business plan is a detailed document that defines a company’s vision, strategy, and financial objectives. It’s used to guide the startup’s growth and operations while providing investors with a clear picture of the company’s potential.

Why Do Startups Need a Business Plan?

Startups need a business plan to secure funding, set a clear strategy, and plan for sustainable growth. It ensures that all aspects of the business, from finances to marketing, are aligned toward achieving long-term goals.

- Funding: Investors and lenders require a business plan to evaluate the startup’s viability.

- Strategy: It helps founders define key business objectives and how to achieve them.

- Growth: A plan is critical for guiding a startup’s development and scalability.

What Are the Types of Business Plans for Startups?

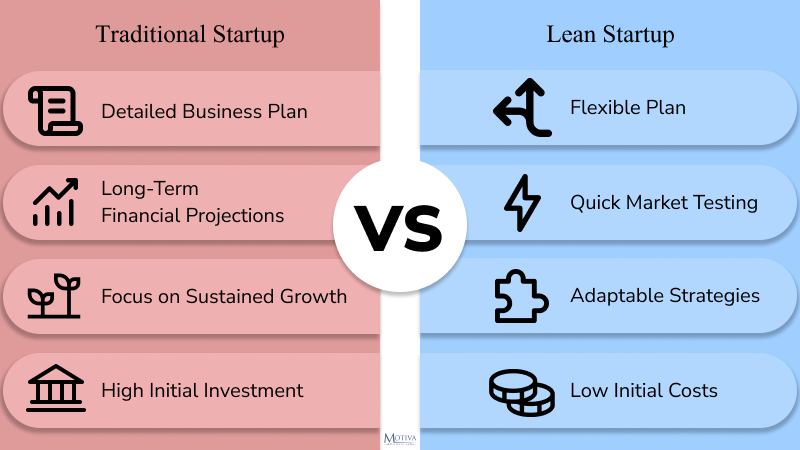

Startups typically use either a traditional business plan, which is more detailed, or a lean startup plan, which is concise and adaptable. The choice depends on the startup’s stage, goals, and funding requirements.

Traditional vs. Lean Startup Business Plans

Traditional business plans provide detailed market analysis, financial forecasts, and operational strategies, while lean startup plans focus on agility and rapid market adaptation. The traditional plan is best for securing larger investments, whereas the lean plan allows for quicker pivots based on real-time data.

Traditional Startup Business Plan

A traditional business plan is a detailed document that outlines the full strategy and structure of a business before it launches. It typically includes sections like market research, financial projections, marketing strategies, and operational plans.

The goal is to provide a clear roadmap for the business’s future, covering everything from the company’s mission to its revenue model, target audience, and competitive landscape.

Lean Startup Business Plan

A lean startup business plan is all about creating a flexible strategy that evolves as you test your product in the real world. Instead of spending a lot of time on a long, detailed plan, you focus on getting your product in front of customers quickly and making adjustments based on their feedback. The idea is to keep things lean and adaptable, making changes along the way until you either find your market fit or decide to move on.

The goal is to avoid wasting time and resources by validating your ideas early. Depending on the type of business, these plans can look different, but they all aim to balance speed with customer insight, refining the approach as you go.

What Should a Startup Business Plan Include?

A startup business plan should include all the key components that provide a clear view of the company’s vision, strategy, and financial outlook. Here are the essential sections:

- Executive Summary: A concise overview of the business, its mission, and key goals.

- Company Description: Background on the company, its products, and the problem it solves.

- Market Analysis: Detailed insights into the target market, trends, and competitive landscape.

- Organization and Management: Structure of the company and key team members.

- Product Line or Services: Information on the products or services offered.

- Marketing and Sales Plan: Strategies for reaching customers and driving sales.

- Financial Projections: Revenue forecasts, budget plans, and cash flow projections.

- Appendix: Supporting documents such as financial statements or legal agreements.

Each section shows investors how the business plans to grow and succeed. Market analysis directly supports financial projections, while the marketing plan aligns with customer segmentation and sales strategies.

How to Write a Startup Business Plan in 10 Actionable Steps

Here’s a step-by-step guide to help you create an effective business plan:

- Begin with a Powerful Executive Summary: A high-level overview of your business.

- Describe Your Company: Include the company’s vision, mission, and objectives.

- Perform Market Analysis: Research the industry, market size, trends, and competitors.

- Define Your Products or Services: Describe what the business offers and how it solves customer problems.

- Conduct Customer Segmentation: Identify your target audience and customer groups.

- Analyze Your Competitors: Detail the strengths and weaknesses of your competition.

- Develop a Marketing Plan: Lay out strategies to attract and retain customers.

- Outline Your Management Structure: Describe key team members and their roles.

- Create Financial Projections: Forecast your financials, including revenue and expenses.

- Include an Appendix: Add supporting documents like financial statements and legal contracts.

Each step builds on the previous one. For example, market analysis informs customer segmentation, which then influences the marketing plan. Ultimately, all these steps feed into the financial projections that demonstrate the startup’s potential for growth.

1. Begin with a Powerful Executive Summary

The executive summary is the most important section of your business plan as it captures the essence of your business in a concise format. It should provide a clear snapshot of your company’s mission, market position, and financial projections.

- Objective: Highlight what the company does, the market it serves, and its key financial goals.

- Tips:

- Keep it short but impactful.

- Focus on your unique value proposition.

- Include high-level financial projections and market potential.

The executive summary ties into other sections of the business plan, providing a preview of the financial projections, market analysis, and company mission, all important for drawing in investors.

What Investors Look for in a Summary

Investors expect certain key elements in an executive summary that help them assess the company’s potential:

- Clear Market Opportunity: Define the market need and how the business meets it.

- Strong Financial Projections: Include revenue forecasts, profit margins, and cash flow.

- Scalability: Show how the business can grow.

- Competitive Edge: Explain what sets the company apart from competitors.

- Team Competence: Highlight the expertise of your management team.

Investors evaluate the startup’s potential based on these metrics, using the financial plan and market analysis as key indicators of future success.

2. Describe Your Company Vision and Mission Clearly

Your company vision describes where you want your business to be in the future, while your mission statement explains how you will get there. Both are essential for setting long-term business goals and ensuring that your strategy aligns with your financial outcomes.

Tips for Writing Your Vision and Mission:

- Vision: Focus on where the company aspires to be in the next 5-10 years.

- Make it ambitious yet achievable.

- Example: “To be the leading provider of sustainable technology solutions globally.”

- Mission: Explain what your company does, why it exists, and how it serves customers.

- Keep it clear and focused on customer impact.

- Example: “We provide innovative tech solutions to drive environmental sustainability.”

Your vision should tie into market strategy, while your mission connects to your company’s day-to-day operations and customer engagement. Both drive financial performance and future growth.

3. Perform a Comprehensive Market Analysis

A market analysis helps you understand your target market, competition, and industry trends, which are crucial for informed business decisions. This section outlines how to perform a market analysis that impacts key aspects of your business plan, including financial projections and customer segmentation.

Step-by-Step Market Analysis:

- Research Your Industry: Understand market size, growth potential, and key players.

- Identify Your Target Market: Segment the market based on demographics, geography, and buying behavior.

- Analyze Competitors: Study direct competitors, their strengths, weaknesses, and market positioning.

- Evaluate Market Trends: Look for opportunities in consumer behavior or emerging technologies that can benefit your business.

A comprehensive market analysis is the foundation for customer segmentation and financial projections, helping you shape your marketing and sales strategies.

How to Identify Market Trends and Opportunities

Use these methods and tools to track market trends:

- Google Trends: Identify what consumers are searching for.

- Industry Reports: Research from sources like IBISWorld or Statista to understand industry movements.

- Social Listening Tools: Tools like Hootsuite and Brandwatch help you gauge consumer sentiment.

Market trends affect your product positioning and customer acquisition strategies, helping you refine your ROI-focused marketing plans.

Use of Data Tools for Better Market Insights (Interactive Tools)

Data-driven insights improve decision-making in market analysis. The following tools provide real-time data to help refine your strategy:

- Google Analytics: Track user behavior on your website and understand your audience demographics.

- SEMrush: Analyze competitors’ strategies and discover keyword opportunities.

- Moz: Monitor search trends and performance metrics for SEO improvement.

These data tools enhance both your market analysis and financial projections, allowing you to create precise, data-backed strategies.

4. Develop Customer Segmentation for Focused Targeting

Customer segmentation divides your target audience into distinct groups based on characteristics like behavior, needs, and location. By segmenting customers, you can create tailored marketing strategies and offer more personalized products or services.

Steps for Customer Segmentation:

- Collect Customer Data: Use data from surveys, website analytics, and CRM systems.

- Segment by Key Attributes: Divide customers based on demographics (age, income), psychographics (lifestyle, values), or geography.

- Evaluate Segment Profitability: Analyze which segments offer the highest potential for revenue and growth.

- Tailor Marketing Strategies: Customize your marketing for each segment to improve engagement and conversion rates.

Customer segmentation aligns with your market analysis and pricing strategies, ensuring you’re targeting the most profitable customer groups.

Segmentation Strategies for Startups

The most effective segmentation strategies for startups include:

- Demographic Segmentation: Based on age, gender, income.

- Geographic Segmentation: Focus on location, region, or climate.

- Psychographic Segmentation: Segment by lifestyle, interests, or values.

By applying segmentation, startups can improve customer lifetime value (CLV) and optimize customer acquisition costs (CAC) for long-term profitability.

5. Analyze Your Competition

Conducting a thorough competitive analysis helps in understanding your market position and differentiating your product. Here’s how to get started:

Steps for Competitive Analysis:

- Identify Competitors: List your direct and indirect competitors.

- Assess Competitor Strengths & Weaknesses: Analyze what they do well and where they fall short.

- Study Market Share: Determine each competitor’s market share and target audience.

- Evaluate Their Marketing Strategies: Understand how they position themselves in the market and attract customers.

- Differentiate Your Business: Highlight what sets you apart from competitors and use this to shape your marketing and product strategies.

Competition analysis informs your pricing, product differentiation, and marketing strategies, all of which support your financial forecasting.

Common Pitfalls to Avoid in Competition Analysis

Avoid these mistakes when conducting a competition analysis:

- Underestimating Competitors: Failing to study competitors thoroughly can result in missed opportunities.

- Focusing Only on Direct Competitors: Consider indirect competitors as well.

- Ignoring Emerging Trends: Pay attention to new technologies or market shifts that may impact your business.

- Relying on Outdated Information: Use up-to-date data for an accurate analysis.

By avoiding these common pitfalls, you can strengthen your market positioning and improve financial projections.

6. Create a Marketing Plan that Stands Out

A marketing plan outlines the strategies your startup will use to reach its target audience and achieve sales goals. A high-impact marketing plan should be data-driven, clearly tied to your business objectives, and scalable.

Actionable Tips for an Effective Marketing Plan:

- Define Target Audience: Align marketing strategies with the customer segments identified earlier.

- Set Clear Goals: Focus on measurable outcomes such as conversion rates and customer acquisition.

- Choose Marketing Channels: Select digital and traditional channels based on where your audience is most active.

- Budget Allocation: Ensure funds are distributed efficiently across campaigns to maximize ROI.

- Track Performance: Use analytics tools to measure the success of campaigns.

A well-crafted marketing plan enhances sales forecasts and directly ties into the customer segmentation and financial projections sections of your business plan.

High-ROI Marketing Strategies for Startups

High-ROI marketing strategies are essential for startups with limited budgets. These strategies ensure the highest return on investment for your marketing spend:

- Content Marketing: Create valuable, relevant content to attract and retain a clearly defined audience.

- Search Engine Optimization (SEO): Optimize your website to rank higher in search engines and drive organic traffic.

- Social Media Advertising: Use paid campaigns to target specific demographics at a low cost.

- Email Marketing: Nurture leads with personalized email campaigns that guide potential customers through the sales funnel.

These high-ROI strategies help reduce customer acquisition costs (CAC) and improve your startup’s bottom line, aligning with financial projections.

Digital Marketing Tips and Tricks (Data-Driven Insights)

To maximize your digital marketing efforts, focus on data-driven strategies that deliver measurable results. Here are some key tips:

- Use Google Analytics: Track user behavior and website performance.

- Leverage A/B Testing: Continuously improve ads and landing pages by testing different versions.

- Target Lookalike Audiences: Use customer data to find new audiences similar to your best customers.

- Optimize for Mobile: Ensure your digital content is mobile-friendly as more users engage via smartphones.

These tips enhance ROI and improve customer retention, driving better overall performance in your business strategy.

7. Develop Strong Startup Partnerships and Resources

Strategic partnerships can lower costs, increase your market reach, and improve sustainability. Building partnerships early on allows startups to share resources and access new audiences.

Tips for Building Strategic Partnerships:

- Identify Complementary Businesses: Look for companies with similar goals but non-competing products.

- Align Objectives: Ensure both parties benefit from the partnership.

- Create Mutual Agreements: Define terms clearly to avoid conflicts.

- Nurture Relationships: Maintain open communication to foster long-term success.

Strategic partnerships are important for resource optimization, helping startups lower costs and expand operations, directly impacting the financial plan.

How to Build Strategic Alliances

Follow these steps to build strategic alliances that help grow your startup:

- Research Potential Partners: Find businesses that complement your startup’s offerings.

- Develop a Proposal: Present clear benefits for both parties.

- Negotiate Terms: Ensure each party agrees on the goals and responsibilities.

- Execute and Monitor: Track the performance of the alliance regularly.

Alliances can improve your business model and contribute to your startup’s financial health by providing access to resources and expertise.

Resource Optimization Techniques for Early-Stage Startups

For startups with limited budgets, optimizing resources is essential for growth. Here are some techniques:

- Outsource Non-Core Activities: Focus on key business functions and outsource others (e.g., HR, accounting).

- Use Freelancers: Hire contractors for short-term projects to avoid long-term expenses.

- Leverage Technology: Use cost-effective software tools to streamline operations.

Optimizing resources helps reduce expenses, contributing to cost control and improving operational efficiency in your financial plan.

8. Outline Your Company’s Organizational Structure

An effective organizational structure ensures that your startup operates efficiently, with clear roles and responsibilities. It directly impacts your ability to manage resources and scale the business.

Steps for Outlining Organizational Structure:

- Identify Key Roles: Define the must-have positions, like CEO, CFO, COO, and CTO, and what they’re responsible for.

- Assign Responsibilities: Make sure everyone knows what they’re responsible for and how their work fits into the bigger picture.

- Establish Reporting Lines: Set up a clear chain of command so there’s no confusion about who reports to whom.

- Adjust as You Grow: Be ready to adapt your structure as the company scales.

A well-structured organization helps optimize resource allocation and improves operational efficiency.

Defining Roles for Maximum Efficiency

Assigning roles carefully is key to achieving maximum efficiency. Follow these tips:

- Match Skills to Roles: Ensure employees’ skills align with their responsibilities.

- Delegate Appropriately: Empower team members by delegating tasks that fit their expertise.

- Monitor Performance: Track progress and adjust roles as needed to maintain efficiency.

Defining roles clearly ensures operational success, contributing to the startup’s growth goals.

9. Create a Financial Plan with Clear Projections

A financial plan outlines how your startup will manage its revenue, expenses, and investments. Accurate financial projections show potential investors how you plan to grow and sustain your business.

Key Financial Elements:

- Revenue Projections: Estimate your sales and profits for the first 3-5 years.

- Expense Forecasting: Detail operational costs, including marketing and employee salaries.

- Cash Flow Statements: Show how cash flows in and out of your business.

- Break-Even Analysis: Calculate when your business will start making a profit.

Your financial projections should be based on your market analysis, customer segmentation, and competition research for a comprehensive plan.

Understanding Cash Flow Management for Startups

Key tips for cash flow management include:

- Monitor Cash Flow Regularly: Track all inflows and outflows to avoid surprises.

- Maintain a Cash Reserve: Keep funds aside for emergencies or slow months.

- Improve Collection Terms: Speed up receivables and delay payables where possible.

Effective cash flow management ensures business stability, supporting scalability and investment readiness.

Key Financial Metrics Investors Care About

Investors focus on key metrics that demonstrate a startup’s financial health and growth potential. These include:

- Return on Investment (ROI): Measure how much profit your business generates relative to the investment.

- Customer Acquisition Cost (CAC): Track the cost of acquiring each new customer.

- Lifetime Value (LTV): Estimate the total revenue a customer brings over the course of their relationship with your business.

Highlighting these metrics in your financial plan will increase investor confidence in your startup’s potential.

10. Don’t Forget the Appendix: Supporting Documents

An appendix is essential for backing up your business plan with supporting documents that validate your assumptions.

Important Documents to Include:

- Financial Statements: Balance sheets, income statements, and cash flow statements.

- Legal Documents: Contracts, licenses, and agreements.

- Market Research Data: Detailed research reports and customer surveys.

The appendix helps validate your financial projections and market analysis, showing investors you have a solid foundation for success.

Mistakes to Avoid When Writing Your Startup Business Plan

- Focusing Too Much on Short-Term Goals

- Not Being Data-Driven

- Ignoring the Importance of Marketing

- Neglecting Competitor Analysis

Focusing Too Much on the Short-Term

Short-term thinking can cause cash flow issues and limit scalability. Focus on long-term growth and sustainability to prevent this.

Not Being Data-Driven

A lack of data leads to poor market analysis and inaccurate financial projections. Use data for decision-making across all areas of your business.

Overlooking the Importance of Marketing

Ignoring marketing reduces customer acquisition and weakens brand visibility, directly impacting revenue and growth.

Ignoring Competitor Analysis

Failure to analyze competitors results in missed opportunities for market positioning, pricing strategies, and customer segmentation.

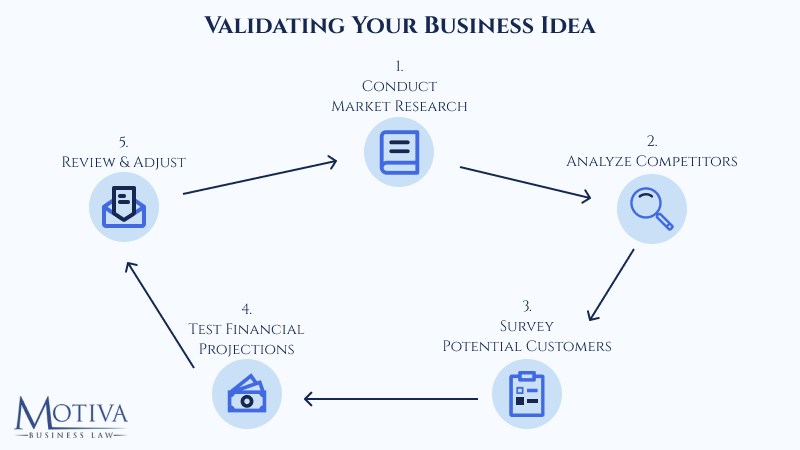

How to Validate Your Startup Business Plan with Data

Use data to validate market fit, financial projections, and customer segmentation. This improves decision-making and investor confidence.

Tools and Platforms to Use for Market Validation

- Google Trends: Analyze search trends.

- SEMrush: Conduct competitor and keyword research.

- SurveyMonkey: Gather customer feedback.

These tools support market validation and improve your business plan’s financial projections.

Key Metrics to Track and Evaluate Success

- Customer Acquisition Cost (CAC)

- Lifetime Value (LTV)

- Return on Investment (ROI)

Tracking these metrics helps scale your business and ensures financial sustainability.

What Investors Really Look for in a Business Plan

Investors focus on:

- Clear Financial Projections

- Thorough Market Analysis

- Scalability

- Experienced Team

These areas link directly to business sustainability and growth potential.

Common Red Flags That Make Investors Turn Away

- Inconsistent Financials

- Lack of Market Validation

- Unrealistic Growth Projections

These red flags hurt investor confidence and undermine your business plan’s credibility.

What are the top marketing mistakes?

How to Pitch Your Plan

- Know Your Numbers: Be prepared to explain your financial projections in detail.

- Tell a Compelling Story: Investors respond to a strong narrative that shows passion and vision.

- Focus on Market Viability: Highlight how your product fits into the market.

- Show Scalability: Demonstrate that your business can grow sustainably.

Top Tips for Writing a High-Impact Startup Business Plan

- Be Concise: Get straight to the point. Investors don’t have time for fluff.

- Use Data: Support every claim with market research or financial projections.

- Highlight Your Unique Value: Explain what sets your business apart from competitors.

- Be Realistic: Provide financial projections that are ambitious yet attainable.

- Tailor for Investors: Focus on the metrics investors care about (ROI, CAC, LTV).

A well-structured business plan impacts long-term goals, influencing both financial projections and market strategy.

Research-Based Planning

- Use Industry Reports: Base your market analysis on real data from reliable sources like IBISWorld or Statista.

- Customer Surveys: Collect direct feedback to validate product-market fit.

- Competitor Analysis: Study competitors’ strengths and weaknesses to position your business effectively.

Research-backed plans improve market positioning, pricing strategies, and make your business plan more appealing to investors.

Customizing Your Plan for Different Audiences

- Investors: Focus on profitability and scalability.

- Partners: Emphasize operational synergy and growth potential.

- Team: Highlight goals, roles, and responsibilities.

Tailoring your plan enhances the clarity of financial projections and market strategies depending on the audience.

How to Keep Your Plan Flexible (Be Ready to Pivot)

- Monitor Market Trends: Regularly update your plan based on new data.

- Stay Customer-Centric: Be willing to adapt based on customer feedback.

- Test New Strategies: Experiment with new approaches without veering too far from core goals.

A flexible plan ties to long-term sustainability and the ability to pivot when market conditions change.

Tools and Resources to Help You Write a Better Startup Business Plan

- LivePlan: Comprehensive business plan writing and tracking tool.

- BizPlan: Offers step-by-step guidance on building a business plan.

- Enloop: Automates financial forecasting for startups.

These tools improve financial projections, market analysis, and investor engagement.

Business Plan Software Tools for Startups

- LivePlan: Helps with financial forecasting and plan customization.

- BizPlan: A user-friendly tool for creating detailed business plans.

- Enloop: Automates financial projections and provides performance scoring.

These tools streamline the business plan creation process and improve the accuracy of financial forecasts.