The trucking business in Illinois is a lucrative industry that offers great growth opportunities and a valuable service for the community. However, logistics and transportation are heavily regulated industries.

To operate those businesses in Illinois, not only will you need a strategic business plan but also a thorough understanding of the legal and compliance requirements.

If you want to ensure your business is protected and compliant, follow this step-by-step guide to ensure you set up your Illinois logistics company for success.

What is a trucking business?

A trucking business, also known as a logistics business, is an enterprise that involves the management and coordination of the flow of goods from the point of origin to the final consumer. It encompasses transportation, warehousing, inventory management, and distribution, all aimed at optimizing efficiency and minimizing costs throughout the supply chain.

Transport and logistics is a vital and valuable industry. According to data from Allied Market Research the global logistics market was valued at $7.6 billion in 2017, and it’s projected to grow to almost $13 billion by 2027.

Also, according to the American Trucking Association, 91% of trucking companies operate six or fewer trucks, which means the industry is dominated by small carriers.

Before implementing your business plan, you want to categorize your business properly.

- Local transport: transport goods within a particular region. That can be anything from livestock to construction materials.

- Global transport: transport goods on an international scale.

Which category your business gets into will depend on the resources at your disposal, how many people you can hire, how much funding you can get, and more.

The benefits and challenges of a logistics business

Starting a trucking company can be a profitable business venture, but it also comes with challenges that need to be assessed. The following are some of the considerations you should keep in regard before starting a trucking company:

Benefits

- Growing industry: The demand for freight transportation services is continuously growing and there are great expansion opportunities in the state of Illinois.

- Be your own boss: The Logistics industry’s great flexibility allows you to be in control of your schedule and take the load of work you can afford in terms of time and money. Also, you can decide who you work with and you will likely benefit from high customer rates.

- Illinois’ governmental support: The state of Illinois is especially apt for those in the transportation industry since it has a great infrastructure and provides a variety of financial incentives to help you launch or support your business.

Challenges

- Strict regulations: The logistics industry is highly regulated and requires strict care of licenses, permits, and insurance-related matters to avoid lawsuits or legal actions against your business.

- Inconsistent work: Although it’s rewarding, the logistics business is subject to market fluctuations. Professionals in the trucking industry need to be organized with their finances to ensure they can navigate through times of scarcity.

- Liabilities: The risks associated with trucking businesses are high, so you need to protect yourself by having efficient insurance, contracts, and employment agreements.

How to start a trucking business in Illinois

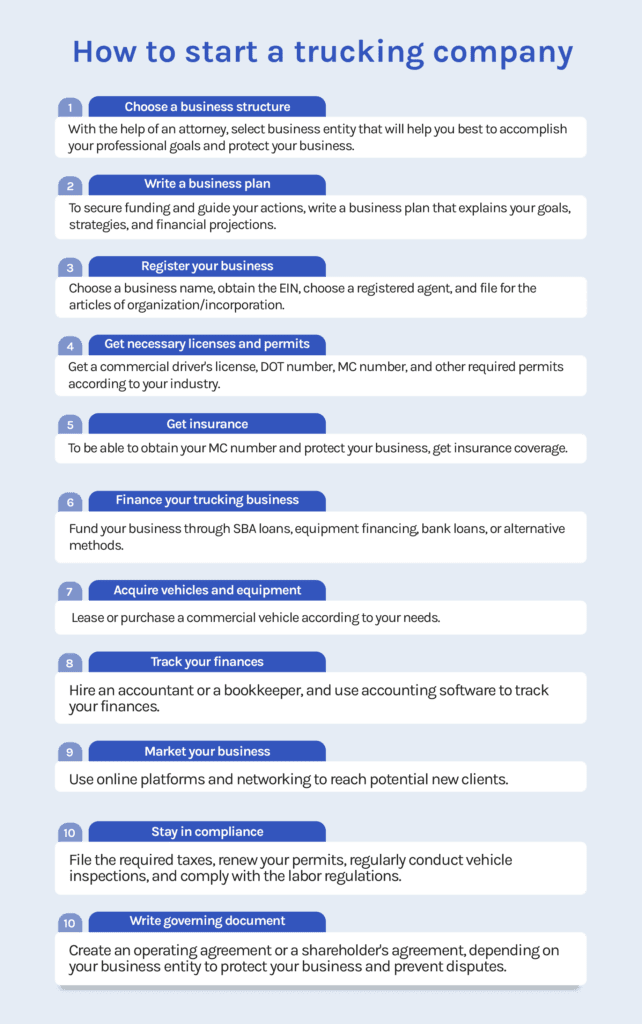

Now that you have assessed the risks and advantages of having a transportation business and want to move forward, ensure you follow the next steps:

1. Choose a business structure

A crucial step when starting a business is defining its business entity. This decision will impact directly your business’s protection and capacity for growth.

Before selecting a business type, consult a startup attorney for assistance in determining which one is best for your situation, according to your business goals, tax considerations, and required level of protection.

There are multiple ways to organize your business in Illinois:

- Sole proprietorship: This is the simplest form of business entity where an individual owns and operates the business. The owner has unlimited liability and is personally responsible for all debts and obligations.

- Partnership: Two or more individuals share the profits, losses, and responsibilities of the trucking company. They can be general. in which partners have unlimited liability for the business’s debts and obligations; limited, in which general partners manage the business and have unlimited liability, while limited partners contribute financially but have limited liability, or an LLP, in which all partners have limited liability from the actions of other partners and are only liable for their responsibilities.

- Limited Liability Company (LLC): Provides limited liability to its owners (called members) and allows for pass-through taxation while shielding personal assets from business liabilities.

- Corporation: Acting as a separate entity from its owners (called shareholders), it provides limited liability protection and has a more complex structure, formed by shareholders, directors, and officers. Corporations can be taxed as C-corps, being subject to double taxation, or S-corps taxed as pass-through entities.

2. Write a business plan

After identifying the type of logistic business you want to run, it is crucial to map out the costs involved. This includes an estimate of expenses related to forming a legal entity, acquiring vehicles, leasing or purchasing warehouse space and parking space, hiring staff, obtaining licenses and permits, and marketing your services.

A detailed budget will help you understand how much capital you need to secure to launch and sustain your business until it becomes profitable.

This document will guide your actions and also serve as a way to show financial institutions or investors you are a good candidate, capable of conducting a profitable business.

Your business plan should include:

- Executive summary: Include a brief description of your trucking business and also of yourself. Explain the reason behind creating this company and what sets you apart from the competition. Describe your mission, finances, and any growth plans.

- Company description: Detail what your business will do, who your ideal client is, what is your experience in the trucking industry, and what sets you apart from the competition. Include information about whether you will specialize in a particular region or a specific freight area, and if you have other partners or employees.

- Operational plan: Be specific about how you will handle dispatching and routing. Specify if there will be other drivers and if you will use load boards or freight factoring. Also, include information about the business software for accounting and mileage tracking you will use.

- Market analysis: Show your understanding of your target audience, who your competition is, and your pricing structure.

- Services: Inform how you will satisfy the needs of Illinois consumers and what problems you are solving. Include pricing and materials you haul.

- Organization and management: Be clear about how many office workers, dispatchers, and any additional drivers you will need to recruit and what is their hiring process.

- Sales and marketing strategies: Detail how you will market your logistics business and disclose your strategies, such as creating a website, attending trade shows, or managing social media accounts, along with its marketing budget.

- Financial projections: Defined the expected performance of your business for at least the next five years in terms of projected income, expenses, and profit.

If you need help writing your business plan, you can contact us as our law firm helps clients with their business plans. You can also facilitate the process with the SBA templates and other free resources.

3. Register your business

The first step to legally establish your business is to register it with state and local agencies. The procedures and required documents will vary according to your business entity and the type of transportation services you plan to offer.

a) Choose a business name

Choose a name that reflects the essence of your business and is memorable. Whenever you choose the legal name of your company, remember that:

- If it’s an LLC, you must add the words “Limited liability company” or its variations. If it’s a corporation, it should include “Company”, “Corporation”, “Limited” or any abbreviation of the mentioned identifiers.

- Your business name must be unique. Ensure your desired name’s availability in the Business Services name database, or contact the Illinois Secretary of State by phone or email to do a preliminary name check.

- Your business should be relevant to your services. Including words related to transportation, such as “freight”, can help your target customers identify what you do and also have marketing advantages.

b) Choose a registered agent

When filing for the Articles of Incorporation or Articles of Organization of your trucking company, you will be required to add a registered agent.

A registered agent is a person or entity designated to receive legal and official documents on behalf of your business. Your registered agent will be responsible for receiving service of process, which includes legal notices, tax documents, compliance documents, and other important correspondence from the state government.

You can choose yourself, a person you trust, or a third-party service as your registered agent. It’s of the utmost importance to appoint someone you trust that will be available to receive any legal notices and inform you of them.

c) File for Articles of Organization or Articles of Incorporation

Contrary to other business structures, such as sole proprietorships and partnerships, corporations and LLCs require the intervention of the state for their creation.

To formally register your LLC, you must file for the Articles of Organization. On the other hand, if your business is a corporation you must file for the Articles of Incorporation.

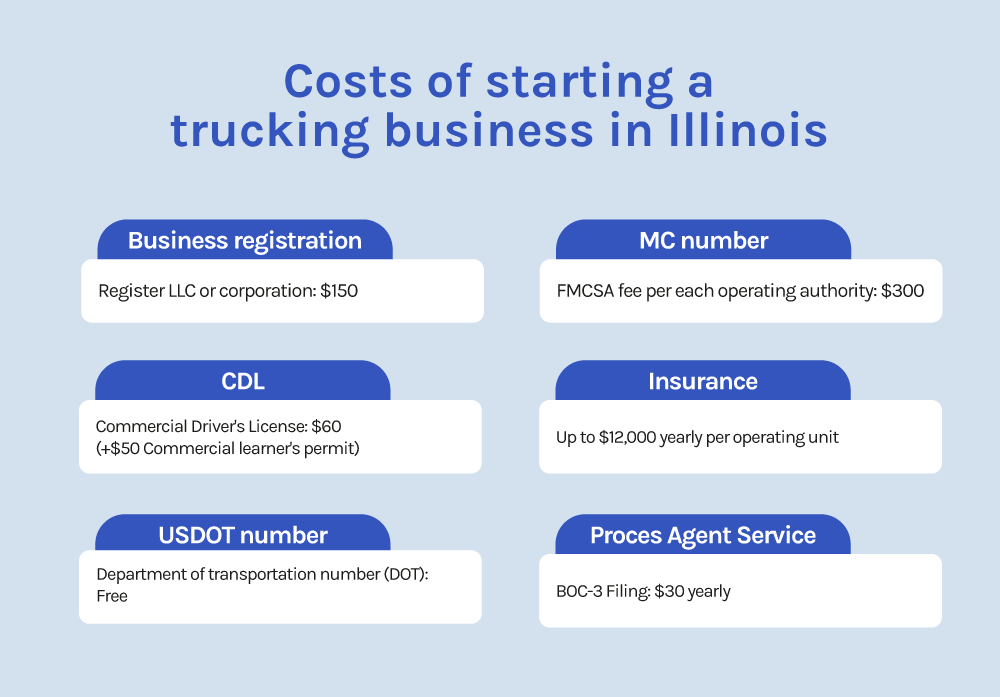

For a $150 fee and a simple online process, you can carry out this process. You will be required information such as:

- Business name

- Business purpose

- Registered agent and registered office

- Members (in the case of LLCs) or officers (in the case of corporations)

- Organizer

d) Obtain an Employee Identification Number

Issued by the Internal Revenue Service, an EIN is a 9-digit number that your business will need for tax purposes and other reasons, including:

- Recruiting: Hiring employees, reporting corresponding taxes, and filing payroll tax returns

- Opening a bank account: Having separate business and personal bank accounts is highly recommended, as it will help you simplify record-keeping

- Obtaining business licenses and permits: Some licenses and permits require an EIN as part of the application process.

Applying for the EIN is a free service, and you can obtain your employer identification number online, by fax, mail, or telephone.

Get the necessary licenses and permits

The trucking industry is heavily regulated by all levels of government as it involves moving valuable cargo across state, or even country lines.

Regulated by The Federal Motor Carrier Safety Administration (FMCSA) and the U.S. Department of Transportation (DOT), licensing and compliance requirements vary greatly depending on whether your trucks travel within a state or interstate, the cargo you transport, and the Gross Vehicle Weight Rating (GVWR) of your fleet.

In general, the following registration and permit requirements apply to most logistic businesses:

- Commercial Driver’s License (CDL): A driver must obtain the state’s commercial driver’s license to operate the transporting vehicle. If you received your CDL in another state and are looking to transfer it to Illinois, you must follow the same process as a new applicant. There are three different types of CDLs that the driver requires depending on the type of vehicle he/she operates.

Before you are eligible for a CDL, you must obtain a Commercial Learner’s Permit. This requires you to pass the knowledge, skills, and medical exams, submit your 10-year driving record, and pay the CLP $50 examination fee. Two weeks after obtaining your CLP, you’ll be able to take your CDL examination for a $60 license processing fee.

- USDOT Number: To operate a logistic company or haul cargo, either intrastate or interstate, your business must be registered with the FMCSA and obtain a DOT Number. The FMCSA requires that all trucks that weigh over 10,000 pounds cross state lines to get a DOT number. The state of Illinois requires that even intrastate trucks must have DOT numbers if they weigh over 26,000 pounds.

The USDOT number registers the business with the DOT and allows for easy tracking of your safety score. You will receive your USDOT number and will be issued a provisional permit until the completion of an 18-month New Entrant Safety Assurance Program. After completing the program, your number and permit become permanent. The originals will be kept in your business office, but placing a copy in your vehicle and having the number stenciled on the outside of the truck are also required. Oftentimes, the USDOT number and MC number will be placed under the company logo.

- Authority to Operate (MC Number) – An MC Authority is a unique number assigned by FMCSA to identify a motor carrier and other entities involved in the transportation of goods in interstate commerce. In other words, you will need an MC number to get paid for transporting goods across state lines.

The fee to obtain the MC Number is $300 for a permanent authority and it might take about 20-25 business days to review.

- Enroll in the FMSCA Clearinghouse: Prior to hiring a driver, you must also check their Clearinghouse to be informed of past positive drug or alcohol tests. Operated by the FMCSA, a clearinghouse stores and maintains records of (CMV) drivers’ drug and alcohol testing violations to identify those who have violated these regulations.

- Illinois Requirement – If you plan to haul freight, you may be required to abide by the Illinois Department of Transportation’s requirement and report the size and weight of what your business intends to carry. Additionally, depending on the type of freight your business transports, you may need other business permits issued by the state of Illinois including liquid fuel carrier licenses, heavy load permits, hazardous materials permits, intrastate operating authority, etc.

- BOC-3 Form: If you require an interstate operating authority, you should register a BOC-3 form with the FMCSA. This form ensures that there is a designated representative available to accept legal documents on behalf of the carrier.

- Other permits: Your vehicle may require special permits for oversized, overweight, and over-dimensional situations, or if you will transport liquor.

Get insurance

Insurance is another critical component of any logistics business, and it is also required by the FMCSA to approve your MC license. As soon as you apply for the MC number, contact an insurance agent that specializes in trucking companies. To get the best insurance quote ensure to hire drivers with CDL experience and clean driving records. FMSCA requires an insurance certificate for a minimum of $750k.

Trucking businesses are exposed to many risks: road accidents, personal bodily injuries to drivers and third parties, stolen or damaged cargo, etc. Therefore, having adequate insurance coverage not only sasafeguardsour business and property but also instills confidence in your customers and partners.

Finance your trucking startup

Even when you start with only a commercial truck, you are surely going to require funding to launch your business. Consider which of the following alternatives fits best your current status:

- SBA loans: Small Business Administration loans are provided by participating lenders but guaranteed by the U.S. Small Business Administration. These loans typically have lower interest rates and longer repayment terms but are hard to get for their eligibility criteria.

- Equipment financing: These kinds of loans help you secure funding for buying, leasing, or repairing trucking equipment. These loans usually require collateral, which will be your truck, and for you to repay the borrowed money, plus interest, over a fixed amount of time.

- Bank loans: They can be used for a variety of purposes, such as expanding your logistics business or investing in new equipment. However, banks usually set rigorous conditions, such as asking for you to have an excellent credit score and a profitable business plan.

Purchase or lease vehicles and equipment

Depending on the nature of your logistics business, you can either lease or purchase your required vehicles and equipment.

These are the things you want to consider first:

- Business Needs: Assess your specific requirements, such as the type of cargo you will be transporting, average distance, and load capacity needed.

- Truck Type: Choose the appropriate truck type based on the products you will transport, such as a flatbed, refrigerated, or box truck.

- Size and Capacity: Consider the size and capacity of the truck, ensuring it can handle your anticipated cargo volume efficiently.

- Maintenance and Reliability: Research the truck’s maintenance requirements, reliability ratings, and availability of spare parts to minimize downtime and repair costs.

If your financial capabilities only allow you to lease a vehicle. remember to consult a contract review lawyer to ensure the terms of the lease agreement are favorable to you.

- Track your finances

Rely on the professional services of a bookkeeper to ensure you keep accurate and up-to-date records of your business transactions. Also, seek the assistance of an accountant to ensure you are taking advantage of all the available deductions and are complying with the industry’s tax regulations.

Consider working with accounting software to help you automate financing tasks, such as invoicing and expense tracking.

- Market your business

Develop a marketing strategy to ensure your services get to those who need them.

- Online presence: Start by building a website that highlights your services, expertise, pricing, and contact information. Also, take advantage of social media platforms to engage with potential clients and share relevant content.

- Networking and partnerships: Start by joining the Illinois Trucking Association to connect with people in your industry. Attend trade shows, conferences, and industry events to connect with potential clients or partners.

- Referrals: Encourage satisfied customers to provide testimonials that highlight the benefits of working with your logistics business. Offer referral incentives to existing clients who refer new business to you.

- Hire and train employees

When hiring employees for your trucking business, there are several factors you should consider. Here are some key things to keep in mind:

- Experience and qualifications: Look for candidates with relevant experience and qualifications, such as a commercial driver’s license (CDL) and a clean driving record. Consider the type of freight you transport and whether specialized skills or certifications are required.

- Physical health: The demands of the job can be physically challenging, so consider candidates’ overall health and ability to handle the physical aspects of the job and pass the required medical exams.

- Availability and flexibility: Determine the scheduling needs of your business and look for candidates who can accommodate those needs. Consider whether you need drivers who are available for long-haul trips or those who can handle local or regional routes.

- Stay in compliance

Once you have your permits, ensure you are performing their required multi-year renewals. Failing to keep up with these legal requirements can result in loss of good standing or significant penalties.

Also, ensure you comply with the following regulations, if applicable:

- Taxes: Each year, you must comply with state and federal tax identification numbers. For trucks weighing 55,000 pounds or greater, you should comply with Heavy Use Tax Regulations, which means filing the IRS 2290 Form.

- Vehicle inspections: Your vehicles are subject to a thorough examination of components such as brakes, tires, lights, steering, exhaust system, and more. Ensure your vehicle is in order by a 2290 tax form. Also, ensure to comply with the FMCSA limits on size and weight.

- Drivers: Comply with the regulations of hours of service limits. According to them, truckers can operate a vehicle for up to 11 hours after a 10-hour break. Units must also have electronic logging devices (ELDs) to track their driving and rest time

Create a governing document for your company

One crucial step in setting up your trucking business is creating an operating agreement or shareholder’s agreement. Having a governing document will help you:

- Clearly define ownership and management: To avoid disputes and ensure smooth operations, It’s key to outline how decisions will be made, who has authority, and how profits and losses will be distributed.

- Protect business interests: An operating agreement or shareholder’s agreement can include non-compete and confidentiality clauses to protect the business’s trade secrets, client relationships, and proprietary information. These provisions help safeguard your competitive advantage and prevent key personnel from engaging in activities that may harm the business.

- Facilitate Financing and Partnerships: When seeking financing or entering into partnerships with other entities, having a well-drafted operating agreement or shareholder’s agreement enhances your credibility and professionalism. Potential lenders, investors, or partners will have confidence in your business because it demonstrates that you have a clear plan in place for governance and operations.

Starting a trucking business can be a rewarding venture, but it requires careful planning and adherence to the right steps. By following the correct procedures, you can set a solid foundation for your business and increase the likelihood of long-term success.

Remember to seek professional advice when needed and leverage available resources to make informed decisions. With proper planning and execution, your trucking business can thrive and achieve your desired goals.

Frequently Asked Questions

How long does it take to start a logistics business?

Depending on your preparation, financing, permits, licensing, and the complexity of your business, launching your trucking company may take from six to 18 months.

How much does it cost to start a trucking company?

The costs will vary according to different factors, such as the type of trucking services you provide, the coverage area, and the size of your business. Including equipment, licensing fees, and professional services you can approximately spend between 10,000 and 100,000.

What documents do I need to start a transporting business?

Generally, you will require the following documents:

- Business registration

- EIN

- Commercial Driver’s License

- US Dot Number

- MC number

- Insurance