During a business transaction, you need to define early in the process how to structure the deal. Preferably defined in the letter of intent, deciding whether to purchase the stock or the assets of the business will ensure both parties are aware of what will be included in the deal. What are the differences between each, and which is more convenient for you?

In general, an asset sale allows the transfer of specific assets and liabilities while the seller remains being owner of the legal entity. On the other side, a stock sale involves the transfer of equity, which directly makes the buyer the owner of the entire business and responsible for all its assets and liabilities.

Most small business transactions are structured as asset deals. Typically, buyers prefer an asset purchase because of its tax benefits and to avoid unwanted liabilities. Sellers, however, will prefer stock sales for similar reasons. An experienced M&A attorney will help you make a decision that suits your professional needs and gives you the best tax advantages. Continue reading and gain a full understanding of the implications of each transaction structure.

What is an Asset Sale?

An asset purchase occurs when the seller transfers individual assets and liabilities to the business buyer while retaining ownership of the legal entity.

Essentially, an asset transaction involves the combined sale of each individual asset along with the acceptance of agreed-upon liabilities. By buying all the company’s assets, you are buying the entire business and having absolute control of it, even when you do not own its shares.

Through an asset purchase agreement, the seller and buyer will negotiate and specify which assets and liabilities are to be included in the transaction, such as the following:

1. The entire business

2. Trademarks, copyrights, and other intellectual property

3. Real estate and equipment

4. Inventory

5. Contracts, licenses, and permits

6. Trade secrets and goodwill

7. Net working capital

By “cherry-picking” the desired assets, buyers can discard underlying liabilities such as contract disputes, mortgage payments, or product warranty issues.

Asset sales typically do not include buying the target’s cash, for the seller will generally retain the long-term debt obligations. However, they generally include the corporation’s net working capital, comprised of items such as accounts receivable, inventory, and accounts payable.

Asset deals allow buyers to have taxation benefits by “stepping up” the company’s depreciable basis in its assets. This adjustment can result in higher depreciation deductions or potential tax savings for the purchaser.

Asset sales: Advantages and disadvantages for buyers

Pros

- Taxation: Buyers can have more advantageous tax benefits by adjusting the value of the acquired assets and depreciating the costs.

- Liability assumption: By cherry-picking the assets and liabilities that are involved in the transaction, the buyer can evade inheriting undisclosed legal risks associated with the company and form a new entity

- Fewer resources needed: With the desired assets in mind, the due diligence process may be less exhaustive and will likely require less time and money to conduct.

- Disregard minority shareholders: With an asset sale, you will not need the approval of minority shareholders to complete the transaction, as they can be forced to accept the terms of the sale.

Cons

- Complexity: Due to the need to enumerate each asset that will be included in the transaction, the contract writing and negotiation process may be cumbersome.

- Contract assignment: An asset-structured deal may not allow the transfer of contracts, for lease agreements, vendor contracts, employment agreements, and other key documents may need to be renegotiated.

- Need for assets to be retitled: An asset sale may require additional paperwork that ensures assets are retitled and correctly assigned.

- Possibility of higher purchase price: The seller may insist on receiving a higher purchase price to compensate for the fact that the tax burden is carried by them.

Asset sales: Advantages and disadvantages for sellers

pros

- Retain appreciated assets: Seller can retain ownership of specific assets that they want to keep

- Negotiable pricing: Sellers have the freedom to negotiate the prices of individual assets, which allows them to potentially secure higher valuations for specific assets that hold strategic importance for the buyer.

- Retain employees: The seller can decide to keep key employees in case the business wants to continue functioning

Cons

- Tax disadvantages: The seller carries the tax burden of the transaction when paying capital gains rates and facing the possibility of being subject to double taxation

- Transfer complexity: Transferring assets may be more complicated than transferring stock

- Need to renegotiate: Agreements tied to certain assets may need third-party consent or to be renegotiated, which slows down the transaction process.

What is a stock sale?

In a stock sale or equity sale, the buyer will assume all or the majority of the shares of a company, which will automatically turn them into the owner of the business entity, along with its assets and liabilities.

A stock purchase agreement does not require an in-detail description of the assets that will be included in the deal because each of them lies within the corporation. The contract will simply outline the terms of the sale and provide for the transfer of ownership.

Essentially, a stock purchase is a more straightforward process as most contracts, such as leases and permits, will be automatically transferred to the new owner. However, this is a double-edged sword, because buyers will face more risks as they will be responsible for contingent liabilities, which are unknown or undisclosed risks, such as lawsuits, employee issues, and environmental concerns. However, an experienced M&A attorney can minimize these threats with proper negotiation of reps and warranties.

Limited Liability Companies do not have shares, so to structure an LLC, partnership, or sole proprietorship as a stock sale, the ownership of the business is transferred in the form of membership interests. However, for the sake of simplicity, the transaction is still referred to as a “stock sale”.

Differences between Asset and Stock Sales

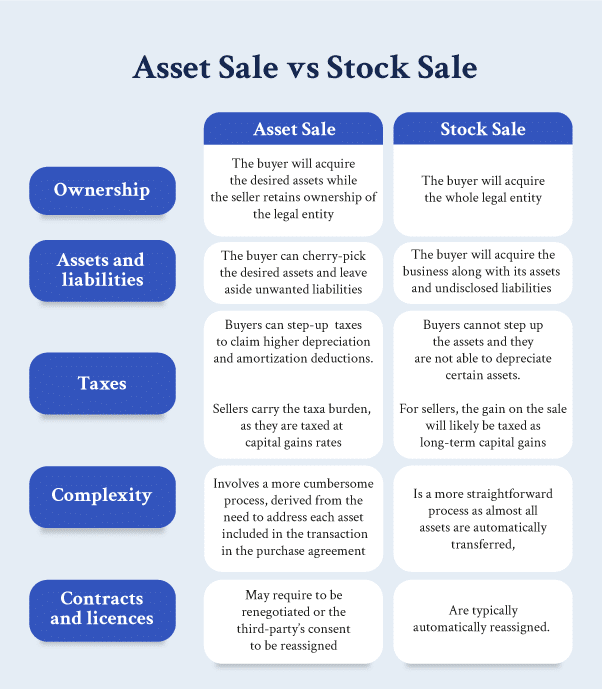

As mentioned before, the primary difference between a stock and asset purchase is that when buying the company’s stocks, you will inherit the whole business, including its assets and liabilities, and face tax disadvantages. On the other side, an asset deal will allow you to select only the wanted assets and liabilities without owning the legal entity and having tax advantages.

Below, we will discuss the differences between these two purchase structures in detail.

Tax Consequences

Asset sale: In an asset sale, the buy-side will benefit from the step-up on a tax basis and be able to have future tax savings. By allocating a higher value for assets that depreciate quickly, such as equipment, and a lower value for those that amortize slowly, such as goodwill, the buyer can generate tax deductions by depreciating those assets.

However, sellers will face significantly higher taxes. The tax implications will depend on the sold business’s tax status, the assets involved, and how the purchase price is allocated among assets. While intangible assets, such as goodwill, are taxed at capital gains rates, tangible assets attract ordinary income tax rates. Furthermore, if the sold company is structured as a C-corporation, the seller faces double taxation. First, they will pay corporate taxes when selling the assets to the buyer, and once again at the personal level during the distribution to the shareholders.

Stock sale: With a stock purchase agreement, it is the seller who typically obtains a more favorable tax treatment. The corporation does not pay tax on the sale. Rather, the gain on the sale will likely be taxed as long-term capital gains. If the sold company has a C-corp tax status, the corporate-level taxes are bypassed.

Buyers, nevertheless, will lose the ability to step up the assets and are not able to re-depreciate certain assets. The assets will transfer at the same value they were carried under the former ownership, for the allowable tax deduction will be lower. Furthermore, assets that the business previously depreciated cannot be depreciated once again.

Complexity

Asset sale: An asset sale will typically require a more lengthy contract because it needs to describe in detail each of the assets that will be included in the sale. The buyer’s attorney may also take time to negotiate the representations and warranties of these assets to set separate terms for each item and ensure the protection of the buy side. Additionally, transferring assets may be more complicated because passing the ownership rights of some assets, such as leases, copyrights, or permits, can require retitling, renegotiation of contracts, and extra paperwork.

Stock sale: Generally, transferring stock is a more straightforward process than selling assets, and the contract does not need to specify each of the assets the new owner will acquire. Typically, you can transfer the ownership of contracts, permits, and licenses without third parties’ consent.

Liabilities

Asset sale: By selecting only the desired assets, buyers can avoid potential liabilities, such as long-term debt obligations, lawsuits, decaying equipment, or tax penalties. The seller will be forced to retain these business liabilities and also has to liquidate the assets that weren’t purchased, as well as dissolve the leftover entity after the deal is complete.

Stock purchase: When structuring the deal as a stock purchase, buyers are obliged to acquire the entire business entity, along with its undisclosed liabilities. This means that, as the new owners, they will face more risk with this type of transaction for being responsible for any remaining or future legal and operational issues.

Contracts and legal documents

- Asset sale: Acquiring legal documents, such as contracts, leases, permits, and licenses presents more difficulties in an asset sale. Typically, contracts need to be renegotiated or the third party’s approval, the new owners need to apply for licenses and permits, and some assets need to be retitled.

- Stock sale: Contracts are easily reassigned and companies that rely on licensed software of other intellectual property can continue operating without interruption.

Employees

- Asset sale: Since an employee is hired through an employment contract, you may require the employees’ consent and to renegotiate contracts to retain them. However, you can dismiss those employees who do not help you accomplish your business objectives.

- Stock sale: You may acquire the business along with its full workforce and ensure the operations keep running normally for as long as the transition.

Should I structure my acquisition as an asset sale or a stock sale?

There is no rule of thumb when it comes to deciding whether an asset or stock sale is better for your business acquisition. You should always consult a business attorney and a CPA to ensure you are making an informed decision. However, below are some general recommendations about how to structure your sale, according to your needs, position in the deal, and size of the transaction.

Generally, you want to choose an asset sale if:

- It is a small business transaction, with a value under $50 million

- You are the buy side of the transaction

- There are specific assets you want to acquire

On the other side, you will typically choose a stock sale if:

- The transaction involves a big corporation, with a value higher than $50 million

- When after conducting due diligence the business appears solid and is expected to continue with a good performance for the foreseeable future

- When you need specific assignable contracts, licenses, or permits for the operations of the business. For example, if you want to purchase a bar in Chicago, where obtaining a liquor license involves a difficult process, a stock purchase agreement could allow you to directly own the business with this benefit.

Motiva Business Law’s Acquisition Lawyers guide you throughout the transaction

Business acquisitions are complex transactions that require professional attention from start to finish. From writing the LOI, structuring the deal, conducting due diligence, and drafting agreements, the process demands expertise in mergers and acquisitions (M&A) law.

At Motiva Business Law, our team of experienced M&A attorneys understands the intricacies of business acquisitions. We provide comprehensive legal support to ensure a smooth and successful transaction for both the buyer and the seller.

We recognize that each acquisition is unique, and we tailor our approach to meet the specific needs of our clients. Whether it’s a small-scale acquisition or a large corporate merger, our attorneys are committed to guiding our clients through every stage of the process. By leveraging our expertise, we help mitigate risks, address legal complexities, and facilitate a seamless acquisition for all parties involved.

With Motiva Business Law by your side, you can trust that your acquisition will be handled with precision and care. We ease the burden of the transaction process and provide our clients with the confidence they need to achieve their strategic objectives.

Schedule a consultation at (630) 517-5529.