Put simply, franchising is a business model where you take what has worked for you, your business name, brand, know-how, and system, and teach someone to replicate it. Franchising is a powerful business strategy that has boosted the profit of countless entrepreneurs. However, there are some legal requirements franchisors need to address before starting their franchise business.

Considerations for starting a franchise

Before starting any process, you need to ensure your business is apt for franchising. The following are some of the considerations you should analyze:

- Capital: It is of the utmost importance that you verify whether you are financially capable of taking the franchising process. Ensure you have a considerable net worth to sustain the business. Consider that you will need to invest in hiring professionals, such as franchise attorneys, accountants, and franchise consultants to guide you through the process. You will also need to develop operation manuals and training programs for your franchisees. Explore funding alternatives to finance the formation of your franchise.

- Time: Franchising will also require you to spend months developing your business model and setting up your documents to comply with regulations.

- Ability to be replicated: You need to ensure your daily operations and systems are clearly defined and can be easily understood and replicated by others.

- Favorable financial performance: No one wants to invest in a business that is not profitable. Ensure the sales of your business are stable and that you can prove it with accurate financial records.

- Scalability: Verify if your business is capable of expanding and assess its capacity for growth. Is there enough demand for your product? Are you able to get supplies or equipment in other locations?

- Appealing concept: Ensure your business has a unique selling proposition that makes it attractive to investors. Consider the reputation of your brand and the demands of your business operations.

Starting a franchise: Compliance and required legal documents

Franchisors are required to comply with both state and federal franchise laws. Most of the federal obligations are contained in the federal Franchise Rule at 16 C.F.R. parts 436 & 437, promulgated by the Federal Trade Commission (FTC).

It is common for business owners to accidentally start a franchise business, which exposes them to penalties for not complying with franchise laws. Whenever you are planning to expand your business, always consult with a business attorney who ensures your business follows the concerning regulations.

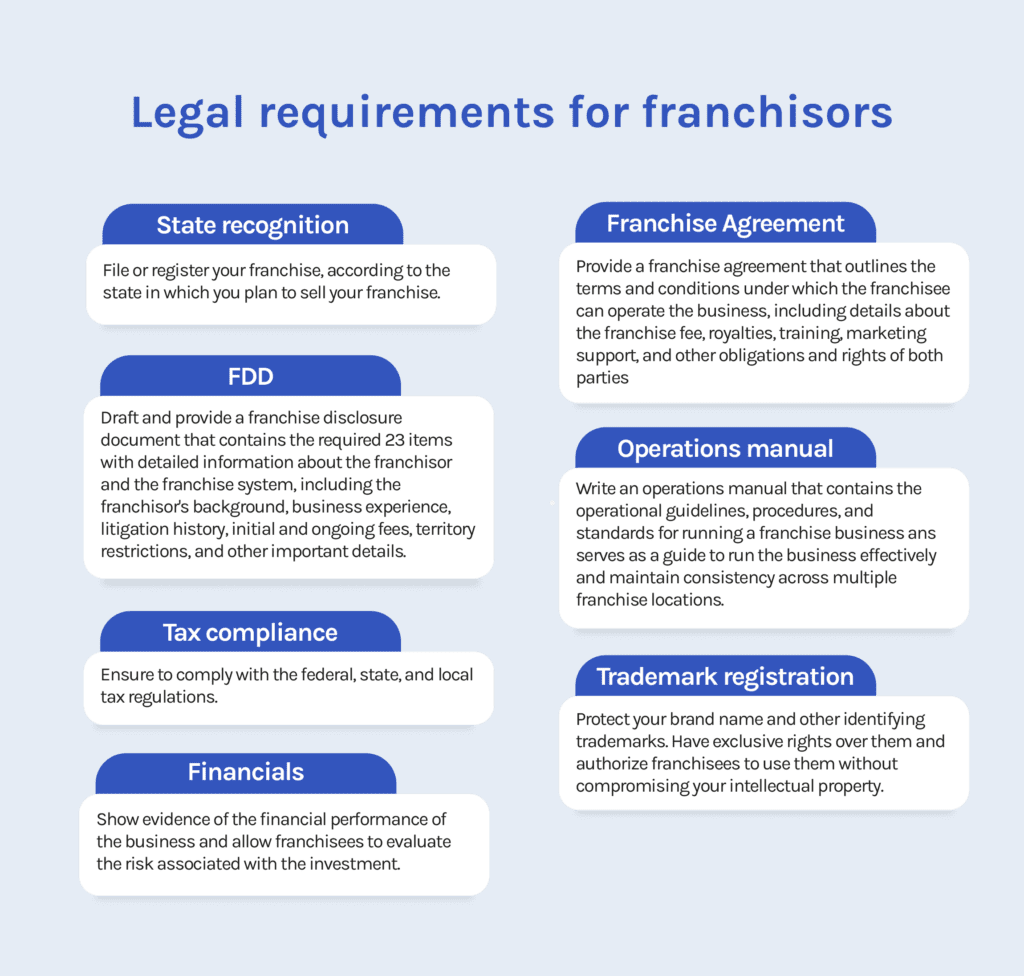

The following are the legal requirements you should consider as a franchisor.

1. Comply with Federal and State Requirements

Federal

Franchises in all states are required to provide potential investors with a franchise disclosure document not later than 14 days before the closing. This document should contain 23 established items with specific information about the company for prospective franchisees to support their decisions before entering the agreement.

State

A franchisor is subject to specific requirements depending on the state where the franchise will be sold.

Some states require the FDD to be registered, others where the franchise should be filed before being sold, and others don’t require registration.

Registration states need to pay a fee to register the FDD and other franchise information. They are also required to renew their registrations annually. Some of these states include Illinois, California, New York, and Minnesota.

On the other side, there are “business opportunity” states, which require franchises to be filed. Some of them must have a trademark registered with the federal government. Filing states can pay either a one-time or annual fee. Examples of these are Florida, Georgia, and Texas.

Finally, some states do not need any filing or registration, such as Arizona, Mississippi, or Ohio.

As mentioned, franchise laws vary from state to state and their formation requirements, for franchisors must consult an attorney to ensure they comply with all the applicable laws.

2. Trademark Registration

The first step is to obtain a federal trademark registration for your brand with the United States Patent and Trademark Office (USPTO). This is key so you protect the business’s intellectual property and ensure you have control of your business and trade name. Take into account that the trademark application process takes up to 12 to 18 months.

Consider the following questions:

- Is your business trade name registered or capable of being registered in the future?

- Do you control the website domain of your brand name?

- Are there competitors who use an almost identical brand name?

- What will be the guidelines under which franchisees will able to use your IP? What are the restrictions?

- How will you monitor the use of your IP to ensure they comply with the standards?

3. Provide a Franchise Disclosure Document

Franchisors should provide an FDD, which is a legal document that must be given to individuals interested in buying a franchise as part of the pre-sale due diligence process. The franchise disclosure document contains essential information that enables potential franchisees to make informed decisions about their investment, such as details about the franchisor, financials, legal issues, and required capital.

A franchise attorney will carefully draft a franchise disclosure document that contains the legally required information and accurately reflects the condition of the company, the terms of the agreement, and the implications of the deal. Also, an experienced lawyer will ensure to draft the FDD in a way that illustrates the profitability of the deal and the potential of the business.

The FDD must be provided by the franchisor at least 14 days before signing a franchise agreement or accepting any payment connected with the franchise sale.

According to the federal Franchise Rule, each FDD is required to contain the following 23 sections in the specified order:

- Item 1: Information about the franchisor and any parents, predecessors, and affiliates.

- Item 2: Franchisor and key executives’ business experience

- Item 3: Franchisor’s past and current litigation

- Item 4: Bankruptcy history of the franchisor and its key executives

- Item 5: Initial fees and required pre-opening investment

- Item 6: Required ongoing royalties and additional fees

- Item 7: Estimated initial investment and required capital to sustain the first three months of operation

- Item 8: Restrictions on the source of products and services

- Item 9: Franchisee’s role and obligations

- Item 10: Whether the franchisor offers the possibility of financing

- Item 11: Franchisor’s support and ongoing assistance

- Item 12: Territorial terms and exclusivity obligations

- Item 13: Use of trademarks

- Item 14: Use of intellectual property

- Item 15: Day-to-day operations and management

- Item 16: Restrictions on the products and services the franchisee can offer

- Item 17: Renewal, termination, exit, franchise sale, and other contractual terms

- Item 18: Disclosure of public figures that have supported the brand

- Item 19: Financial performance of the business

- Item 20: List of existing and closed outlets and contact information of franchisees who have entered the franchise system

- Item 21: Financial statements

- Item 22: Contracts that are included in the agreement, such as licensing agreements, distribution agreements, non-competes, etc.

- Item 23: Receipt

An FDD contains crucial information for the franchisee. The franchisor-franchisee relationship is an ongoing one, building trust and aligned reasonable expectations are key for long-term success for both parties.

Exceptions for Disclosure

All prospective franchisees should receive the FDD unless one of the exemptions below applies. It’s key to verify whether the state laws recognize these exemptions too and the inflation monetary adjustments.

- Minimum payment: When franchisees are not required to pay the franchisor more than $615 after six months of commencing operations

- Fractional franchise: Franchise transactions in which the prospective franchisee has at least two years of experience in the same type of business as the franchisor and will generate a revenue lower or equal to 20% of the prospective franchisee’s year of gross sales.

- Large franchise investment: Franchises that require an initial investment of $1,233,000 or greater.

- Large franchisee exemption: The franchisee possesses a net worth of at least $6,165,500 and has at least five years of business experience.

- Insider transaction: This applies when the franchise is sold to officers, directors, partners, or other associates.

- General partnership: Bona fide franchise relations between partners

- Single trademark license: Traditional trademark licenses where a single licensee is granted the right to use a trademark

- Oral franchise agreement: Those where there is no written documentation of the franchise agreement

- Leased department business: Applies in retail settings where an independent retailer sells its own goods and services.

- Petroleum Practice: Gasoline stations and other businesses that are governed by the Petroleum Marketing Practices Act.

4. Provide a Franchise Agreement

After the prospective franchisee has reviewed the FDD and agreed to its terms, both parties will sign the franchise agreement. This contract will provide a framework for the operation of the franchise and outline the terms of the agreement, including details about fees,

While the Franchise Disclosure Document details the implications of the transaction, the franchise agreement is the binding contract that will define the roles and obligations of both parties.

The agreement should address some of the following issues:

- Territory: Geographic area in which the franchisee can operate and develop the business.

- Duration: Defines for how long the franchisee will benefit from the franchise agreement.

- Operations: Sets a timeline for opening the location and defines how are franchisees expected to run their units, and any sales requirements.

- Support: How the franchisor is going to support the franchisee and describe the training programs.

- Payments: The required fees and royalty payments.

- Trademarks: Allowed use of intellectual property

- Renewal and termination: Describes how the franchisee will be able to renew the agreement and also withdraw from the deal.

- Advertising and marketing: Defines the outlines for promotional activities

- Exit: Determines whether the franchisee can sell their franchise and under what terms

- Dispute resolution: Procedures to solve and prevent litigation conflicts.

5. Tax Compliance

Consult professionals to select the business entity that best fits your professional goals. An accountant and an attorney will help you comply with the local, state, and federal taxes and structure your business for the best tax advantages and so it can be prepared for growth.

6. Operations Manual

Your operations manual will outline the policies and procedures your franchisees need to know to maintain uniform quality and services across the locations. A well-drafted operations manual will be key to the franchisee’s success since it will serve as a guide on how to run the business, manage operations, and deliver the desired brand experience. This document will help train new franchisees to preserve the brand’s identity and reputation.

Although the operations manual isn’t necessarily a legal document, the FDD must provide a preliminary showing of it so the prospective franchisee is aware of its day-to-day duties. Once the franchisee signs the franchise agreement, the franchisor will grant full access to the operations manual.

7. Financial statements

Also as part of the FDD item 19, a franchisor must provide specific financial information that showcases the company’s financial performance. The required information should express a level of actual or potential sales, income, gross profits, or net profits. This way, the possible franchisee can understand the risks and opportunities of the investment.

Illinois Franchise Law Compliance

If the franchisee resides in Illinois or the business will be located in this state, the Illinois Franchise Registration Disclosure Act will apply.

According to Illinois Franchise Law, a franchise is an oral or written agreement in which the following conditions are satisfied:

- Someone is granted the right to do business using a prescribed marketing plan or system

- The operation of the business is associated with a third party’s trademark

- The person has the right to do business in exchange for a fee of at least $500.

Exemptions include fractional franchises, on-premises concessions, certification and testing services, and transactions involving the Petroleum Marketing Practices Act.

Illinois is regarded as a registration state, which means that to sell franchises in this state, the franchisor will need to register the FDD with the Franchise Bureau of the Illinois Attorney General.

To register the franchise, franchisors should pay a $500 fee and submit the FDD with specific documents, including the applicant’s cover letter, sales agent disclosure form, uniform consent to service of process, and auditor’s consent letter. The renewal fee in Illinois is $100, a process that must be done annually.

Florida Franchise Law Compliance

Regarded as a “business opportunity state” Florida requires franchisors to file an annual franchise exemption notice to the Florida Department of Agriculture and Consumer Services to comply with the Federal Franchise Rule.

Filing this application costs a $100 fee and asks for franchisors to provide your company’s legal and brand name, address and contact information, tax identification number, and an acknowledgment signed by an officer that your franchise complies with the FTC guidelines and rules.

What happens if you do not comply with the franchise regulations?

Violation of the franchise law can result in serious consequences for a franchisor. Under federal law, violations can result in penalties of up to $10,000 per occurrence. In multiple states, violations give franchisees the right to rescind their purchase and recover damages.

Motiva Business Law for Franchise Formation

We know how exciting it is to take your business to the next level. At Motiva Business Law, we want to make sure you expand your business the right way. Our team of experienced legal professionals specializes in providing comprehensive legal support to franchisors, guiding them through every step of the franchising process.

Our franchise attorneys understand the challenges and complexities of franchising, and we are dedicated to helping you navigate through them with confidence. Our tailored legal solutions are designed to protect your brand, streamline the franchising process, and ensure compliance with all relevant regulations and laws.

By choosing Motiva Business Law as your legal partner, you gain access to expert advice on franchise agreements, franchise disclosure documents, regulatory compliance, and more. We work closely with you to develop a customized legal strategy that aligns with your business objectives and sets the stage for successful franchising.

Contact us today and take the first step towards franchising success. Schedule your consultation at (630) 517-5529.