According to the Corporate Transparency Act, which will be effective starting January 1st, 2024, certain companies should file specific information about their beneficial owners. Who needs to share this information? The “beneficial owners” are those who directly or indirectly have substantial control over the reporting company, or at least 25% of the ownership or voting rights of a reporting company.

In this article, we’ll explain in depth what exactly is a beneficial owner and everything you need to know to comply with the Corporate Transparency Act.

What is the Corporate Transparency Act?

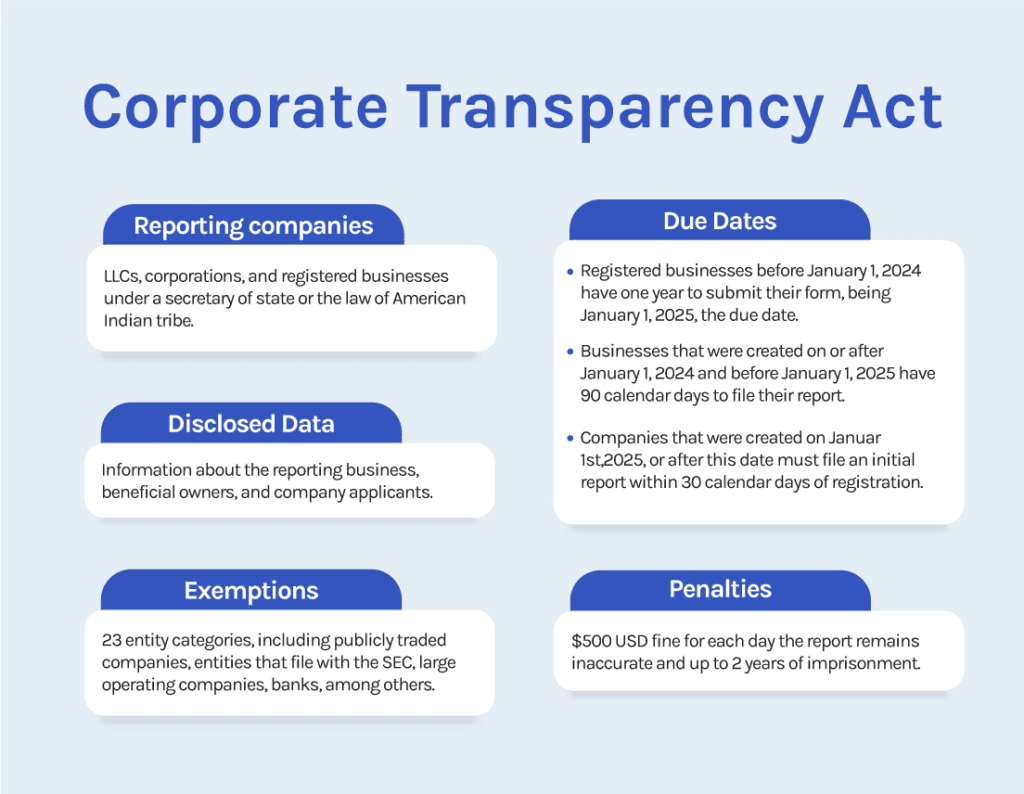

The Corporate Transparency Act (CTA), requires the vast majority of small corporations and LLCs registered in the United States to submit a Beneficial Ownership Information (BOI) report that includes data about the company applicants and its beneficial owners.

As part of the Anti-Money Laundering Act of 2020, the CTA’s objective is to reduce financial crimes, such as money laundering, tax fraud, terrorist financing, and other illicit activities by making it more difficult for individuals to anonymously control U.S companies and engage in illicit activities.

Reporting companies are required to submit a report that includes personal details and documents about their beneficial owners. Companies that were registered before January 1st, 2024 will have until January 1st, 2025 to file their initial report with FinCEN. However, companies that were formed on January 1st, 2024 will have a 30-day deadline once they receive a notice about its creation or registration.

The CTA provides 23 exemptions for highly regulated types of entities, such as public companies, banks, public accounting firms, and others.

The information that reporting companies disclose will not be made publicly available and is to be stored and maintained solely with the U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) or subject to disclosure only in limited circumstances.

Whose information should be included in the BOI report?

Required businesses should share information about the following aspects:

- The reporting company

- Company’s beneficial owners

- Company applicants

Below, we will discuss in depth what information is to be disclosed.

Which are the reporting companies?

The CTA requires registered entities with a US Secretary of State or similar office under the law of state or Indian tribe to comply. The following are the included reporting companies:

- Domestic reporting companies: Corporations, limited liability companies, limited partnerships, or entities that were formed by the filing of a document with a secretary of state or any similar office under the laws of a State or Indian tribe.

- Foreign domestic companies: Corporations, LLCs, or any entities that were formed under the laws of a foreign country and registered to do business in the United States or Tribal jurisdiction.

Which are the 23 exemptions?

There are 23 categories of entities that are exempt from filing a BOI report. Exempt entities include publicly traded companies and other entities that file reports with the SEC. The following are the 23 exemptions:

- Securities reporting issuers

- Governmental authorities

- Banks

- Credit unions

- Depository institution holding company

- Money services business

- Broker or dealer in securities

- Securities exchange or clearing agency

- Exchange Act registered entities

- Investment company or investment adviser

- Venture capital fundraiser

- Insurance companies

- State-licensed insurance producer

- Entities registered with the Commodity Futures Trading Commission

- Accounting firms

- Financial market utilities

- Pooled investment vehicles

- Tax-exempt entities

- Entities that assist tax-exempt entities

- Public Utilities

- Large operating companies

- Subsidiaries of certain exempt entities

- Inactive entities

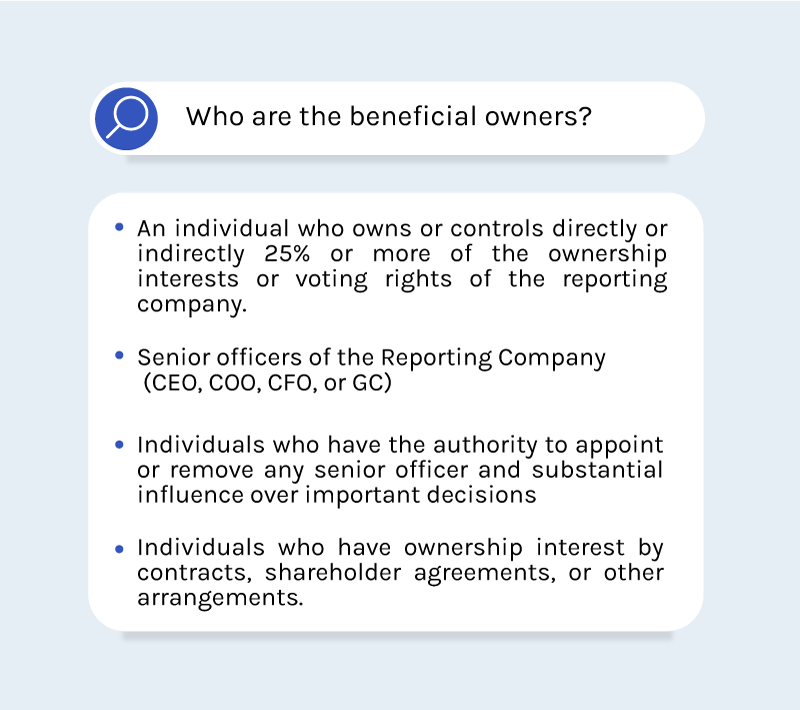

Who are the beneficial owners of a company?

A “beneficial owner” is an individual who directly or indirectly controls a legal entity, which includes those who:

- Control 25% or more of the company’s ownership interests or voting rights (this includes shares, capital, stock or profit interests, convertible instruments, options, contracts, or other mechanisms used to establish ownership).

- Someone who exerts “substantial control” over the reporting company.

An individual exercises “substantial control” over the reporting company if the person meets at least one of the following criteria:

- Serves as a reporting company’s senior officer, such as the president, CEO, CFO, COO, general counsel, or any other office that performs a similar function regardless of title.

- Has authority to appoint or remove officers

- The individual is an important decision-maker and has the authority to influence key actions, such as the sale or transfer of principal assets, major expenditures or investments, dissolution, merger, approval of the operating budget, entering into or terminating significant contracts, or amendments of any substantial governance documents.

Who is NOT a beneficial owner?

According to the FinCEN, those who are exempt from the definition of a “beneficial owner” are the following:

- Minor children. However, the company should report the required information of the parent or legal guardian of the minor child.

- An individual acting as a nominee, intermediary, custodian, or agent on behalf of another individual;

- An individual acting solely as an employee and who does not serve as a chief officer

- An individual whose only interest in a Reporting Company is a future interest through a right of inheritance; and

- A creditor of a Reporting Company

Who are the company applicants?

Company applicants are defined as those who:

- Directly filed the document to create or register the business entity in the United States

- Signed the formation document on behalf of the reporting company

What information needs to be disclosed?

Initial reports to FinCEN must include the following information:

Reporting Company

- Company’s legal name

- Current address

- State of Formation

- IRS Taxpayer Identification Number

Beneficial Owner

- Legal name

- Date of birth

- Current address

- Photograph of an identification documents, such as a passport or driver’s license

When are the FinCEN reporting due dates?

The reporting deadlines vary according to when the company is established:

- Domestic and foreign reporting companies that were created before January 1, 2024, must file an initial report by January 1, 2025.

- Domestic and foreign reporting companies that register their companies on January 1, 2024, and before January 1, 2025, must file an initial report within 90 calendar days of receiving a registration notice.

- Domestic and foreign companies created on or after January 1, 2025, must file an initial report within 30 calendar days of creation.

Once an initial report is filed, reporting companies do not have to fill out annual reports.

However, the CTA requires files to be updated or corrected if necessary. In the event of adding inaccurate information, a company has 30 calendar days from the moment the mistake was identified to correct the report.

How do you file BOI reports?

Starting on January 1, 2024, FinCEN will allow reporting companies to electronically file their reports through a system that will be available on the institution’s website.

The portal is under development by FinCEN, and it is known as the Beneficial Ownership Secure System (BOSS). The system is not yet available, but you will be able to find it on the stipulated date at FinCEN’s Website.

There will be no fee to file the reports.

Who will have access to the information contained in the BOI report?

The information provided to the FinCEN is not to be shared publicly. However, if necessary, the institution is authorized to disclose the data to a limited group of requestors, including:

- Federal agencies engaged in national security, intelligence, and law enforcement

- State law enforcement agencies with a court order

- The Treasury Department

- Financial institutions with the reporting company’s consent

- Government regulators of financial institutions

- Certain foreign authorities request information through a U.S. agency.

What are the penalties for not filing the report?

Non-compliance or willfully providing false information can result in high penalties and possible imprisonment. The escalating fines range from $500 to $10,000 per violation and jail time of up to two years in federal prison. Individual employees who prepare and submit reporting information may be held personally liable for false reports.

How to prepare for BOI reporting?

To properly fill your report and avoid penalties, take the following steps:

- Review contracts and governing documents

- Identify if your business is required to file a report.

- Identify whether you or any of your affiliate entities qualify for an exemption

- Identify the reporting companies’ beneficial owners

- Update and correct beneficial ownership information regularly

The best way to be prepared for the Corporate Transparency Act requirements is to be assisted by a professional to gather the required information and fill it out correctly. As a business owner, you may feel sure about what information you should provide to the FinCEN.

A business attorney will determine whose information needs to be filed and do it on time so you can avoid any penalizations or legal actions.

Motiva Business Law helps you prepare

for CTA compliance

It’s very common for business owners to not be sure if their companies should file the report or who their beneficial owners are. We take the burden of filing your reports properly and on time.

Our corporate attorneys at Motiva Business Law will help you comply with the FinCEN requirements. We will gather all the needed information and take any action on your behañlf concerning the CTA or other regulatory

Schedule a consultation at (630) 517-5529.