What Are Mergers and Acquisitions (M&A)?

Mergers and acquisitions, also known as M&A, refers to the process of consolidation between two companies and/or their assets. This business strategy involves combining or taking over organizations to achieve specific goals.

The main purpose of a merger and acquisition is to gain a strategic advantage. Other purposes include expanding market share, entering new markets, acquiring new technologies or products, reducing costs through economies of scale, and eliminating competition.

M&A activities can reshape industries, affect market dynamics, and significantly impact the involved companies’ futures.

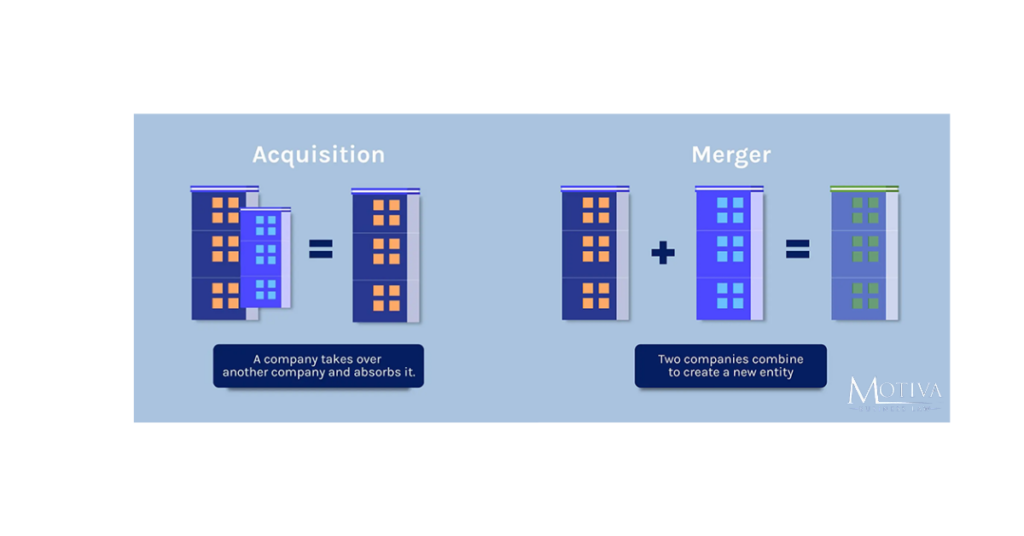

What Is the Difference Between Mergers and Acquisitions?

The key difference between a merger and an acquisition is the resulting organizational structure and control. In a merger, a new company is formed when two individual entities join together. In an acquisition, one company takes ownership of another, maintaining its identity while integrating or controlling the acquired company.

In a merger, two or more companies combine to create a new corporate entity, which usually is assigned a new name. The firms are typically the same size, and they merge strategically to gain leverage from this integration. With a merger, both companies can benefit by saving on production costs, entering new markets, and combining their strengths.

On the other hand, in an acquisition, a company takes over another company and establishes itself as the new owner. Through a business purchase, companies may be able to achieve significant growth, by increasing their market share and being able to access new technologies, assets, operating procedures, and distribution channels.

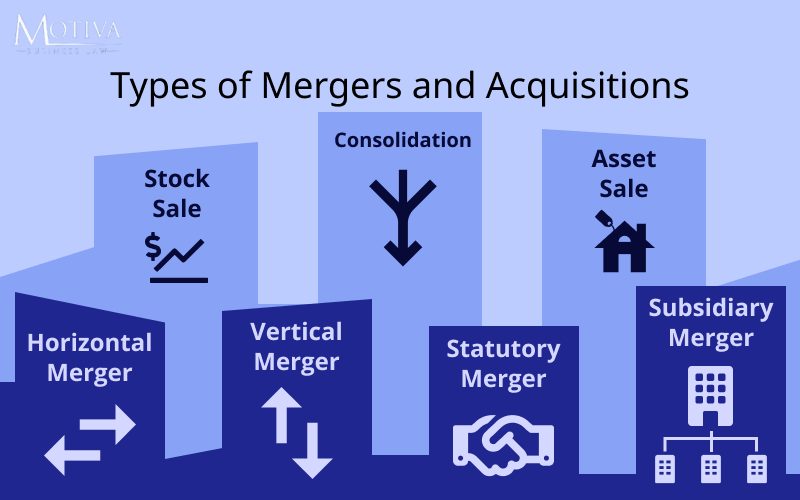

What Are the Types of Mergers and Acquisitions?

Mergers and acquisitions come in various forms, each with distinct characteristics and strategic purposes. The main types of mergers and acquisitions are:

- Horizontal merger

- Vertical merger

- Statutory merger

- Subsidiary merger

- Consolidation

- Asset sale

- Stock sale

What Are the Benefits of Mergers and Acquisitions?

Mergers and acquisitions can lead to greater growth, increased market share, increased shareholder value, enhanced synergy, bigger economies of scale and greater diversification. Five key benefits of mergers and acquisitions are listed below:

- Greater Growth: The main reason why companies go through an M&A process is to significantly increase their revenues at a faster rate. Buying a company or integrating with one has a direct impact on performance efficiency that could have not been achieved so easily organically.

- Increased Market Share: When two competing companies merge, they will gain leverage and a larger market share. Similarly, with a business acquisition, the buyer immediately absorbs the competition and gains more relevance in the market.

- Enhanced Synergy: Mergers follow the adage, “One plus one equals three”, which means that two companies can provide even higher value together by joining forces, knowledge, and resources.

- Bigger Economies of Scale: By merging, companies are able to buy resources in greater quantities at a lower cost and improve profit margins.

- Greater Diversification: Mergers and acquisitions can help companies expand their geographic scope, as well as the variety of products and services it provides.

What Are the Drawbacks of Mergers and Acquisitions?

While mergers and acquisitions can offer significant benefits, they also come with various drawbacks. Five drawbacks of M&A’s are listed below:

- Cultural integration

- Challenges in merging different corporate cultures

- Potential clash of values and work styles

- Employee retention

- Risk of losing key talent during the transition

- Uncertainty and stress leading to decreased productivity

- Regulatory hurdles

- Potential delays due to regulatory approvals

- Compliance issues and associated costs

- Integration of systems and processes

- Difficulties in combining different technological infrastructures

- Time and resources required to align operational procedures

- Resources allocated to M&A

- Diversion of focus from core business activities

- Financial and human resources dedicated to the merger process instead of other strategic initiatives

What Is the Process of a Merger and Acquisition?

These stages of mergers and acquisitions guide companies through the complex process of combining or acquiring businesses. Each step is needed for ensuring a successful transaction and realizing the intended benefits of the deal. The merger and acquisition process typically follows a structured approach. Here are the 6 main steps of the M&A life cycle:

- Initial discussions

- Letter of Intent

- Due diligence

- Business valuation

- Business Financing

- Purchase agreement and closing

Initial Discussion: What is Merger and Acquisition Analysis and How do We Analyze a Merger and Acquisition?

The initial discussion step involves preliminary talks between companies considering a merger or acquisition. This stage is crucial for establishing interest, outlining broad terms, analysis of the companies and setting the foundation for further negotiations. Companies explore potential synergies, discuss high-level strategy, and assess cultural fit.

During this phase, various professionals assist. Investment bankers help identify potential targets or acquirers. Lawyers provide initial legal advice on structure and regulations. Accountants offer preliminary financial insights. Management consultants may advise on strategic fit.

Merger and Acquisition Analysis is a key part of the process and means evaluating potential M&A deals to determine their viability and potential value.

Negotiation is a key aspect of this step, as parties begin to outline their expectations and potential deal structures. The outcome of these initial discussions determines whether to proceed with more detailed analysis and due diligence.

Letter Of Intent

Once the terms of the negotiation have been set, we can assume both parties are serious about the merger or acquisition, so they can move forward to signing the letter of intent (LOI).

An LOI is a non-binding document that includes the key points of the negotiation. Although the LOI does not bind an acquisition, it is important for an M&A lawyer to draft it, because it will be the foundation for the transaction. Also, LOIs can be binding when adding the wrong information, so it is better for a legal expert to take care of it. Letters of intent include essential terms of the transaction, in which can be included:

- Purchase price

- Whether the sale will be an asset sale or a stock sale

- Buyer’s right to access seller’s documents and financials

- Confidentiality clause

- Timeline for the LOI

Due Diligence

Due diligence is the process of inspecting the target business to ensure it is a good investment. In Mergers and Acquisitions, the buyer needs to go through the key aspects of the business to be protected after the purchase. Some considerations the purchaser needs to look after are:

- Management structure

- Federal, state, and local tax returns for the last three years

- Profit and loss statements

- Business, sales, and marketing plans and strategies, with any printed materials and SOPs

- Business licenses

- Lease/real estate agreements

- Environmental compliance

- List of all active or threatened litigation, arbitration, administrative or other proceedings involving the company, any subsidiary or any officer or director (including parties, remedies sought, and nature of legal action).

- List of products and services offered or planned to be offered, and their respective descriptions. prices, and SKUs

- Permits and records relating to safety and health issues

Valuation Of Mergers and Acquisitions

Business valuation refers to the process in which the value of a company is established depending on determining factors. The way a business’s worth is determined varies by industry, but the value will mostly depend on the earnings of the company. Other factors also impact the value, such as; differentiating traits of the business, the stage of the company’s life cycle, and its positioning in the market.

The valuation process involves analyzing various financial metrics, market conditions, and future projections

Accurate valuation affects the deal’s structure, financing, and ultimate success. It helps buyers avoid overpaying and sellers ensure they receive fair compensation for their business. The valuation also informs negotiations and influences the terms of the final agreement.

Three key methods of business valuation in Mergers and Acquisitions are outlined below:

- Discounted cash flow (DCF) method: This approach takes into consideration the future projections of the cash flow and compares it with its current cash flow perspective.

- Cost approach: This method estimates how much it would cost to create a replica of the business from the ground. This approach works best with businesses that have physical locations or serve tangible goods.

- Market approach: This valuation approach takes into consideration the price for which similar businesses have been sold recently and uses it as a basis for determining the selling cost.

The valuation outcome serves as a foundation for subsequent steps in the M&A process, guiding decisions on deal structure, financing, and final negotiations.

Merger and Acquisition Finance

There are several ways in which a company raises money to fund mergers and acquisitions. The main forms of M&A financing are debt (loans) and equity (investor capital).

Financing is a critical step in the M&A process as it directly impacts the feasibility and structure of the deal. The objective of financing, besides funding an acquisition, is to manage the capital in a way that corresponds to the operating cash flow performance of the company.

Equity financing: Companies can simply pay the transaction with cash, or opt for a stock exchange. The latter is one of the most used alternatives for financing. In this situation, the acquiring company exchanges its shares for the shares of the target company.

Debt Financing: The parties involved in the transaction agree for the buyer to take charge of the debt the seller owes as a way of payment. Since it is very common that the reason behind a sale is debt, this is a great alternative that benefits both the buyer and the seller.

Proper financing ensures the acquiring company can complete the purchase without compromising its financial health. It also affects the potential return on investment and the company’s post-merger financial structure.

Depending on the size of the deal, investment bankers (for larger acquisitions) or commercial lenders (smaller deals) play a central role, advising on financing options and helping to secure funding from various sources. They may arrange syndicated loans or help issue new securities. Accountants assist by analyzing the financial implications of different financing structures. Lawyers are involved in drafting financing agreements and ensuring compliance with securities regulations.

The outcome of this step significantly influences the deal’s success. It determines the acquiring company’s debt levels, impacts shareholder value, and shapes the merged entity’s capital structure. Effective financing sets the stage for a smooth transition and positions the combined company for future growth.

Purchase Agreement and Closing

A Purchase Agreement is a legally binding contract that outlines the final terms and conditions of a merger or acquisition. This document formalizes the transaction and includes details such as purchase price, payment terms, representations and warranties, and closing conditions.

This step involves negotiating the final terms, drafting the agreement, and executing the closing. It’s a crucial phase where all previous discussions and findings come together in a legally enforceable contract. The importance of this stage cannot be overstated, as it solidifies the deal and protects both parties’ interests.

Lawyers play a central role in this phase, drafting and reviewing the Purchase Agreement to ensure it accurately reflects the agreed-upon terms and protects their client’s interests. They also handle the many other contracts associated with the transaction, such as employment agreements, real estate transfers, vendor contracts, or non-compete clauses.

Accountants assist by ensuring the financial terms align with the valuation and due diligence findings. They may also help structure the deal for optimal tax implications.

Investment bankers continue to advise on deal terms and may help resolve any last-minute negotiation issues.

Company executives and board members are typically involved in final approvals and signing the agreements.

The closing marks the official transfer of ownership and completion of the M&A transaction. It’s when funds are transferred, shares are exchanged, and the deal becomes final. This step transforms months of negotiation and planning into a concrete business combination, setting the stage for post-merger integration and realization of the anticipated benefits.

What Is The History of Mergers And Acquisitions?

The concept of mergers and acquisitions (M&A) has a long history, dating back to the late 19th century. The first notable M&A wave occurred in the United States between 1895 and 1905.

The idea of combining businesses through mergers or acquisitions wasn’t invented by a single person.The popularity of M&A surged during the 1980s, often referred to as the “decade of greed.” This period saw a significant increase in hostile takeovers and leveraged buyouts. Companies began to use M&A strategies more aggressively to gain market share, eliminate competition, and boost profitability.

During this time, many large corporations embraced M&A as a core business strategy. Conglomerates formed, diversifying their portfolios across various industries. Investment banks and financial institutions played a key role in facilitating these deals, developing new financial instruments and strategies to support M&A activities.

Since then, M&A has remained a common practice in the business world, with activity levels fluctuating based on economic conditions and industry trends.

What Are Famous Mergers And Acquisitions?

Here are 5 famous mergers and acquisitions in history:

- Disney and Pixar (2006) Value: $7.4 billion Significance: This merger brought together two animation powerhouses, combining Disney’s marketing prowess with Pixar’s innovative technology and storytelling. It revitalized Disney’s animation division and led to numerous blockbuster films.

- Exxon and Mobil (1999) Value: $81 billion Significance: This merger created ExxonMobil, one of the world’s largest oil companies. It was a response to falling oil prices and aimed to improve efficiency and reduce costs in the highly competitive energy sector.

- AOL and Time Warner (2000) Value: $165 billion Significance: At the time, this was the largest merger in corporate history. It aimed to combine AOL’s internet services with Time Warner’s media content. However, it’s often cited as an example of a failed merger due to culture clashes and the dot-com bubble burst.

- Facebook and Instagram (2012) Value: $1 billion Significance: This acquisition allowed Facebook to neutralize a potential competitor and expand its social media dominance. Instagram’s user base has since grown exponentially, making this deal highly profitable for Facebook (now Meta).

- Google and Android (2005) Value: $50 million Significance: This relatively small acquisition proved immensely valuable for Google. Android became the world’s most widely used mobile operating system, giving Google a strong foothold in the mobile market.

Why Do You Need A Lawyer In A Merger And Acquisition?

A lawyer is essential in a merger and acquisition (M&A) for several reasons. A M&A lawyer is essential for three key reasons: due diligence, legal risk, and legal documentation.

M&A lawyers are involved in due diligence by reviewing contracts, corporate records, intellectual property rights, employee agreements, and pending litigation. They assess potential legal risks and liabilities that could affect the transaction’s value or success. These attorneys also examine regulatory compliance issues and help identify any legal obstacles that might impede the deal.

M&A lawyers help by identifying potential legal problems early in the process, developing strategies to address them, and working to minimize their impact on the deal. They provide advice on structuring the transaction to avoid legal pitfalls and ensure compliance with relevant laws and regulations. When issues do arise, these attorneys negotiate solutions and represent their clients’ interests in any disputes.

M&A lawyers draft and review all necessary legal documents, including purchase agreements, shareholder agreements, and non-disclosure agreements. They also conduct or oversee thorough investigations of the target company’s legal affairs, identifying potential risks or liabilities.

When Do You Need A Mergers And Acquisitions Attorney?

You need a Mergers and Acquisitions (M&A) attorney from the moment you consider an M&A. Engaging an M&A lawyer at the outset of the process is crucial for several reasons:.An M&A lawyer should be hired when the idea of an M&A transaction is first considered. They can provide valuable insights into the feasibility of the transaction, potential legal hurdles, and strategic considerations before significant resources are committed. This early involvement allows for better planning and can help avoid costly mistakes.They can guide you through initial negotiations, help draft confidentiality agreements, and advise on the steps of due diligence.

When hiring an M&A attorney, consider their experience in your specific industry and with similar types of transactions. Look for a lawyer who understands your business goals, can provide both legal and strategic advice, and has the ability to work well with your team are all important factors.

What Do Merger And Acquisition Lawyers Do?

Merger and acquisition (M&A) lawyers specialize in facilitating complex business transactions. M&A lawyers assist with structuring deals, conducting due diligence, negotiating terms, regulatory filings and drafting necessary legal documents. These attorneys also help manage risks associated with the transaction and protect their client’s interests throughout the process.

Laws related to M&A practice include corporate law, contract law, securities regulations, tax law, and antitrust law. Key documents M&A lawyers work with include confidentiality agreements, letters of intent, purchase agreements, and various ancillary agreements. They also handle the requirements for the transaction.

To become an M&A lawyer, one must earn a bachelor’s degree, pass the Law School Admission Test (LSAT), complete law school and obtain a Juris Doctor (JD) degree, pass the bar exam in their state, gain experience in corporate law, often starting at a law firm, and specialize in M&A through work experience and continuing education.

Ensure Success with a Skilled M&A Lawyer by Your Side

If you’re considering a merger or acquisition, having the right legal support can make all the difference. Visit our practice areas page to learn how we can help guide you through each step of the process. Our experienced attorneys are ready to ensure your interests are protected and set you up for success.