What is a horizontal merger?

In M&A, a horizontal merger occurs when two or more companies at the same level of the supply chain join together to form a new organization. In this process, also known as horizontal acquisition or horizontal integration, companies are usually part of the same industry.

How do horizontal acquisitions work?

A horizontal merger is a way of growing a business by acquiring a competitor or a company that creates similar products to expand its market share and leveraging the benefits of scale.

Buying other businesses in your industry has two main advantages: 1) minimizing your competition and 2) increasing your own customer base. A horizontal acquisition saves a business owner the work of convincing consumers of a competitor to switch over to your brand.

A horizontal takeover does not have to involve a competitor. A business can also use a horizontal acquisition to enter a new market.

For example, a luxury handbag company that uses animal products can buy a vegan luxury handbag company to appeal to a new customer base. This allows the buying company to use its transferable skills of making handbags for a new consumer base.

Examples of horizontal mergers

Facebook and Instagram

In 2012, Mark Zuckerberg acquired the social media company, Instagram, for a record-setting $1 billion. With the Facebook and Instagram merger, the company secured its place in the social media industry. This acquisition was the step that allowed the company to grow to more than 1 billion users.

Disney and Marvel

It was 2009 when the Walt Disney Co purchased Marvel Entertainment. The superhero franchise benefited from better financing facilities after being acquired by Disney, while the latter took advantage of this fusion to focus on long-term growth and provide greater value.

Daimler-Benz and Chrysler

In 1998, these two separate automobile companies used a horizontal acquisition strategy to expand their businesses and safeguard their long-term competitiveness. By doing so, they were able to deliver new products and services, extend their operations and improve their competitive position globally. With this horizontal takeover, DaimlerChrysler expanded the range of its services, which included automotive mobility, transportation, and services.

Horizontal merger guidelines

A horizontal integration implies having the opportunity to establish a company’s dominance in the market, which can be unfair to other businesses in the same industry. The Government examines horizontal takeovers to ensure they do not become an oligopoly, the term used when the market is highly concentrated and dominated by a few.

The Department of Justice and the Federal Trade Commission have created outlines with respect to horizontal integrations. The Agencies have established these guidelines to ensure a healthy competitive environment where companies can have the same opportunities.

Summarized, the Horizontal Merger Guidelines state that the Agencies:

- Examine the immediate anticompetitive effects of the merger

- Work to predict whether a horizontal merger may substantially lessen competition.

- Review the merging companies’ market shares and the current level of competition in their market

- The Agencies examine whether a merger is likely to change the manner in which market participants interact, inducing substantially more coordinated interaction.

- Consider how the decrease in competition will affect innovation

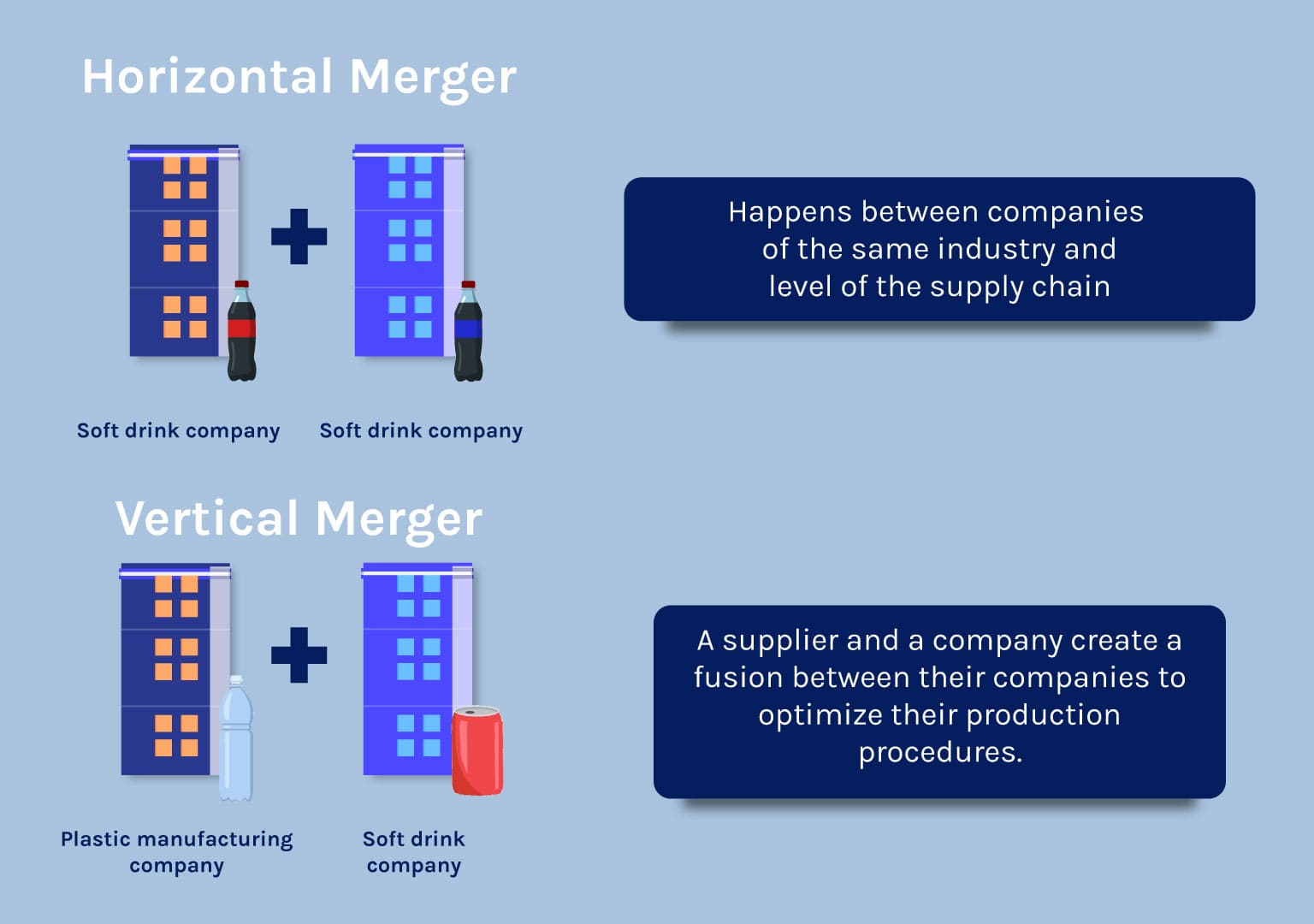

Horizontal vs. Vertical Mergers

The difference between horizontal and vertical mergers is in the stage of production the acquiring companies are in. A horizontal merger occurs when a company acquires another one that is at the same level in the supply chain and sells similar products; while at a vertical merger, the involved companies are at different stages, and one sells something to the other.

The main reason for vertical mergers is to increase the efficiency of the supply chain.

Benefits of horizontal mergers

- Increase market shares

When done correctly, a horizontal acquisition can increase the power of two companies. With integration, both can merge synergies, offer new products, and benefit from diversification by entering new markets.

- Reduce competition

If you can’t beat them, join them. And a horizontal merger is the best example of that. An integration helps the involved companies to expand their knowledge and resources to provide the best value and stand against other competitors in the market.

- Expand operations

Another good reason to opt for horizontal integration is to be able to reach geographic points that were out of hand for the separate companies and improve the distribution of the products and service delivery.

- Benefit from economies of scale

By increasing its level of output, the new company can obtain cost advantages and have better operational efficiency with a bigger scale of production.

Disadvantages of horizontal mergers

A horizontal acquisition, however, also has some disadvantages.

- Acquiring the wrong target

Firstly, you want to make sure you understand the consumers you are acquiring. If you acquire a brand that appeals to a different type of consumer base and then mold the target brand to yours, you may lose those consumers and defeat the purpose of your horizontal acquisition.

For example, using our luxury purse example above if you sell luxury handbags that use animal leather and acquire a business whose consumers value vegan goods, it is wise that you understand this part of the acquired consumers. If you change the vegan handbags to animal leather, the consumers will eventually catch on and quit buying your products. The intention and strategy is key to the success of your horizontal acquisition.

- Getting liability

Another potential disadvantage of a horizontal acquisition is that of any other acquisition. You want to do your due diligence and make sure adding the competitor is actually going to add value to your existing company. Otherwise, the risk is not only a failed business purchase, but the tanking of your existing brand.

If you need help with a horizontal acquisition, call today at (630) 517-5529.