Business Law Blog

Read Articles by Motiva Business Law

FTC Bans Non-Compete Agreements

April 25, 2024

Are Non-Compete Agreements Banned? On April 24, 2024, the Federal Trade Commission (FTC) issued a rule banning non-compete agreements for employees. It will become effective ...

Read More

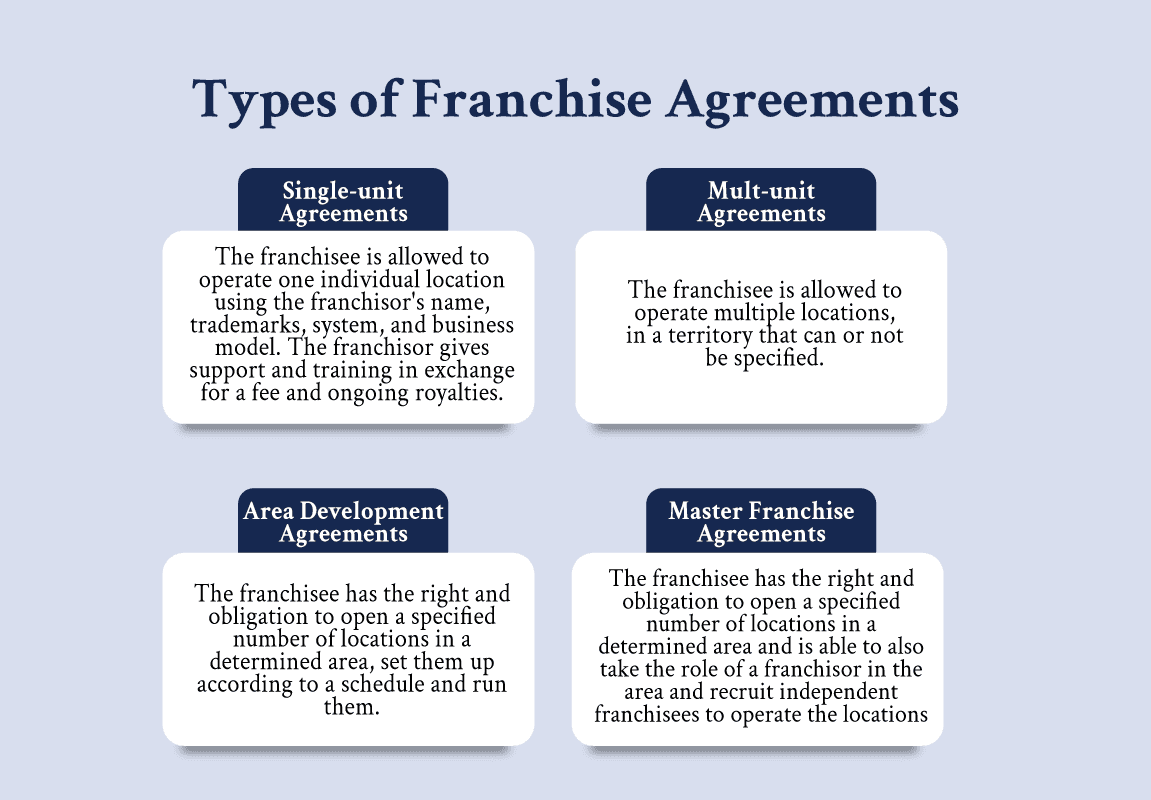

The 4 types of franchise agreements

March 25, 2024

Franchise agreements can be divided into two main categories, single-unit and multi-unit franchise agreements. However, there are different variations of multi-unit franchise agreements in which ...

Read More

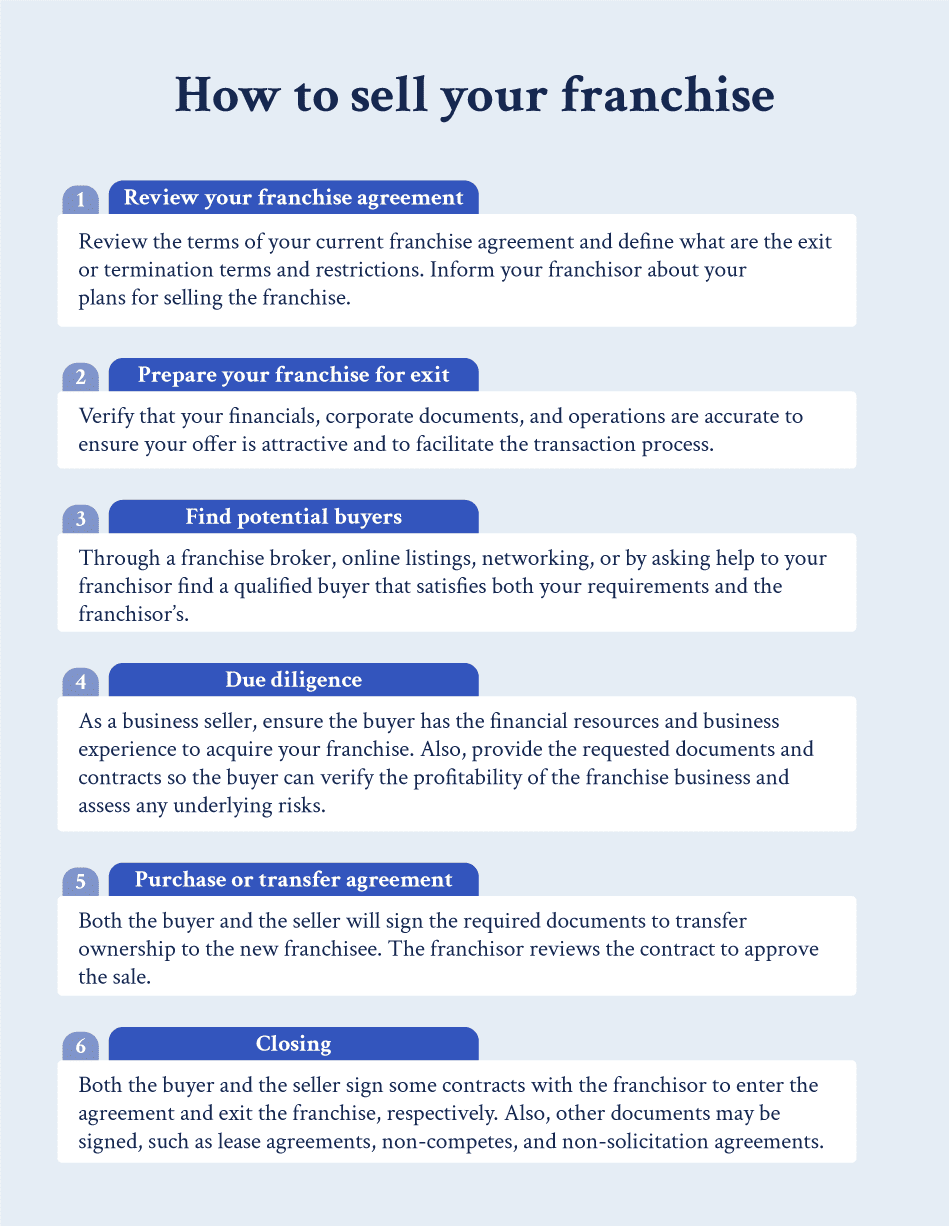

How to sell your franchise business as a franchisee

February 27, 2024

As a franchisee, you may want to sell your franchise for a variety of reasons. Retirement, the franchise not being what you expected, or chasing ...

Read More

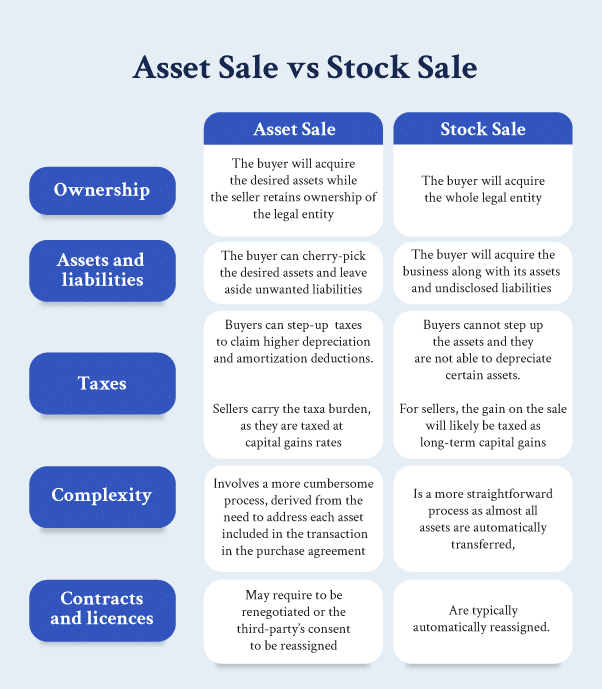

Asset Sale vs Stock Sale

February 6, 2024

During a business transaction, you need to define early in the process how to structure the deal. Preferably defined in the letter of intent, deciding ...

Read More

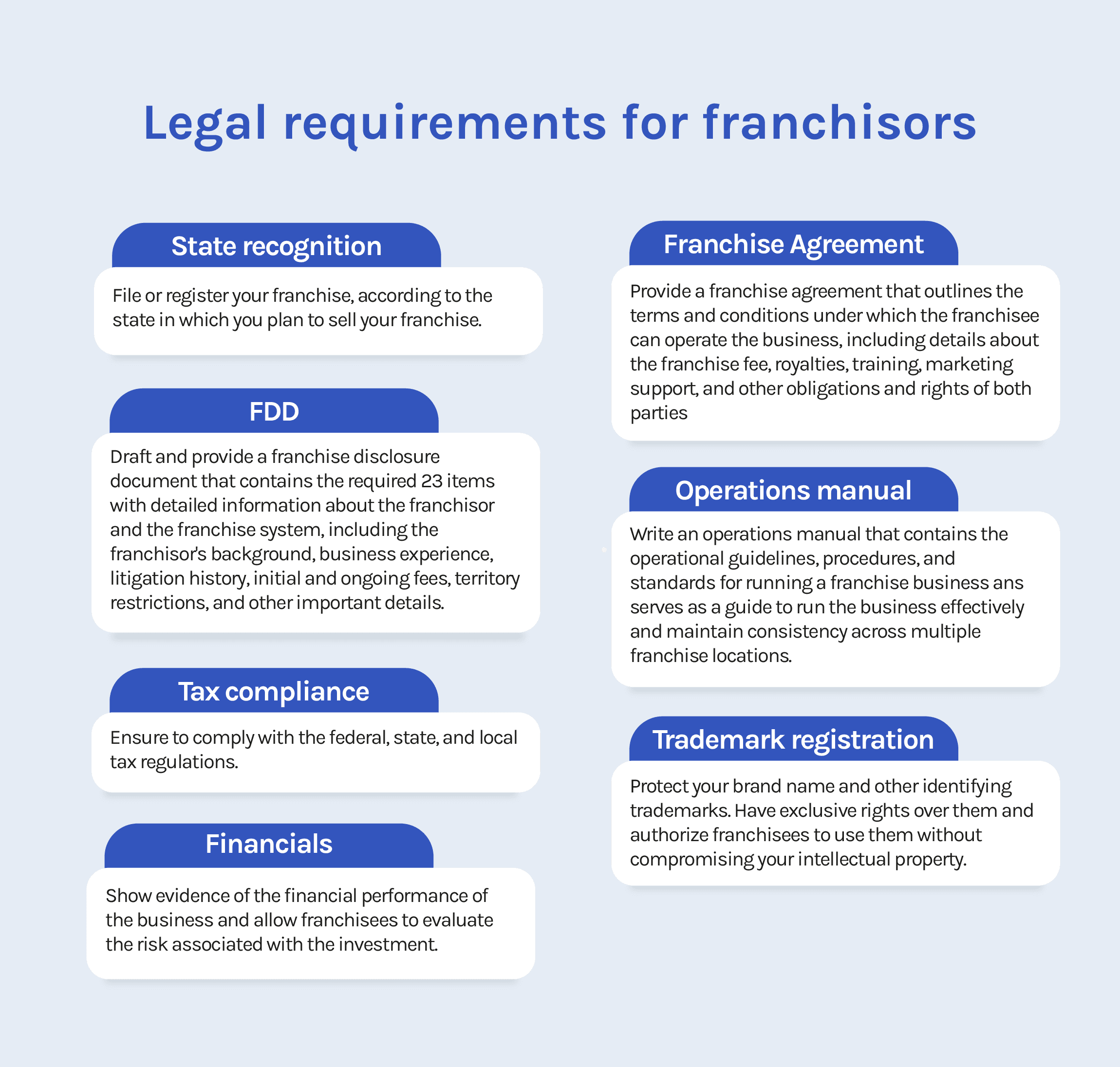

Legal Requirements to Start a Franchise

January 15, 2024

Put simply, franchising is a business model where you take what has worked for you, your business name, brand, know-how, and system, and teach someone ...

Read More

Legal Due Diligence in M&A: How to Do it + Checklist

December 21, 2023

One of the key aspects to enable a successful business acquisition is conducting legal due diligence, which is the process of examining the target business’s ...

Read More

Franchise vs Chain: What are the differences between the two business models?

December 13, 2023

In a chain, all store locations are owned by a parent company, while in a franchise, units are owned and operated by separate individuals who ...

Read More

Who are the beneficial owners of a company?

December 12, 2023

According to the Corporate Transparency Act, which will be effective starting January 1st, 2024, certain companies should file specific information about their beneficial owners. Who ...

Read More

what is a close corporation?

December 7, 2023

A close corporation, also known as a closely held corporation, is a type of business entity where the majority of the ownership is held by ...

Read More

How to buy a FedEx route?

December 5, 2023

FedEx, short for Federal Express, is a globally recognized courier delivery service that specializes in small package information, transportation, pickup, and delivery domestically or internationally ...

Read More

How to start a trucking company in illinois

November 30, 2023

The trucking business in Illinois is a lucrative industry that offers great growth opportunities and a valuable service for the community. However, logistics and transportation ...

Read More

What is an asset purchase agreement?

November 22, 2023

When buying a business, an asset purchase agreement (APA) is the contract under which a seller transfers some or all the company’s assets to a ...

Read More