Reaching an agreement on the purchase price can be one of the most difficult aspects of a business transaction, as it requires strong negotiation skills from both parties.

When there seems to be no consensus about the final price, the parties can include an earnout provision in the agreement as a strategy to close the deal.

What is an earnout?

An earnout is a contractual provision commonly found in mergers and acquisitions in which a seller is to receive additional compensation if the business achieves specific performance goals after the acquisition is closed.

An earnout helps allocate the risk for the purchaser, for the final purchase price will be contingent on certain financial or operating conditions being met regarding profits, EBITDA margins, or earnings per share.

How do earn-out Payments work?

Earnouts are payments to the seller that depend on satisfying specific performance milestones that can be linked to gross revenue, employee retention earning rates, gross revenue growth rates, or almost any measurement both the buyer and the seller agree to.

The payout level of the earn-out can vary depending on different factors, such as the size of the business. Usually, the earnout portion of the purchase price is about 10%-25% percent of the purchase price. A larger earnout may be applicable when the risks are higher.

Earn-outs typically take place over a three to five-year period after the closing.

For example, the seller thinks the business is worth $10 million, but the buyer believes $8 million is a fair offer. Both can agree on the buyer paying $8 million upfront, but the buyer will have to pay the remaining amount if the business’s revenue grows a 40% in a period of three years. If the revenue only grows 20%, the buyer will have to pay only $1 million.

When to use an earn-out in M&A?

Earn-out agreements should be considered only when the company will continue with its regular operations or member of its management team, so the future projections are accurate. If after the business acquisition, the new owner plans to make noteworthy operational modifications, it is not a good idea to use this provision.

Earnouts can be useful when:

- The target business is a startup, so it has a limited operating history but significant growth potential.

- The market is facing high interest rates, so the buyer will want a delayed payment.

- There is an uncertain economic environment or a highly volatile industry

- The business has not been capable of achieving its projections

- The company is dependent on relatively few customers

- The company encourages employees to remain working there after its buyout

If this is not the case, other risk allocation strategies can be useful to push the deal, such as holdback escrows.

Advantages and disadvantages

With an earnout provision, the buyer and the seller can get to a price arrangement more easily. However, earnout agreements increase the possibility of disputes.

Here are some pros and cons of earn-out agreements from the perspective of buyers and sellers

Benefits to buyers

- Reduce the amount of capital that must be put at risk when closing the transaction

- Have a more objective purchase price, based on its performance

- Shift the risk allocation from the buyer to the seller

- Increase the possibilities of employee retention

- Financing facilities through deferred payments

Disadvantages to buyers

- Management restrictions

- The seller may want to stay involved in the business for a longer time

Benefits to sellers

- Be able to receive a fair payment for the business, that without the earnout provision would not have been possible.

- Since the final purchase payment is deferred, the seller will pay the whole tax amount once the earnout is received.

Disadvantages to sellers

- Earnouts can be manipulated against the seller’s convenience, for a buyer can mismanage the company to purposefully affect its performance.

- The business may be impacted by external factors that were not considered at the agreement signing.

- The seller depends on the credit risk of the buyer

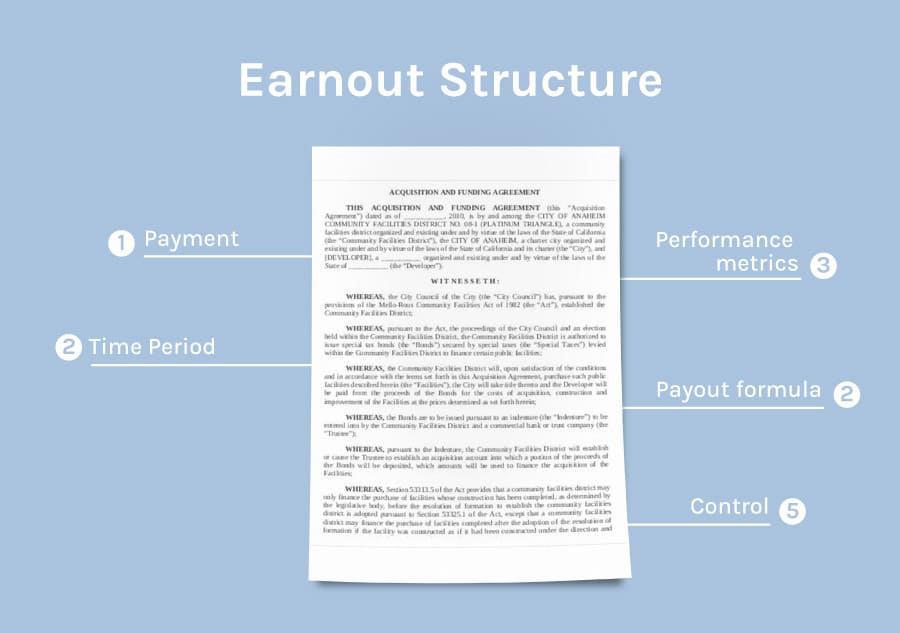

Earnout Structure: Key considerations

An earnout structure goes far beyond cash compensation.

Other terms should receive close attention, regarding the operations of the business, the members and managers of the organization, and other key elements.

The company’s management and key employees will determine the company’s projections in terms of revenue, EBITDA, growth, etc., which will settle the basis of the payout for the seller.

Before structuring an earnout, here are some considerations that you should contemplate:

1. Payment

a) Total purchase price: The first step is to determine the total purchase amount. Usually, the buyer sets the price after a preliminary valuation. The price will be determined depending on the potential risks, tax implications, and other factors.

b) Up-front payment: Next comes the definition of the percentage of the total purchase price that will be paid at the transaction closing.

c) Contingent payment: The remaining amount that the seller will pay to the buyer if certain conditions are met.

2. Time period

After all the aspects of the payment have been stipulated, both parties need to agree on the earnout period. As mentioned above, earnout periods often last between one and five years, three years being the average duration. The length of this period should be enough for the team to attain their goals, but not exceedingly long as to induce the employees to lose their objectives out of sight.

3. Performance Metrics

The financial and operational goals that will be decided upon the earnout should be clearly defined and easily measured.

Financial measures are based on revenues, while operational metrics relate to milestones such as the retention of key employees, customers, or product launches. We will discuss performance metrics in more detail further below.

4. Payout formula

Both parties of the business acquisition should agree on the level of payment in proportion to the performance of the business. Typically, the earnout structure provides rewards even when the achievement is not satisfied. An absolute milestone is not usually seen in these types of deals.

It’s paramount to dictate an accounting standard that objectively quantifies the performance of the acquired company.

5. Control

The seller will normally be expected to continue running the business or stay present during the earnout period. If the seller weren’t overseeing the operations, it would be unfair to cut the compensation for the performance of a company that is out of his control.

For this reason, it’s key that both parties agree on the extent to which the seller will continue having control or the involved in the management of the business.

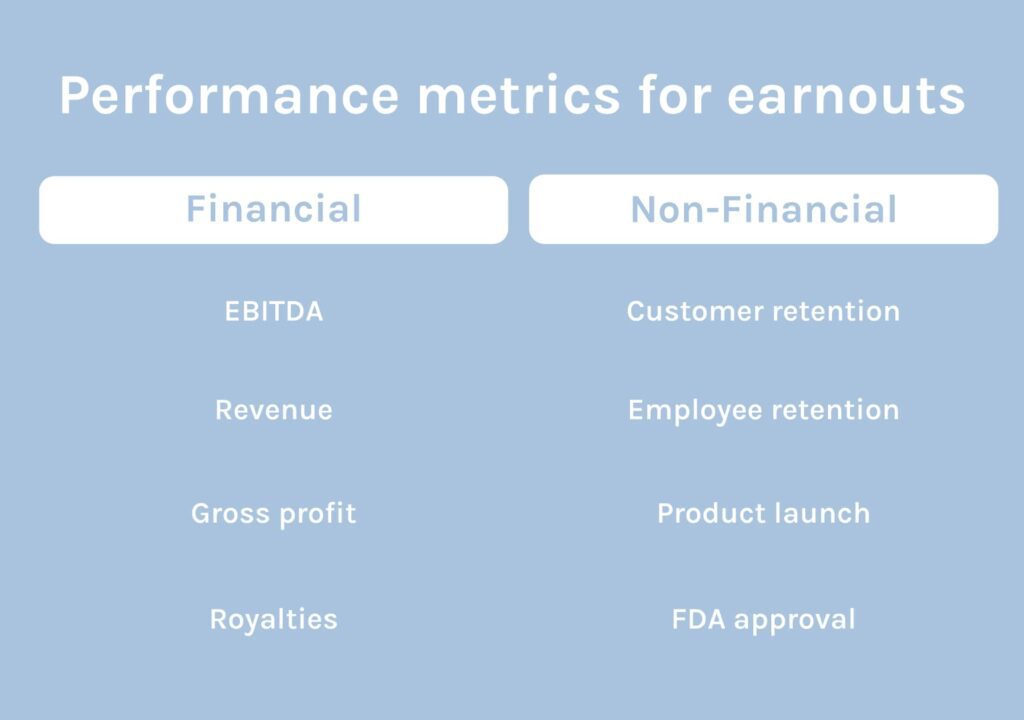

Performance metrics

The key component of an earnout is the formula on which it is based. Even though a formula is clearly established, the interpretation of metrics is subject to the parties’ interpretation and manipulation.

It’s paramount to have a clearly defined performance indicator to reduce bias.

Deciding on which metric to choose depends on several factors, such as the extent of control the seller will have after the closing, whether the business will merge with another, the potential risks, and others.

Depending on the situation, a revenue approach will be more appropriate than an earnout based on EBITDA or a non-financial metric.

See in more detail what each metric consists of.

Financial metrics

Include income statement line items, balance sheet items, or buyer’s stock price.

Sellers prefer revenue-based performance metrics rather than profits because revenue is less impacted by expenses and buyer post-closing accounting practices. Simple performance measurements, such as sales, units sold, or gross profits are also preferred because they are less likely to be manipulated than profits.

Buyers, on the other hand, care most about profits, for they are a more precise indicator of the success of the business.

EBITDA, Net Income: Earnings before interest, taxes, depreciation, and amortization (EBITDA) are one of the most common performance metrics. Since the purchase price is often calculated using the EBITDA as a basis, the earn-out is usually calculated using the same method.

Earn-outs based on any profit measure must be extremely detailed and should include a clear definition of profit.

Buyers prefer net income as the most accurate reflection of the financial performance of the company, but this number can be manipulated through extensive capital expenditures.

Revenue: Since revenue is not proportionate to profit, buyers are frequently reluctant to use this metric to base the earn-out. The seller can focus on sales and ignore expenses, for which revenue does not reflect the real value of the company.

Gross profit: This metric is used when the target company is fully integrated into the buyer, making it very difficult to measure the stand-alone profit profile post-assimilation. It is also used in cases where pricing is flexible.

Royalties: The number of units sold is a simple metric for earnouts, and it’s the most resorted for business transactions where the buyer wishes to pay the seller for successful product launches.

Non-financial metrics

Operational milestones refer to achieving specific events, such as a regulatory approval or the launch of a new product. Non-financial metrics can also be related to the retention of key employees and customers.

These kinds of metrics are especially useful for startups when there are insufficient historical records to use as a baseline.

Retention of Key Customers: Earnouts can be released gradually, in the measure key customers remain loyal to the company.

Retention of Key Employees: Earnouts can be released gradually, in the measure employees or the management stays loyal to the company.

Product launch: The payment of the earn-out is contingent on a successful product launch.

FDA Approval: These milestones usually apply to companies in the pharmaceutical industry, and they are accomplished once the Federal Drug Administration approves a specific product.

An earn-out structure should be carefully planned, as it requires the consideration of numerous key factors that can seriously affect the good standing of both parties.

This kind of contractual provision can represent a high potential for dispute when not handled by an experienced M&A advisor. A business acquisition lawyer will be capable of structuring the earn-out in a way that the risk of dispute is mitigated and the person that the attorney represents is protected from liability.