The Illinois Articles of Organization is the name given to a legal document that is required to formally register a limited liability company in this state. This document provides the Illinois Secretary of State with the essential information to start the formation process of your LLC.

An LLC is a business structure in which owners are protected from the company’s debts or other liabilities. Although it is the most common business structure, you should always decide if an LLC is the best business entity for your business goals, along with a corporate lawyer and an accountant.

The Articles of Organization are a requirement to start your LLC, and they can be filed via mail, in person, or by filling out the online application. Choosing the latter is the most accessible option, and you can use this alternative as long as you comply with the following requirements:

- The business has at least one member upon completion of filing.

- The business will exist for general purposes.

- You do not require optional provisions

- The business will have perpetual existence

- There is only one organizer, at least 18 years old, who is not submitting the request for someone else.

If all five of these criteria are not met, the request must be filed in person or via email, using this form, and including a certified bank check or money order with the corresponding fee.

You can either email your form or attend in person at the following address:

Department of Business Services

Limited Liability Division

501 S. Second St., Rm. 351

Springfield, IL 62746

The following are the steps for filing online the Articles of Incorporation for your LLC in Illinois.

How to file the Articles of Organization in Illinois

1. Go to the Illinois Secretary of State website

Go to LLC Articles of Incorporation

After carefully reading the guidelines to start your submission process, click on “file”.

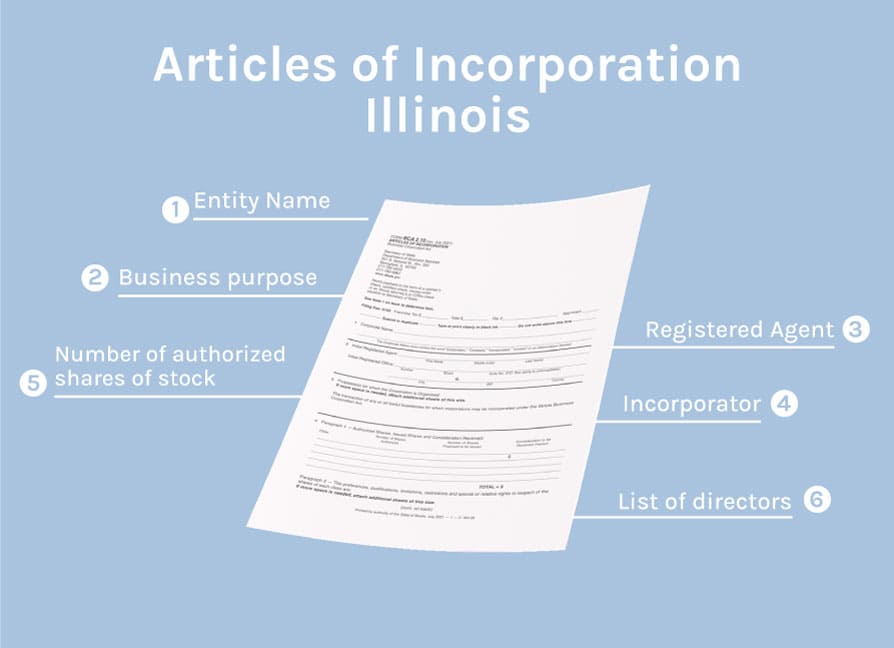

2. Choose an entity name

So the Secretary of State can approve the name of your LLC, you need to meet the Illinois naming guidelines:

- Your name must be unique and different from other registered names in the Illinois Secretary of State.

- The name of your business must contain the phrase “limited liability company”, or one of its variations (LLC or L.L.C.), separate from any word.

- It must consist of letters in the English alphabet, Arabic or Roman numerals, and a limited set of symbols.

- The name of your LLC cannot contain words that may get it confused with one of the other business entities, such as Corporation, L.P., Corp, Co., Ltd, Limited Partnership, or any of its variations.

- It should not include words that can confuse your business with a government agency (FBI, Treasury, State Department, etc.).

- Your name must be the same as your brand name, which is the one your LLC conducts business with. This applies unless you register for an Assumed Business Name (DBA).

- Your name cannot contain any word or phrase (e.g., trust, trustee, fiduciary, bank, banker, or banking) unless permitted by the Secretary of Financial and Professional Regulation.

Verify Name Availability

You can check whether the name you chose has been already taken by searching on the Illinois business name database.

3. Add the Principal Place of Business of your LLC

Type in your business address.

If you want to be a foreign entity, you can add an address outside Illinois for this section.

Note that the Principal Place of Business has to be a physical location, you cannot add a P.O. Box. It is essential that you select a location to which you have frequent access, for that is the address where you are going to receive service of process and important legal documents.

4. Appoint the Registered Agent and Registered Office

A registered agent is a designated individual or business entity that will receive any legal documents on behalf of your LLC.

The registered agent will receive notifications of utter legal importance for your business, such as notices of a lawsuit, tax notices, and compliance documents.

For this reason, it is paramount that your registered agent is someone of your entire trust and that will be available to receive service of process at the stated location during business hours.

You can choose yourself as your registered agent for your LLC, a person that you trust, or a third-party service that will receive your legal documentation on your behalf, as long as they meet the following requirements:

The Registered Office is the location of the designated agent, which has to be inside the state of Illinois and should have a physical location, it cannot be a P.O. box. Remember that the registered agent has to:

- Be 18 years or older, in case it is an individual.

- Be available in person during normal business hours at the specified location.

Since all the addresses you submit are in the public record, using a third-party registered agent protects your privacy, and if you face a lawsuit, this will be the address the paperwork will be sent to.

You can find a ranking of the 12 Best Registered Agents in Illinois here.

5. Appoint LLC members

In this section, you are going to add the names of the members of your business. “Members” is the name designated for the owners of an LLC.

You must state the names of the people who have the authority to manage your LLC and their respective addresses. Please notice that these addresses are going to be public.

6. Select an Organizer

In the attestation section, you will submit the name of the person who took charge of the filing and signing of the Articles of Organization, which is yourself.

Remember that the organizer has to be an individual that is at least 18 years old. An organizer does not have to necessarily be a member of the managers of the company.

Complete the required fields with your name and address.

7. Select Processing

The Illinois Secretary of State offers two options for the processing of your service.

Expedited service: Using this option, your submission will be reviewed within 24 business hours and an additional fee will be applied to your services.

Non-expedited service: Your application will be reviewed within 10 business days

8. Add Billing and Payment information

The fee for your filing process will depend on whether you chose an expedited or non-expedited service. For the first option, the current fee is $150, while for the latter, you are going to be charged an additional fee of approximately $50.

By completing your billing and payment information, you will receive a confirmation email.

Finally, you will receive a copy of the filing documents at the specified time.

Complementary steps to Start an LLC in Illinois

Create an Operating Agreement

An Operating Agreement is an essential document for LLCs, for it states your business’s ownership structure and member roles. Although it is not a legal requirement, it is highly recommended to have this business contract to avoid conflicts between the members.

With an Operating Agreement, business owners do not rely solely on verbal agreements, and they can clearly follow the business’s functional and financial guidelines.

If you do not have a valid, legal operating agreement, the state laws of Illinois will govern your business and this may have counterproductive effects on your business.

Obtain an EIN

The Employer Identification Number (EIN) is a requirement if your LLC has more than one member, even if your business does not have employees.

You will need an EIN when trying to open business bank accounts, apply for business licenses and file your tax returns.

You can get an EIN for free through the IRS website.

Open a Business Bank Account

The best practices are to create a separate bank account for your business. This way, in case your LLC faces a lawsuit, your business will be liable for it, and not your personal assets.

Although you can start an LLC on your own, it is highly recommended that you seek the legal assistance of a Startup Attorney. A business formation lawyer will guide you on the best business entity to choose, write an Operating Agreement that will fit your business needs, prepare the contracts that will ensure a smooth business formation, and guide you on licensing.

Need help with your LLC? Contact our skilled business formation attorney at 630-517-5529 today and we will personally help you start your business.