What are articles of incorporation?

Articles of incorporation consist of a set of documents that are required to legally form a corporation. A corporation, which can be taxed as an S Corp or a C Corp, is a business entity that has a complex management structure. The main characteristics of a corporation are that it is owned by shareholders, protects its owners from liability, and offers different forms of taxation.

Contrary to other business structures, such as sole proprietorship or general partnerships, which are immediately formed once the owners establish a business, a corporation and an LLC require the intervention of the state for their creation, and a business must satisfy certain conditions depending on the state where the incorporation takes place.

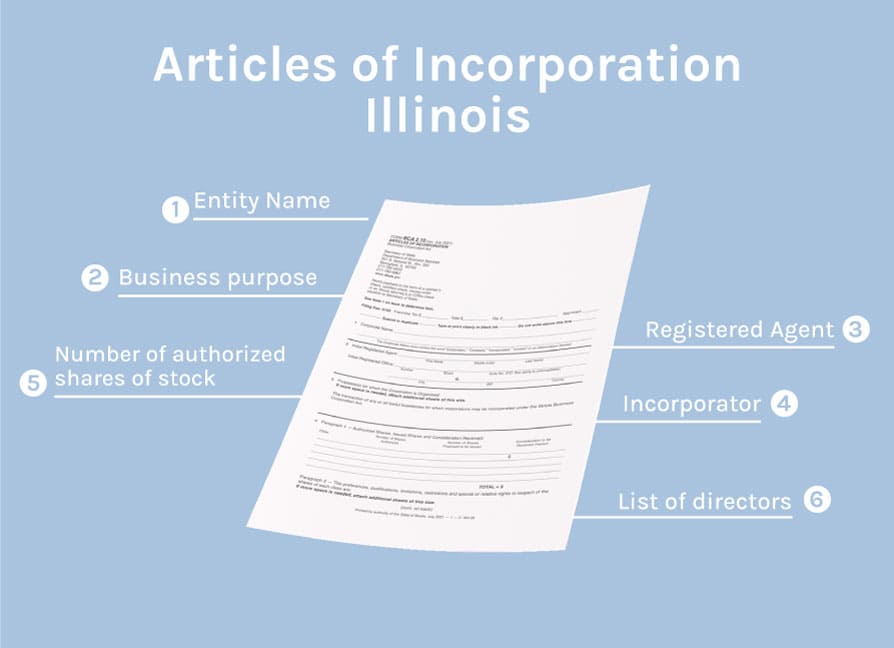

To incorporate a business in Illinois, you must file the Articles of Incorporation (BCA 2.10) with the Illinois Secretary of State and pay a $150 fee. The articles can either be filed online or delivered to the Secretary’s address either in person or by mail to the address below:

Secretary of State

Department of Business Services

501 S. Second St., Rm. 350

Springfield, IL 62756

5 Steps to File Illinois Articles of Incorporation

1. Choose the Illinois corporate name

This part may seem the easiest, but to do it correctly, business owners must pay attention to several considerations:

- Plus your desired corporation name, you must add the word “Corporation,” “Company,” “Incorporated,” “Limited,” or any abbreviation of the mentioned identifiers.

- Your name must be unique from other business entities registered with the Illinois Secretary of State. You can check your name’s availability in the Business Services name database, or contact the Secretary by phone or email to do a preliminary name check. Also, if you submit your articles of incorporation online, likely, the incorporation service you hired will already include this.

- You can also reserve the name you intend to use for up to 90 days. To do so, you need to file an Application for Reservation Name and pay a $25 fee.

- Your name cannot include any words that make reference to the business of banking, insurance, or corporate fiduciary unless you have authorization from the state Commissioner of Banks and Real Estate.

- Your name cannot include words that may mistake your business with a government agency (FBI, Treasury, State Department…)

2. Determine a business purpose

The business purpose explains the activities that the incorporation will engage in once it is formed. There are two types of business purposes.

- General: The state of Illinois allows companies to use a general-purpose clause, for which they can state their corporation is formed to “engage in any lawful activity”. Using this purpose can help the company maintain flexibility in its operations.

- Specific: It includes a detailed explanation of the services or products the corporation or LLC provides.

3. Select a Registered Agent

All corporations in Illinois require to have an agent for service of process.

An agent is a designated individual or corporation that receives legal and tax documents and that accepts service of lawsuits on behalf of the corporation.

The registered agent must:

- Be an individual, business entity or professional registered agent service.

- Have a physical street address in Illinois. P.O. boxes and shared mailboxes (like at FEDEX or UPS) are not allowed. In case the agent is a corporation, it must be authorized to do business in this state. Even if the State accepts these addresses, your business is at risk of not receiving important legal communications.

- Be available (in person) during business hours.

This section must include the registered agent’s name, street, and mailing address.

4. Add incorporator information

This is the individual who conducts the filing process of the Certificate of Incorporation and signs them. There can be more than one incorporator included. You must include the incorporator’s name, street, mailing address, and signatures as well.

5. Determine the number of authorized shares of stock

All corporations have stock, which represents the ownership in a corporation. Corporations must determine:

- Class of shares

- The authorized number of shares

- Number of shares proposed to be issued

- Consideration to be received

A corporation does not need to issue the total number of authorized shares, some of them can be held to add owners later or increase the ownership percentage for a current shareholder.

In Illinois, corporation owners are not required to disclose the par values of the stock. Par value is the lowest legal price for which a corporation may sell its shares.

6. Assign a list of Directors

Although you are not required to list the number of directors and their information, it is recommendable that you assign at least one, or the state will list your incorporator by default.

Draft Illinois Corporate Bylaws

After filing Articles of Incorporation, a corporation must set its company bylaws, which is the governing document that showcases the rules set by the Board of Directors. This document describes the operational structure of a corporation and its management procedures.

Broadly, Illinois Corporate Bylaws should include

- The assignment of the corporation’s key roles, the number of directors and officers

- Periodicity of meetings and voting procedures for the election of the Board of Directors and officers

- Record-keeping procedures and management

- Dispute prevention course of action

- How bylaws will be added/amended in the future

Corporate Bylaws are not to be submitted to the Illinois Secretary of State, but they still are a requirement for corporations, according to Illinois statute §805 ILCS 5/2.20. It is mandatory for corporations that bylaws be adopted either by shareholders at the first shareholder meeting or by directors at the initial director meeting.

Furthermore, corporate bylaws are essential for a corporation, as it is a way to ensure the proper organization and management of the company. These guidelines are key to the corporation, for this specific business entity requires strict control of its activities.

Being the foundation of the corporation, and a legal document, Corporate Bylaws need specialized care. The best practices are to hire a business attorney to draft this document. The contract lawyer will ensure the roles are clearly defined and state strategic procedures against possible disputes.

Appoint the Board of Directors

The incorporator designs the initial corporate directors who serve on the board until the first annual meeting of shareholders. There must be at least one director, however, Illinois law does not specify a maximum number of directors.

Directors are responsible for taking management decisions and establishing corporate policies and strategies. The first Board of Directors meeting plays an important role in the corporation, as there will be defined key organization aspects such as

- The designation of temporary officers (CEOs, CFOs…), committees, chairmen, secretaries, etc.

- Assumption of bylaws

- Establishment of dispute prevention policies

- Selection of a corporate bank

Each meeting requires having a record that is going to be signed by all attending directors.

File Annual Report

For Illinois corporations, it is mandatory that all corporations file an annual report with the Secretary of State and pay a $75 fee. The report must be filed each year on the corporation’s anniversary date. When not filed before the established period, the company can be accrue to a penalty. This report can either be filed online or by mail.

Annual report filing forms

- Domestic corporations: Form BCA 14.05D, Domestic Corporation Annual Report.

- Foreign corporations: Form BCA 14.05 FOR, Foreign Corporation Annual Report.

Obtain an EIN

The Employer Identification Number (EIN), also known as Federal Tax Identification Number, is a unique nine-digit number used to identify a business for tax purposes.

An EIN is required to open a business bank account for the company, for Federal and State taxation purposes, and to apply for business licenses. An EIN is needed by any business that retains employees, or for any corporation or partnership.

Applying for an EIN is a free service provided by the IRS. You can do it online or by fax or mail.

Securing an EIN is one of the steps to establish your corporation and ensure regulatory compliance according to the state of Illinois.

Filing the Articles of Incorporation and following the instructions above are the basic steps for starting a corporation in Illinois. To make informed decisions and to guarantee the correct formation of your company, always have the guidance of a business law attorney, an accountant, and other professional business advisors.

Do you want to start a corporation? Call (630) 517-5529 to schedule a consultation with a business formation attorney.