One of the primary and most important decisions you need to make when starting a business is choosing the right business entity.

Whether you opt for an LLC or a Corporation, this decision will affect how your company is taxed, its structure, management, and other key operational concerns. LLCs and corps offer different pros and cons, and the best choice for your small business will depend on your professional objectives.

Differences between LLC vs Corporations

Both LLCs and Incs are separate legal entities that protect their business owners from liability and require to be registered with the state they operate in.

Broadly, the differences between LLCs and Corporations are that while LLCs are easier to set up and offer great flexibility in terms of management and structure, corporations have to comply with strict reporting and recordkeeping procedures.

LLCs are free to select how to be taxed, and they can choose a taxation model as that of a sole proprietorship, partnership, C corp, or S corp. However, when it comes to attracting investors, corporations offer the best advantages, for shares in a corporation are easier to transfer than ownership interests in an LLC.

We will explore in depth the differences between LLCs and corporations to help you gauge what is the best option for your small business. Remember to always support your decision with the expert advice of a business formation attorney and an accountant.

LLCs and Inc. Overview

What is an LLC?

A limited liability company (LLC) is a business structure that combines the liability protection of a corporation and the tax flexibility of a partnership. The limitation of liability allows proprietors to protect their personal assets from debts, lawsuits, or any harmful action against the company.

Types of LLCs

The type of Limited Liability Company you operate with depends on who is the people responsible for its management, the professional services it offers, location, and other factors.

- Single-member LLC: These LLCs are owned by a single member and are taxed as sole proprietorships. This means that owners only file taxes on their personal returns.

- Multi-member LLC: Are formed by two or more owners and are by default taxed like partnerships, unless the members decide to file as an S-corp or C-corp.

- Member-managed LLC: As specified in the LLC’s operating agreement, this type of LLC is controlled by all the company’s owners, for each of them is responsible for the day-to-day operations and can make decisions for the business.

- Manager-managed LLC: In this type of LLC only designated members can run the business. The remaining serve only as passive investors who are not involved in business operations.

- Series LLC: SLLCs consist of a main LLC that houses separate series within it. This allows to divide business assets, debts, obligations, and rights so they can operate as a separate entity.

- PLLCs: Professional Limited Liability Companies are required for certain licensed professionals, such as doctors, lawyers, accountants, and others.

For a more in-depth examination of the benefits of an LLC, see this Venture Smarter article on the features of Limited Liability Companies.

What is a corporation?

Also distinct from its owners, and therefore with limited liability, a corp, or inc. is a legal entity composed of shareholders, directors, and officers.

To create a corporation, the owners of the company, called shareholders, must go through a legal process called incorporation. This operation involves submitting specific legal documents, information about the contributors of the company, the number of shares, and the types of stock issued.

There are three main types of business incorporations, which rather than being business entities, are tax classifications assigned by the IRS.

C-Corps

A C Corporation is the default corporation under IRS rules. With this legal structure, shareholders are taxed separately from their company. This tax classification can be opted by both LLCs and corporations, though it is more typically used by the latter.

Under a C- Corp designation, a corporation files taxes using the IRS Form 1120, and then shareholders pay taxes at the individual level if the corporate income is distributed as dividends.

C-corps are a good choice for businesses that require investment capital.

S-Corps

S-Corps combine the tax benefits of a partnership with the protection of a C-corp. S corporations are “pass-through tax entities”, which means the earnings of the company go directly to shareholders without facing an income tax at the corporate level. Corporations under this designation avoid double taxation and file an information federal return (Form 1120S).

However, S corporations are subject to strict regulations, such as the prohibition of having foreign investors and limiting the number of shareholders to 100.

Similarities and differences between LLCs and Incs.

Similarities

Liability Protection

Both LLCs and corporations are separate entities from their owners, which allows proprietors to secure their personal assets from business debts, lawsuits, and other threats.

Incorporation

LLCs and corps require to file specific documentation with the Secretary of State to be formally registered. LLCs file the Articles of Organization for business registration, while a corp starts the incorporation process by filing its corresponding Articles of Incorporation.

Differences

Ownership

An LLC is owned by “members”, while corporations are formed by “shareholders”. In LLCs, each member owns a percentage, or “membership interest” of the business, as stipulated by the owners in the operating agreement.

A member can either be an individual, a corporation, a foreigner, or another LLC, and ownership is distributed regardless of their financial contribution to the company.

Having an operating agreement is key for LLCs, for it will define the rights and responsibilities of the members, the procedure to integrate new ones into the LLC, and other operational elements. If an LLC does not have an OA, it will automatically operate according to state law.

The difference with corporations is that the extent of ownership depends on the stocks shareholders have. Stocks, also called “equity” or “shares”, represent the ownership of a fraction of the corporation.

The shares of an Inc. can be easily transferred, for they can be sold, given, or inherited. To gain partial ownership of a company, an individual or organization can buy stock, or sell it to own less of the corporation. However, control and ownership of a corporation are separate, and the right of making decisions is limited as established by the corporate bylaws.

Structure

As explained in the types of LLCs, limited liability companies can either be member-managed, run by their owners, or manager-managed, where investors don’t have an active role.

The flexibility of an LLC allows these business entities to create a management structure that addresses the company’s needs, as stated in the operating agreement.

In contrast, the structure of corporations has to follow specific guidelines. Incs. will be owned by stockholders, and formed by a board of directors that supervises the business and take full responsibility for delivering profits in the form of dividends to shareholders. Additionally, officers, such as the Chief Operating Officers, manage the day-to-day operations.

Shareholders don’t have an active role in the business other than voting on major decisions that affect the entire company, such as the election of the Board of Directors.

Taxes

Corporations are taxed depending on their assigned tax classification. By default, corporations are taxed as C-Corps. Under this assignation, businesses first pay taxes on the corporation earnings, and then shareholders are individually taxed on the distributed dividends, facing double taxation.

By electing to be taxed as an S corp, corporations can avoid this double taxation and not pay corporate income tax. Instead, the company’s profits pass through to the shareholder’s returns at an individual level. However, to be eligible for an S corporation taxation, the company must have less than 100 shareholders and meet specific requirements.

On the other side, LLCs do not have an IRS tax classification of their own, which allows for greater flexibility and the possibility to choose how to be taxed. Profits and losses are reported on the owners’ returns at an individual level but can be subject to employment tax when distributing profits. An LLC can also opt to be taxed as a C corp or an S Corp if qualified.

Liability

Both corporations and LLCs have their own legal existence, which means the company itself is responsible for debts, lawsuits, and other liabilities.

The owners’ liabilities are limited to facing the risk of losing their financial contributions to the business, while their personal assets remain protected in the event of a dispute. Nevertheless, members or shareholders are still liable for individual negligence or any obligations on which they’ve signed a personal guarantee.

To stay protected, the owners of corps and LLCs should maintain their business and personal finances separate. When signing documents and contracts, LLC and corp owners should do it on behalf of the company, and not at their own stake. Similarly, best practices are to always keep independent bank accounts.

Legal Compliance

Both business entities are required to maintain a registered agent and office, file annual reports, and pay franchise taxes to keep the business in good standing with the Secretary of State.

However, corporations have to follow specific regulations concerning recordkeeping procedures and periodical meetings. Corps require a greater deal of paperwork and are obligated to follow a determined structure for their business.

An Inc. has to adopt corporate bylaws and hold annual shareholder meetings that need to be formally documented in meeting minutes. Additionally, its structure must be formed by shareholders, a board of directors, and officers, as registered in the Articles of Incorporation with the state. Any relevant decisions or changes need to be formally decided during a meeting with the board of directors.

On the other hand, LLCs offer great flexibility and can be structured in the way that best fits the needs of their business. Also, there are no requirements concerning annual meetings or recordkeeping procedures.

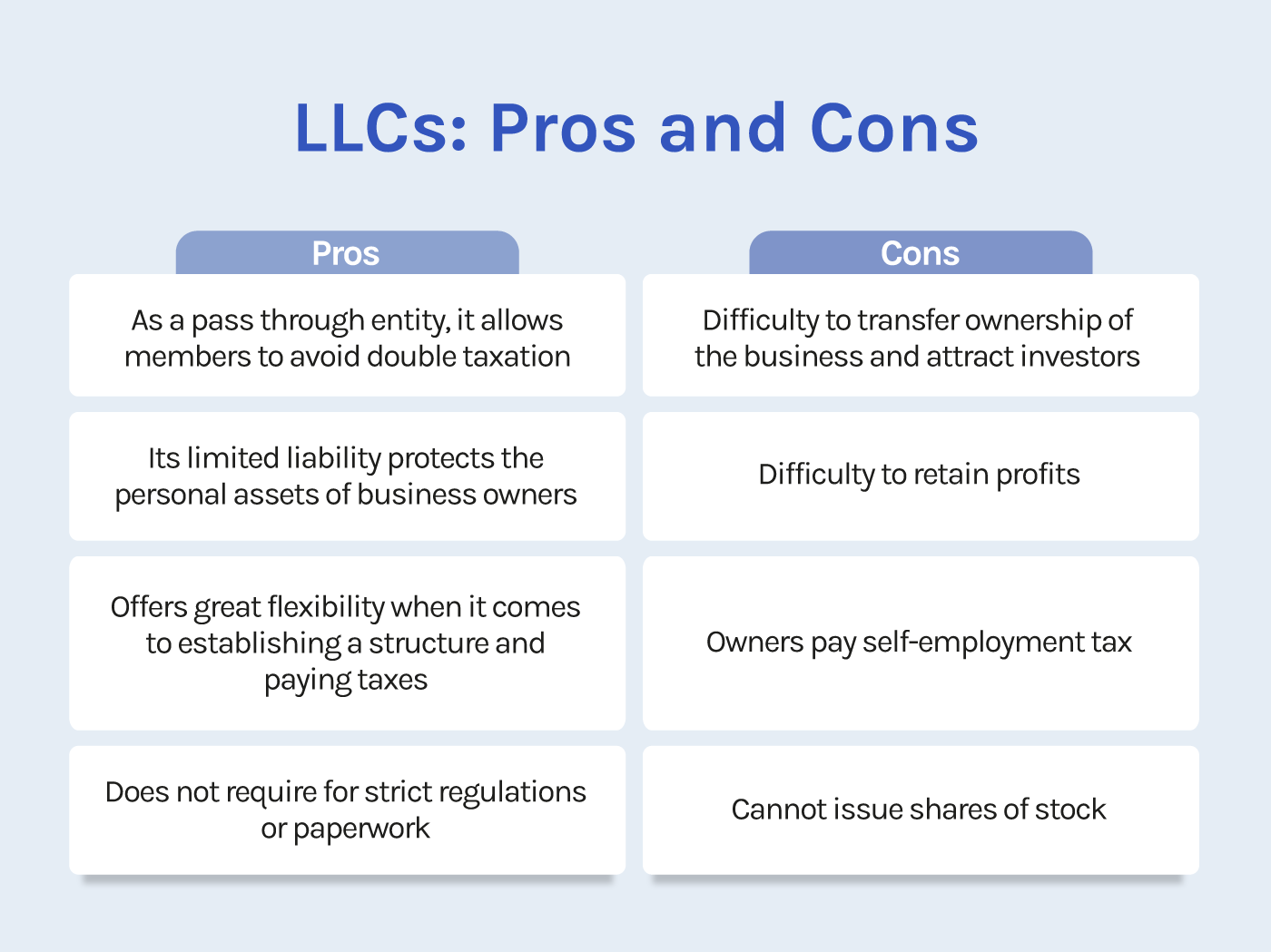

LLC vs Corps: Advantages and disadvantages

When trying to choose a business entity for your startup, you will encounter the different pros and cons LLCs and Corps offer. There is no rule of thumb as to what is the best business structure, for it will depend on your business model and objectives.

Pros of LLCs

Easy setup

To be legally established, LLCs are required fewer formalities and are less expensive to form. LLCs take less paperwork and some states, like Illinois, allow an online LLC formation process. Additionally, there are no legal obligations that push members to keep strict recordkeeping or reporting procedures.

Structural Flexibility

One of the greatest advantages of LLCs is that its members can choose a management structure that best fits their needs. There is no limit to the number of members and they can be foreigners. Also, the owners can define the roles, profit distribution, and ownership interest freely by stating them in the business governing document, the operating agreement.

Tax Options

One of the major benefits of LLCs is their flexibility in the taxation aspect. Because the IRS does not recognize LLCs for tax purposes, their members can select the designation that best fits their objectives and be able to avoid double taxation.

Cons of LLCs

Difficulty in attracting investors

Unless you structure your LLC similarly to a corporation, it is harder for LLCs to get sources of investment because of the difficulty it implies to transfer membership interests.

Self-employment tax

Although LLCs offer a greater advantage in tax terms, one downside of this business entity is that it’s subject to self-employment tax when distributing profits.

Unless the company elects to be taxed as an S-corp or C-corp, owners will pay self-employment taxes, which cover Social Security and Medicare taxes.

Dissolution

Unless there are established procedures in the LLC’s operating agreement, an LLC can be dissolved or altered if it fails to report filings on time, a member exits the company, or there are significant structural changes in the LLC, such as a merger.

Pros of corporations

Easy to transfer ownership

The management and tax structure of corporations make it a more attractive choice for equity financing. The ease to buy, sell, and issuing shares offers allows better opportunities to raise capital. Similarly, this feature of Incs. provides employee stock options.

Tax facilities

If you are able to choose the S-Corp structure, you can avoid double taxation. Yet, writing off operating expenses and losses may help reduce overall tax liability.

Structure for growth

A corporation business entity is recognized internationally, contrary to LLCs. Besides, a corporation continues to exist despite the death or exit of its owners.

Cons of corporations

Double taxation

When choosing the C-Corp designation, corporations have to pay the 21% corporate income tax and then their income at the personal level.

More stringent regulations

Corporations are required to have a defined structure and follow specific reporting and recordkeeping procedures, which makes them less flexible. There are also some restrictions on the number and origin of shareholders for S corps.

Complexity

Starting a corporation is usually more expensive and time-consuming than forming an LLC. Similarly, maintaining a corporation in good standing requires extensive paperwork and ongoing fees.

LLC vs Incs: How to choose?

While an accountant and a lawyer will help you make a conclusive decision as to what business entity to choose, the following questions will guide you through the selection:

- What are your business objectives?

- How do you want to be taxed?

- Do you want to trade publicly?

- Do you expect investors to finance your business?

- Do you plan to have international involvement?

Making the right decision depends on considering tax, financing, legal, estate planning, and your business and personal objectives, in consultation with qualified business formation professionals.

Frequently Asked Questions

1. Which one is better for a small business?

Although it depends on the particularities of the business, an LLC business entity is usually the most suitable business entity for member-managed small businesses for the flexibility it offers.

2. Can an LLC transition to a corporation, and vice-versa?

An LLC can turn into a corporation through a simple process. However, if the objective of the transition is having its tax advantages, LLCs can choose to be taxed as an S-Corp. Although it’s a more uncommon and complicated situation, corporations can also convert into LLCs.

3. Can an LLC be formed by just one member?

Yes, an LLC can be formed by a single member. Contrary to a sole proprietorship, a single-member LLC will protect its business owner from liability.